Answered step by step

Verified Expert Solution

Question

1 Approved Answer

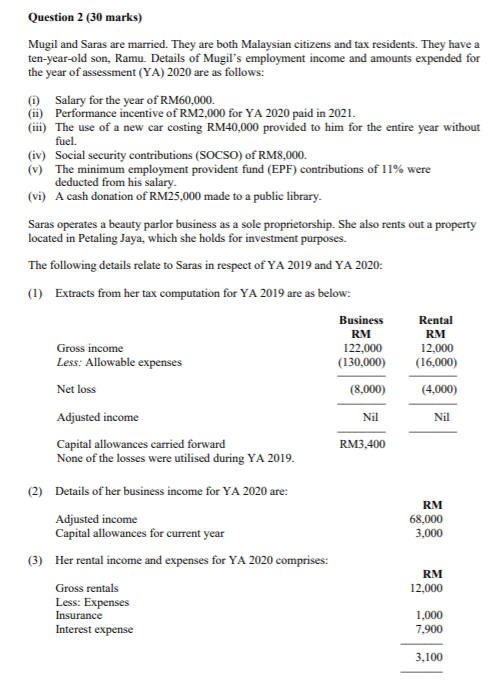

Question 2 (30 marks) Mugil and Saras are married. They are both Malaysian citizens and tax residents. They have a ten-year-old son, Ramu. Details of

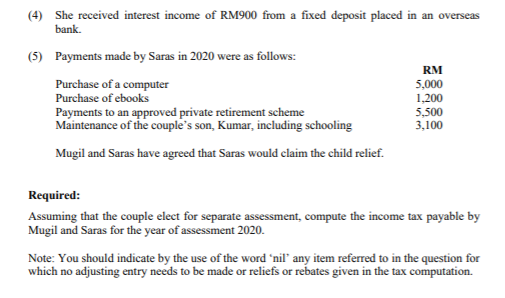

Question 2 (30 marks) Mugil and Saras are married. They are both Malaysian citizens and tax residents. They have a ten-year-old son, Ramu. Details of Mugil's employment income and amounts expended for the year of assessment (YA) 2020 are as follows: 1) Salary for the year of RM60,000. (ii) Performance incentive of RM2,000 for YA 2020 paid in 2021. (iii) The use of a new car costing RM40,000 provided to him for the entire year without fuel. (iv) Social security contributions (SOCSO) of RM8,000. (v) The minimum employment provident fund (EPF) contributions of 11% were deducted from his salary. (vi) A cash donation of RM25,000 made to a public library. Saras operates a beauty parlor business as a sole proprietorship. She also rents out a property located in Petaling Jaya, which she holds for investment purposes. The following details relate to Saras in respect of YA 2019 and YA 2020: (1) Extracts from her tax computation for YA 2019 are as below: Business Rental RM RM Gross income 122,000 12,000 Less: Allowable expenses (130,000) (16,000) Net loss (8,000) (4,000) Adjusted income Nil Capital allowances carried forward RM3,400 None of the losses were utilised during YA 2019. (2) Details of her business income for YA 2020 are: RM Adjusted income 68,000 Capital allowances for current year 3,000 (3) Her rental income and expenses for YA 2020 comprises: RM Gross rentals 12,000 Less: Expenses Insurance 1,000 Interest expense 7,900 Nil 3,100 Question 2 (30 marks) Mugil and Saras are married. They are both Malaysian citizens and tax residents. They have a ten-year-old son, Ramu. Details of Mugil's employment income and amounts expended for the year of assessment (YA) 2020 are as follows: 1) Salary for the year of RM60,000. (ii) Performance incentive of RM2,000 for YA 2020 paid in 2021. (iii) The use of a new car costing RM40,000 provided to him for the entire year without fuel. (iv) Social security contributions (SOCSO) of RM8,000. (v) The minimum employment provident fund (EPF) contributions of 11% were deducted from his salary. (vi) A cash donation of RM25,000 made to a public library. Saras operates a beauty parlor business as a sole proprietorship. She also rents out a property located in Petaling Jaya, which she holds for investment purposes. The following details relate to Saras in respect of YA 2019 and YA 2020: (1) Extracts from her tax computation for YA 2019 are as below: Business Rental RM RM Gross income 122,000 12,000 Less: Allowable expenses (130,000) (16,000) Net loss (8,000) (4,000) Adjusted income Nil Capital allowances carried forward RM3,400 None of the losses were utilised during YA 2019. (2) Details of her business income for YA 2020 are: RM Adjusted income 68,000 Capital allowances for current year 3,000 (3) Her rental income and expenses for YA 2020 comprises: RM Gross rentals 12,000 Less: Expenses Insurance 1,000 Interest expense 7,900 Nil 3,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started