Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 [25 MARKS] In early November 2020, Rapid Investment Ltd considered manufacturing a new product called Spike, which will span over three years.

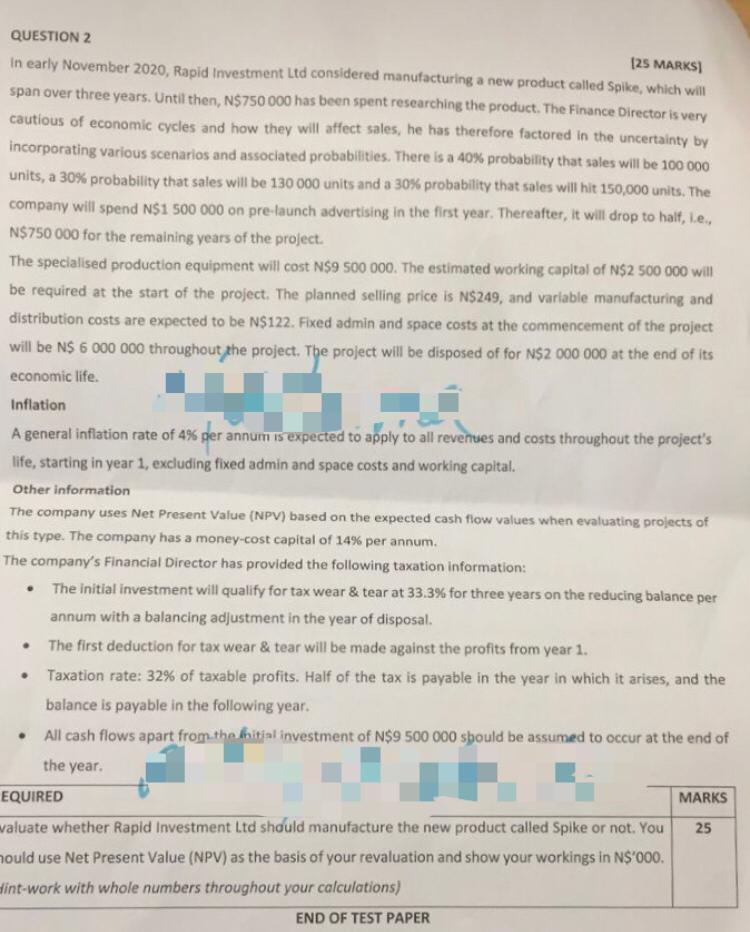

QUESTION 2 [25 MARKS] In early November 2020, Rapid Investment Ltd considered manufacturing a new product called Spike, which will span over three years. Until then, N$750 000 has been spent researching the product. The Finance Director is very cautious of economic cycles and how they will affect sales, he has therefore factored in the uncertainty by incorporating various scenarios and associated probabilities. There is a 40% probability that sales will be 100 000 units, a 30% probability that sales will be 130 000 units and a 30% probability that sales will hit 150,000 units. The company will spend N$1 500 000 on pre-launch advertising in the first year. Thereafter, it will drop to half, i.e., N$750 000 for the remaining years of the project. The specialised production equipment will cost N$9 500 000. The estimated working capital of N$2 500 000 will be required at the start of the project. The planned selling price is N$249, and variable manufacturing and distribution costs are expected to be N$122. Fixed admin and space costs at the commencement of the project will be N$ 6 000 000 throughout the project. The project will be disposed of for N$2 000 000 at the end of its economic life. H Inflation A general inflation rate of 4% per annum is expected to apply to all revenues and costs throughout the project's life, starting in year 1, excluding fixed admin and space costs and working capital. Other information The company uses Net Present Value (NPV) based on the expected cash flow values when evaluating projects of this type. The company has a money-cost capital of 14% per annum. The company's Financial Director has provided the following taxation information: The initial investment will qualify for tax wear & tear at 33.3% for three years on the reducing balance per annum with a balancing adjustment in the year of disposal. The first deduction for tax wear & tear will be made against the profits from year 1. Taxation rate: 32% of taxable profits. Half of the tax is payable in the year in which it arises, and the balance is payable in the following year. All cash flows apart from the initial investment of N$9 500 000 should be assumed to occur at the end of the year. . . . EQUIRED valuate whether Rapid Investment Ltd should manufacture the new product called Spike or not. You hould use Net Present Value (NPV) as the basis of your revaluation and show your workings in N$'000. dint-work with whole numbers throughout your calculations) END OF TEST PAPER MARKS 25

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started