Answered step by step

Verified Expert Solution

Question

1 Approved Answer

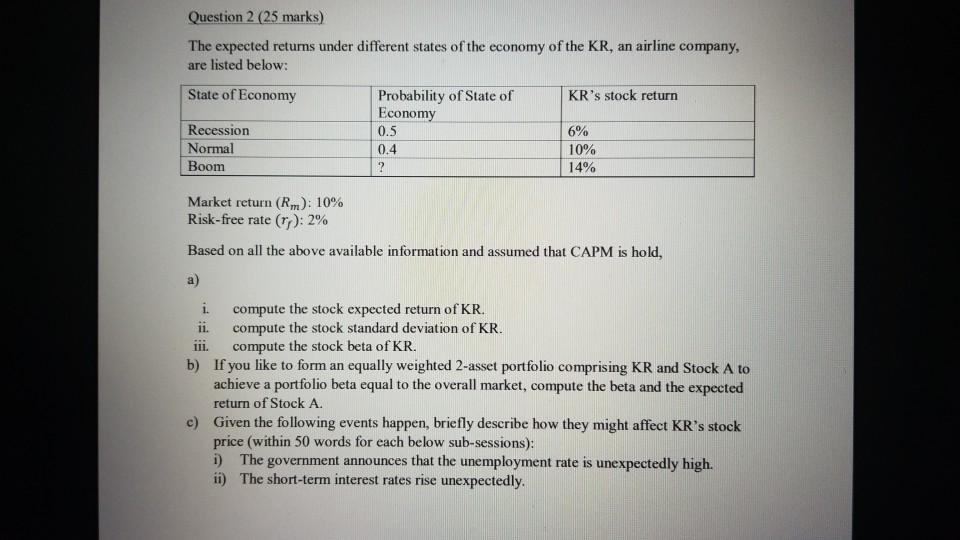

Question 2 (25 marks) The expected returns under different states of the economy of the KR, an airline company, are listed below: State of Economy

Question 2 (25 marks) The expected returns under different states of the economy of the KR, an airline company, are listed below: State of Economy Probability of State of KR's stock return Economy Recession 0.5 6% Normal 0.4 10% Boom 14% ? Market return (Rm): 10% Risk-free rate (rp): 2% Based on all the above available information and assumed that CAPM is hold, i. compute the stock expected return of KR. ii. compute the stock standard deviation of KR. iii. compute the stock beta of KR. b) If you like to form an equally weighted 2-asset portfolio comprising KR and Stock A to achieve a portfolio beta equal to the overall market, compute the beta and the expected return of Stock A. c) Given the following events happen, briefly describe how they might affect KR's stock price (within 50 words for each below sub-sessions): 1) The government announces that the unemployment rate is unexpectedly high. ii) The short-term interest rates rise unexpectedly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started