Answered step by step

Verified Expert Solution

Question

1 Approved Answer

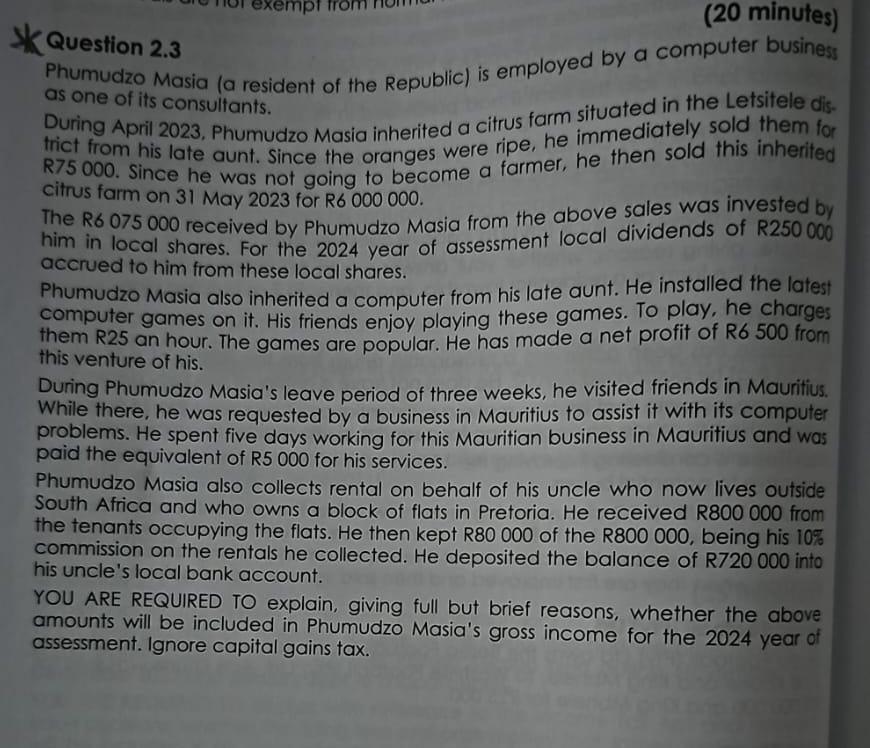

Question 2 . 3 ( 2 0 minutes ) Phumudzo Masia ( a resident of the Republic ) is employed by a computer business as

Question

minutes

Phumudzo Masia a resident of the Republic is employed by a computer business as one of its consultants.

During April Phumudzo Masia inherited a citrus farm situated in the Letsitele district from his late aunt. Since the oranges were ripe, he immediately sold them for R Since he was not going to become a farmer, he then sold this inherited citrus farm on May for R

The R received by Phumudzo Masia from the above sales was invested by him in local shares. For the year of assessment local dividends of R accrued to him from these local shares.

Phumudzo Masia also inherited a computer from his late aunt. He installed the latest computer games on it His friends enjoy playing these games. To play, he charges them R an hour. The games are popular. He has made a net profit of R from this venture of his.

During Phumudzo Masia's leave period of three weeks, he visited friends in Mauritius. While there, he was requested by a business in Mauritius to assist it with its computer problems. He spent five days working for this Mauritian business in Mauritius and was paid the equivalent of R for his services.

Phumudzo Masia also collects rental on behalf of his uncle who now lives outside South Africa and who owns a block of flats in Pretoria. He received R from the tenants occupying the flats. He then kept R of the R being his commission on the rentals he collected. He deposited the balance of R into his uncle's local bank account.

YOU ARE REQUIRED TO explain, giving full but brief reasons, whether the above amounts will be included in Phumudzo Masia's gross income for the year of assessment. Ignore capital gains tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started