Answered step by step

Verified Expert Solution

Question

1 Approved Answer

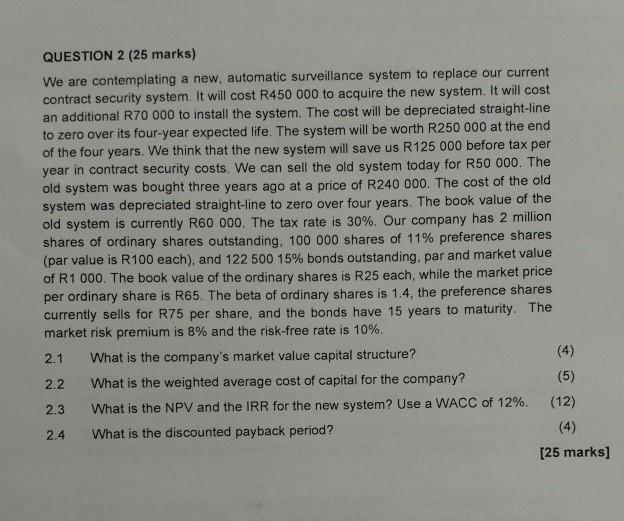

QUESTION 2 (25 marks) We are contemplating a new, automatic surveillance system t contract security system. It will cost R450 000 to acquire the new

QUESTION 2 (25 marks) We are contemplating a new, automatic surveillance system t contract security system. It will cost R450 000 to acquire the new system. It will cost an additional R70 000 to install the system. The cost will be depreciated straight-line o replace our current o over its four-year expected life. The system will be worth R250 000 at the end of the four years. We think that the new system will save us R125 000 before tax per year in contract security costs. We can sell the old system today for R50 000. The old system was bought three years ago at a price of R240 000. The cost of the old system was depreciated straight-line to zero over four years. The book value of the old system is currently R60 000. The tax rate is 30%. Our company has 2 million shares of ordinary shares outstanding, 100 000 shares of 11% preference shares (par value is R100 each), and 122 500 1596 bonds outstanding, par and market value of R1 000. The book value of the ordinary shares is R25 each, while the market price per ordinary share is R65. The beta of ordinary shares is 1.4, the preference shares currently sells for R75 per share, and the bonds have 15 years to maturity. The market risk premium is 8% and the risk-free rate is 10%. 2.1 2.2 2.3 2.4 What is the company's market value capital structure? What is the weighted average cost of capital for the company? What is the NPV and the IRR for the new system? Use a WACC of 12%. What is the discounted payback period? (12) [25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started