Question 2 [30 points] You work for Iris Kitall, the CEO and sole owner of Titanic Inc., a young cosmetics company. Titanic currently has

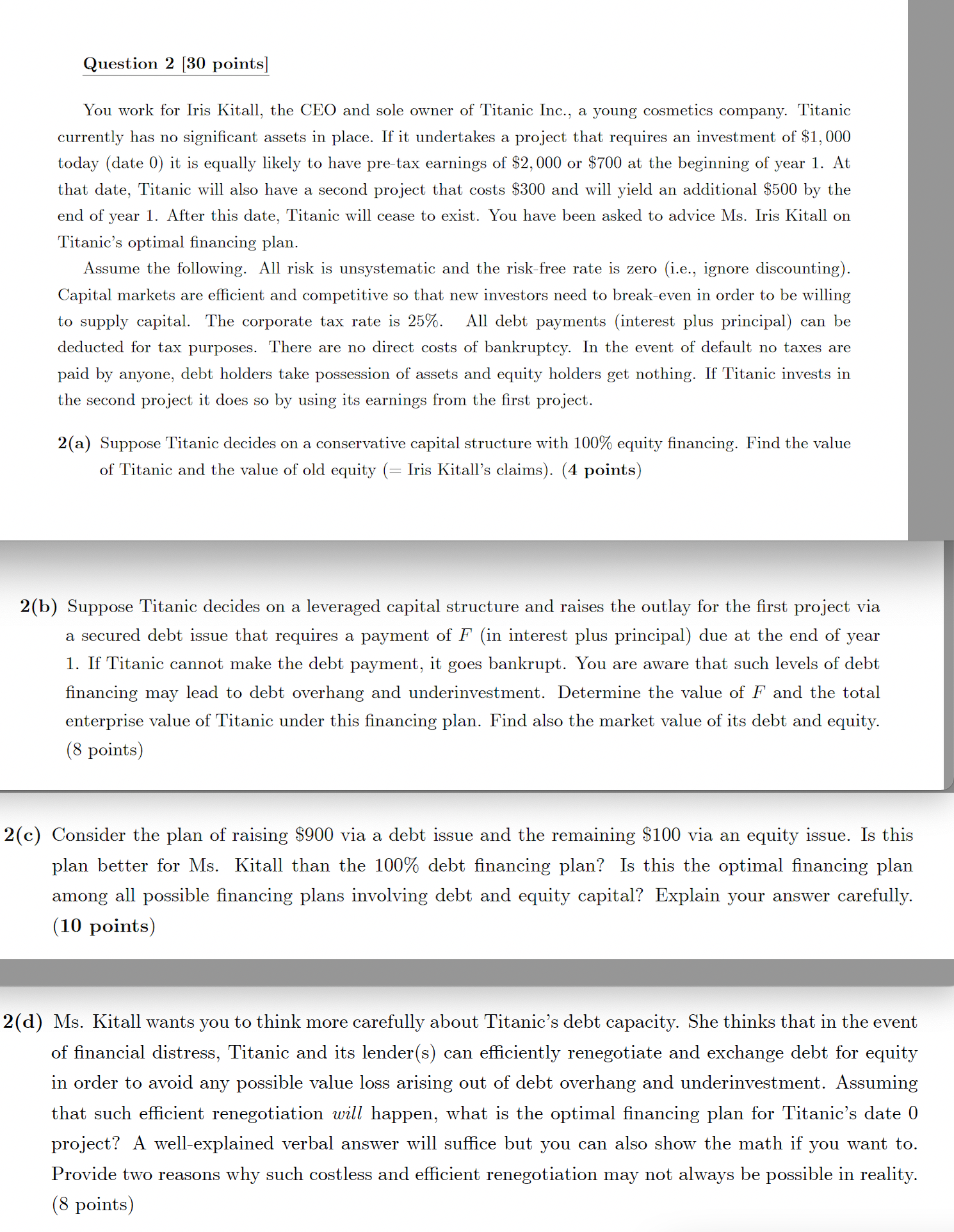

Question 2 [30 points] You work for Iris Kitall, the CEO and sole owner of Titanic Inc., a young cosmetics company. Titanic currently has no significant assets in place. If it undertakes a project that requires an investment of $1,000 today (date 0) it is equally likely to have pre-tax earnings of $2,000 or $700 at the beginning of year 1. At that date, Titanic will also have a second project that costs $300 and will yield an additional $500 by the end of year 1. After this date, Titanic will cease to exist. You have been asked to advice Ms. Iris Kitall on Titanic's optimal financing plan. Assume the following. All risk is unsystematic and the risk-free rate is zero (i.e., ignore discounting). Capital markets are efficient and competitive so that new investors need to break-even in order to be willing to supply capital. The corporate tax rate is 25%. All debt payments (interest plus principal) can be deducted for tax purposes. There are no direct costs of bankruptcy. In the event of default no taxes are paid by anyone, debt holders take possession of assets and equity holders get nothing. If Titanic invests in the second project it does so by using its earnings from the first project. 2(a) Suppose Titanic decides on a conservative capital structure with 100% equity financing. Find the value of Titanic and the value of old equity (= Iris Kitall's claims). (4 points) 2(b) Suppose Titanic decides on a leveraged capital structure and raises the outlay for the first project via a secured debt issue that requires a payment of F (in interest plus principal) due at the end of year 1. If Titanic cannot make the debt payment, it goes bankrupt. You are aware that such levels of debt financing may lead to debt overhang and underinvestment. Determine the value of F and the total enterprise value of Titanic under this financing plan. Find also the market value of its debt and equity. (8 points) 2(c) Consider the plan of raising $900 via a debt issue and the remaining $100 via an equity issue. Is this plan better for Ms. Kitall than the 100% debt financing plan? Is this the optimal financing plan among all possible financing plans involving debt and equity capital? Explain your answer carefully. (10 points) 2(d) Ms. Kitall wants you to think more carefully about Titanic's debt capacity. She thinks that in the event of financial distress, Titanic and its lender(s) can efficiently renegotiate and exchange debt for equity in order to avoid any possible value loss arising out of debt overhang and underinvestment. Assuming that such efficient renegotiation will happen, what is the optimal financing plan for Titanic's date 0 project? A well-explained verbal answer will suffice but you can also show the math if you want to. Provide two reasons why such costless and efficient renegotiation may not always be possible in reality. (8 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started