Question

QUESTION 2 (30 marks) Retro Revival (Pty) Ltd is a company that specialises in finding vintage properties and restoring them to their former glory. They

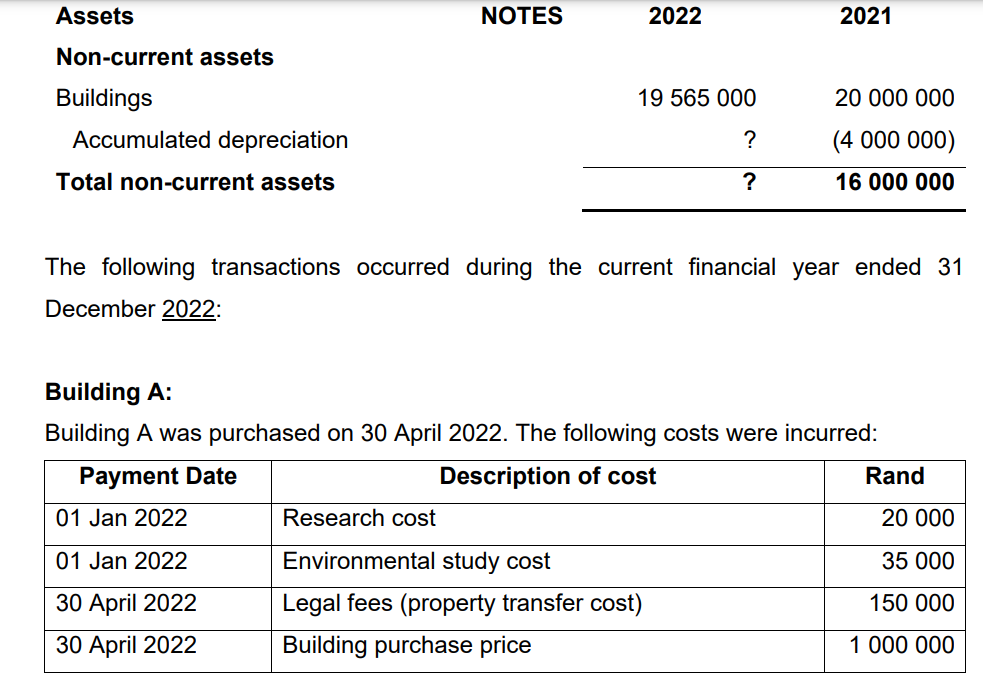

QUESTION 2 (30 marks) Retro Revival (Pty) Ltd is a company that specialises in finding vintage properties and restoring them to their former glory. They are experts in renovation, alteration, and remodelling to preserve the original character of the building. The company operates on a 31 December year-end. You have been given an extract from the Statement of Financial Position as at 31 December 2022:

Building B: Building B was acquired on 30 November 2021 at a cost of R700 000 and underwent renovations during the 2022 financial year. As part of the renovations, solar panels were installed in the building. The solar panels will be depreciated over the same period as the building's useful life. The following is a list of expenses related to Building B incurred during the financial year:

Building C: On 30 June 2022, Retro Revival (Pty) Ltd sold Building C for R2 650 000. The building was acquired on 1 January 2020 for R1 700 000. During its ownership, the company made only one renovation, which was the installation of a new water-cooling system costing R135 000. The system was fully installed and operational as at 31 December 2021.

Additional information:

Buildings are depreciated at 5% per annum on a straight-line basis.

Buildings are considered to have a residual value of R0.

Management has elected to account for all buildings using the cost model.

REQUIRED:

2.1 Calculate the depreciable amounts (the portion of the cost of an asset that can be depreciated over its useful life) for:

2.1.1 Building A

2.1.2 Building B

2.1.3 Building C

2.2 Prepare the general ledger account for Buildings, for the financial year ended 31 December 2022 of Retro Revival (Pty) Ltd. Include all dates and close off the account at the financial year-end. Ignore VAT. Show all workings, and reference accordingly.

2.3 Prepare the general ledger account for Buildings, for the financial year ended 31 December 2022 of Retro Revival (Pty) Ltd. Include all dates and close off the account at the financial year-end. Ignore VAT. Show all workings, and reference accordingly

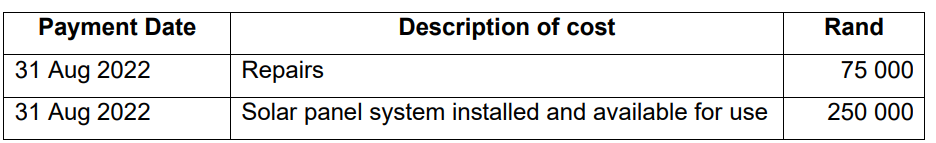

The following transactions occurred during the current financial year ended 31 December 2022: Building A: Building A was purchased on 30 April 2022. The following costs were incurred: \begin{tabular}{|l|l|r|} \hline \multicolumn{1}{|c|}{ Payment Date } & \multicolumn{1}{c|}{ Description of cost } & \multicolumn{1}{c|}{ Rand } \\ \hline 31 Aug 2022 & Repairs & 75000 \\ \hline 31 Aug 2022 & Solar panel system installed and available for use & 250000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started