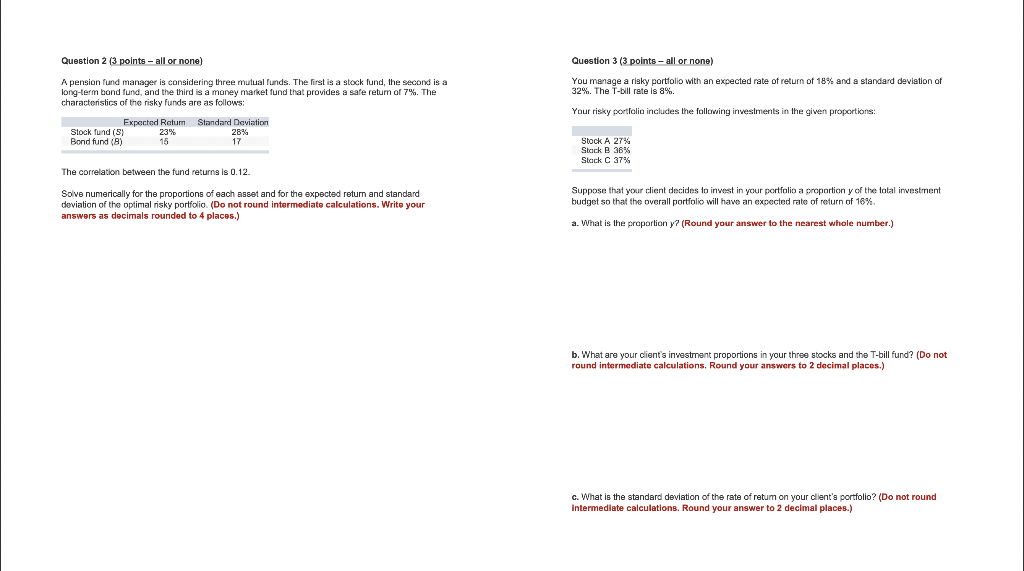

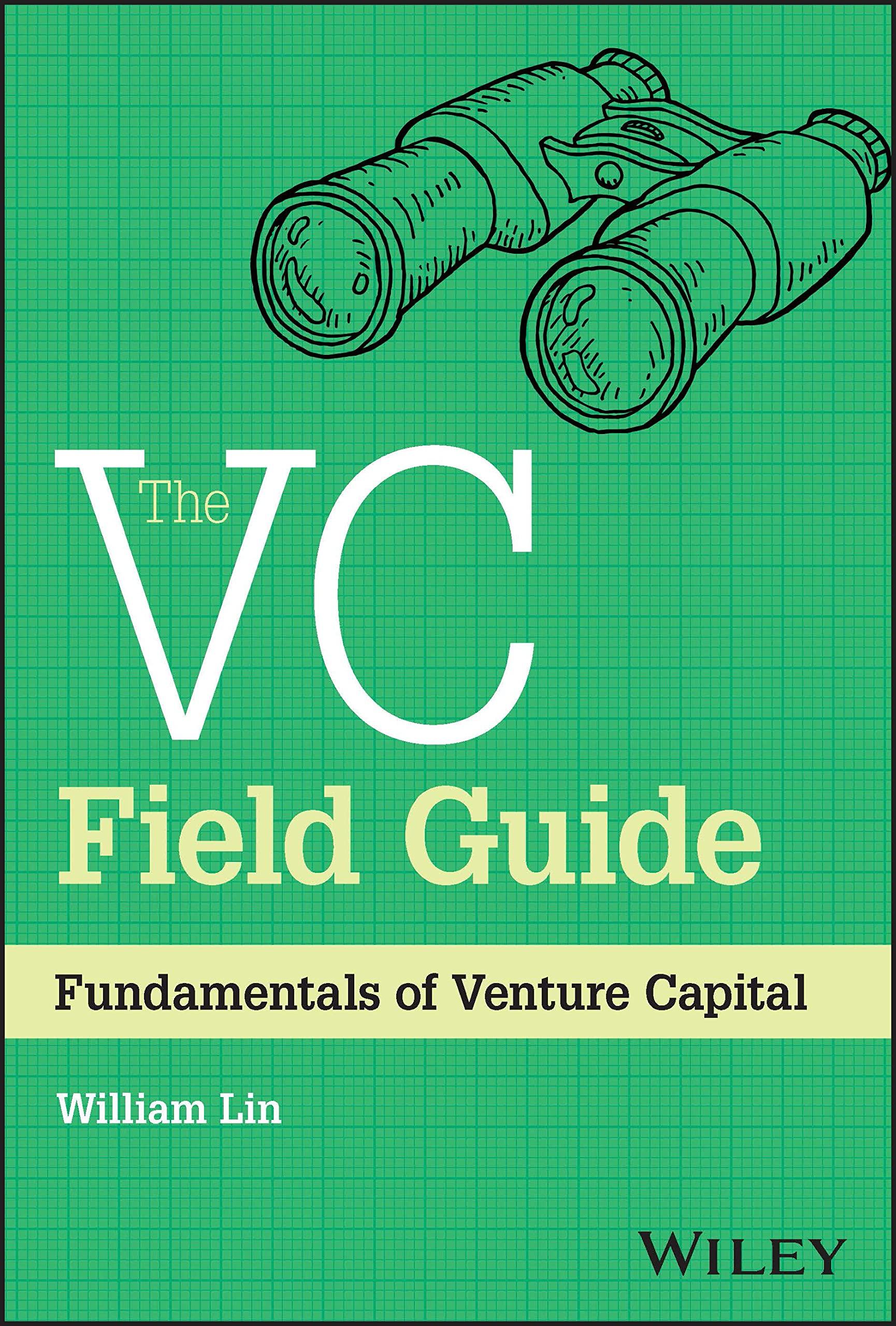

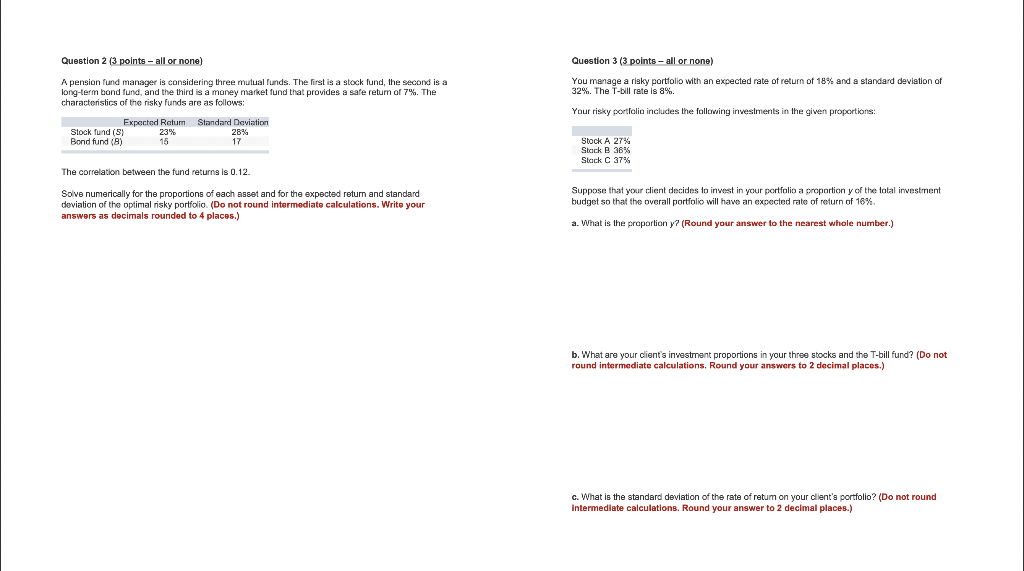

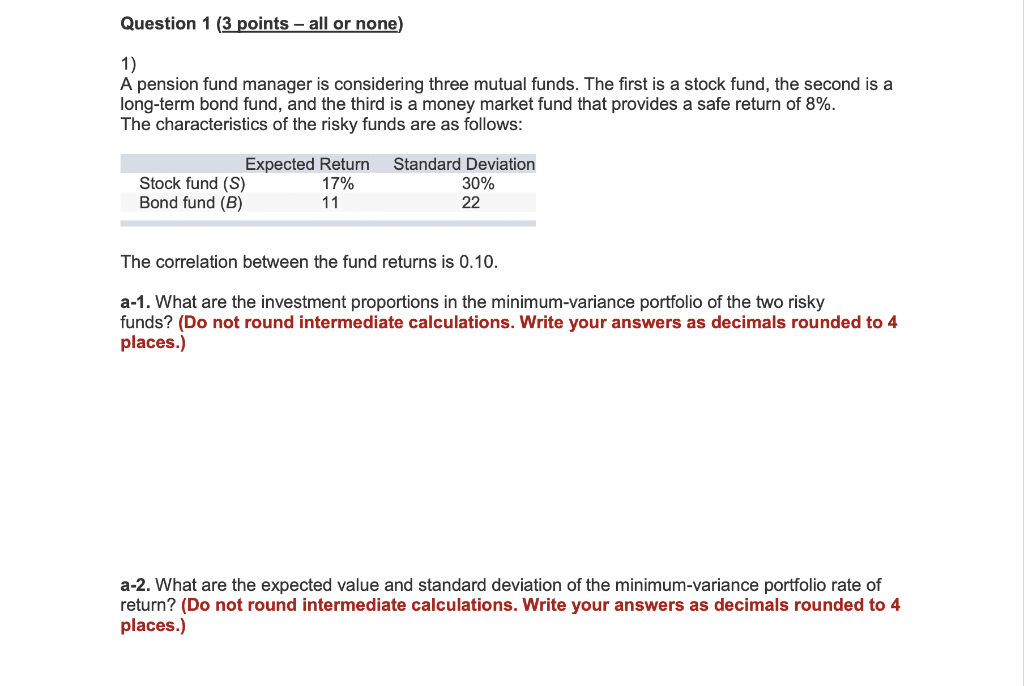

Question 2 (3 points - all or none) Question 3 ( 3 points - all or none) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a You manage a riaky portfolio with an expected rate of return of 18% and a standard deviation of bong-term bond fund, and the third is a money market fund that provides a safe retum of 7%. The 32%. The T-bill rate is 8%. characteristics of the risky funds are as follows: Your risky portfolia includes the following investments in the given proportions: The correlation between the fund returns is 0.12 . Solve numerically for the proportions of each asset and for the expected return and standard Suppose that your dient decides to invest in your portfolio a proportion y of the total investment deviation of the optimal risky portfolio. (Do not round intermediate calculations. Write your budget so that the overall portfolio will have an excected rate of return of 16%, answers as decimals rounded to 4 places.) a. What is the proportion y ? (Round your answer to the nearest whole number.) b. What are your client's investment proportions in your three stocks and the T-bill fund? (Do not round intermediate calculations. Round your answers to 2 decimal places.) c. What is the standard deviation of the rate of retum on your client's portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Question 1 ( 3 points - all or none) 1) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: The correlation between the fund returns is 0.10 . a-1. What are the investment proportions in the minimum-variance portfolio of the two risky funds? (Do not round intermediate calculations. Write your answers as decimals rounded to 4 places.) a-2. What are the expected value and standard deviation of the minimum-variance portfolio rate of return? (Do not round intermediate calculations. Write your answers as decimals rounded to 4 places.)