Question

QUESTION 2 (30 marks) Forever Fit (Pty) Ltd is a chain of fitness studios situated in the Western Cape. You have been presented with the

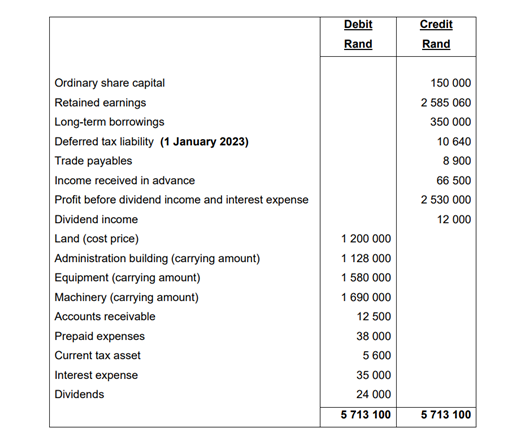

QUESTION 2 (30 marks) Forever Fit (Pty) Ltd is a chain of fitness studios situated in the Western Cape. You have been presented with the trial balance of Forever Fit (Pty) Ltd at 31 December 2023, the current financial year-end, as follows: QUESTION 2 (30 marks) Forever Fit (Pty) Ltd is a chain of fitness studios situated in the Western Cape. You have been presented with the trial balance of Forever Fit (Pty) Ltd at 31 December 2023, the current financial year-end, as follows:

Additional information: Profit before dividend income and interest expense has been correctly calculated and includes the following: Rand Depreciation administration building 24 000 Depreciation equipment 740 000 Depreciation machinery 770 000 Donation to the 'Save the Rhino Fund' 25 000 The 'Save the Rhino Fund' is not a recognised charity in terms of the Income Tax Act. No tax allowance is granted on the companys administration building. The tax bases and wear and tear allowances on the machinery and equipment are as follows: Tax base on 31 December 2023 Wear and tear allowance 2023 Equipment R1 520 000 R760 000 Machinery R1 600 000 R800 000 The income received in advance is taxed in the year of receipt and the prepaid expenses are deductible in the year of payment. The deferred tax balance on 31 December 2022 comprises taxable temporary differences on equipment and machinery amounting to R100 000 and a deductible temporary difference on income received in advance amounting to R62 000. The tax assessment for the December 2022 financial year end was received during 2023 and showed that the amount of the assessed tax on taxable profit was R6 250 less than the amount provided for current income tax in the 2022 financial year. There are no other differences between accounting profit and taxable profit other than those evident from the information provided. The income tax rate is 28%. REQUIRED: 2.1) Prepare the general journal entries to be processed in Forever Fit (Pty) Ltds 31 December 2023 annual financial statements to account for current income tax, deferred tax, and the overprovision of current income tax. Journal dates and narrations are not required. Round all answers to the nearest Rand. (23 marks) 2.2) Prepare all the notes relating to tax expense and deferred tax in Forever Fit (Pty) Ltds 31 December 2023 annual financial statements so as to comply with the International Financial Reporting Standards. The tax rate reconciliation should be presented in currency. Accounting policies are not required. Show all workings and refer to amounts where applicable. Round all answers to the nearest Rand. (7 marks)

\begin{tabular}{|c|c|c|} \hline & \begin{tabular}{l} Debit \\ Rand \end{tabular} & \begin{tabular}{l} Credit \\ Rand \end{tabular} \\ \hline Ordinary share capital & & 150000 \\ \hline Retained earnings & & 2585060 \\ \hline Long-term borrowings & & 350000 \\ \hline Deferred tax liability (1 January 2023) & & 10640 \\ \hline Trade payables & & 8900 \\ \hline Income received in advance & & 66500 \\ \hline Profit before dividend income and interest expense & & 2530000 \\ \hline Dividend income & & 12000 \\ \hline Land (cost price) & 1200000 & \\ \hline Administration building (carrying amount) & 1128000 & \\ \hline Equipment (carrying amount) & 1580000 & \\ \hline Machinery (carrying amount) & 1690000 & \\ \hline Accounts receivable & 12500 & \\ \hline Prepaid expenses & 38000 & \\ \hline Current tax asset & 5600 & \\ \hline Interest expense & 35000 & \\ \hline \multirow[t]{2}{*}{ Dividends } & 24000 & \\ \hline & 5713100 & 5713100 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started