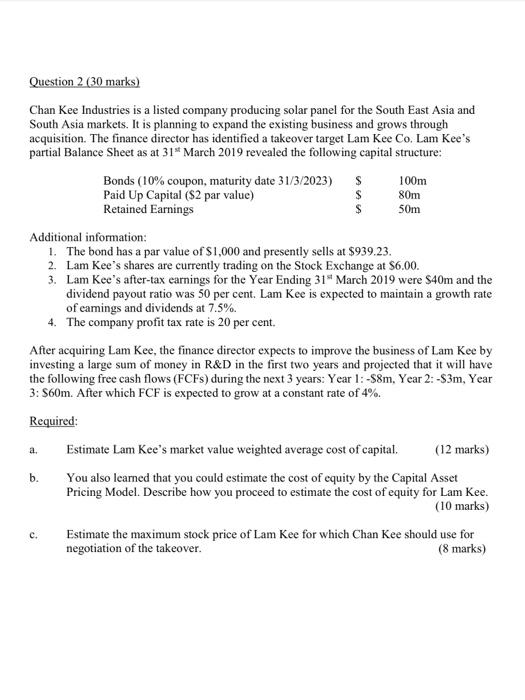

Question 2 (30 marks) Chan Kee Industries is a listed company producing solar panel for the South East Asia and South Asia markets. It is planning to expand the existing business and grows through acquisition. The finance director has identified a takeover target Lam Kee Co. Lam Kee's partial Balance Sheet as at 31 March 2019 revealed the following capital structure: Bonds (10% coupon, maturity date 31/3/2023) $ 100m Paid Up Capital ($2 par value) $ 80m Retained Earnings 50m Additional information: 1. The bond has a par value of $1,000 and presently sells at $939.23. 2. Lam Kee's shares are currently trading on the Stock Exchange at $6.00. 3. Lam Kee's after-tax earnings for the Year Ending 31" March 2019 were $40m and the dividend payout ratio was 50 per cent. Lam Kee is expected to maintain a growth rate of eamings and dividends at 7.5%. 4. The company profit tax rate is 20 per cent. After acquiring Lam Kee, the finance director expects to improve the business of Lam Kee by investing a large sum of money in R&D in the first two years and projected that it will have the following free cash flows (FCFS) during the next 3 years: Year 1:-$8m, Year 2:-S3m, Year 3: S60m. After which FCF is expected to grow at a constant rate of 4%. Required: Estimate Lam Kee's market value weighted average cost of capital. (12 marks) b. You also learned that you could estimate the cost of equity by the Capital Asset Pricing Model. Describe how you proceed to estimate the cost of equity for Lam Kee. (10 marks) Estimate the maximum stock price of Lam Kee for which Chan Kee should use for negotiation of the takeover. (8 marks) a. c. Question 2 (30 marks) Chan Kee Industries is a listed company producing solar panel for the South East Asia and South Asia markets. It is planning to expand the existing business and grows through acquisition. The finance director has identified a takeover target Lam Kee Co. Lam Kee's partial Balance Sheet as at 31 March 2019 revealed the following capital structure: Bonds (10% coupon, maturity date 31/3/2023) $ 100m Paid Up Capital ($2 par value) $ 80m Retained Earnings 50m Additional information: 1. The bond has a par value of $1,000 and presently sells at $939.23. 2. Lam Kee's shares are currently trading on the Stock Exchange at $6.00. 3. Lam Kee's after-tax earnings for the Year Ending 31" March 2019 were $40m and the dividend payout ratio was 50 per cent. Lam Kee is expected to maintain a growth rate of eamings and dividends at 7.5%. 4. The company profit tax rate is 20 per cent. After acquiring Lam Kee, the finance director expects to improve the business of Lam Kee by investing a large sum of money in R&D in the first two years and projected that it will have the following free cash flows (FCFS) during the next 3 years: Year 1:-$8m, Year 2:-S3m, Year 3: S60m. After which FCF is expected to grow at a constant rate of 4%. Required: Estimate Lam Kee's market value weighted average cost of capital. (12 marks) b. You also learned that you could estimate the cost of equity by the Capital Asset Pricing Model. Describe how you proceed to estimate the cost of equity for Lam Kee. (10 marks) Estimate the maximum stock price of Lam Kee for which Chan Kee should use for negotiation of the takeover. (8 marks) a. c