Question: 2.1 Determine the expected return of the entire portfolio that are listed above 2.2 Determine the beta of the entire portfolio listed above 2.3

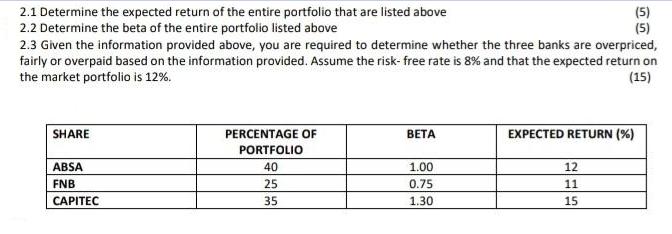

2.1 Determine the expected return of the entire portfolio that are listed above 2.2 Determine the beta of the entire portfolio listed above 2.3 Given the information provided above, you are required to determine whether the three banks are overpriced, fairly or overpaid based on the information provided. Assume the risk- free rate is 8% and that the expected return on the market portfolio is 12%. (5) (5) (15) SHARE PERCENTAGE OF EXPECTED RETURN (%) PORTFOLIO ABSA 40 1.00 12 FNB 25 0.75 11 APITEC 35 1.30 15

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Answer to Question a Determination of Expected return of the entire Portfolio Expected Return of ent... View full answer

Get step-by-step solutions from verified subject matter experts