Answered step by step

Verified Expert Solution

Question

1 Approved Answer

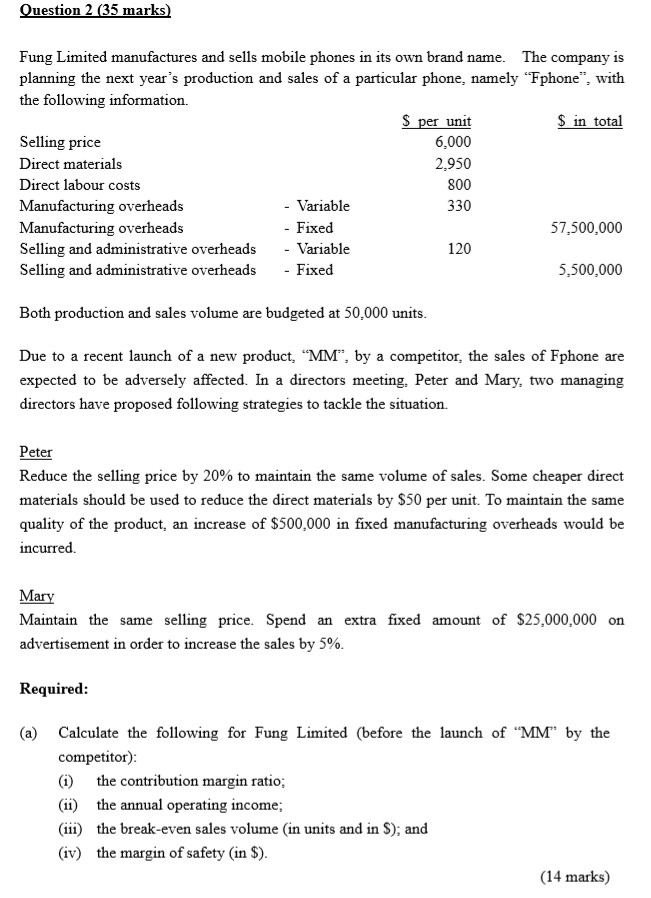

Question 2 (35 marks) Fung Limited manufactures and sells mobile phones in its own brand name. The company is planning the next year's production and

Question 2 (35 marks) Fung Limited manufactures and sells mobile phones in its own brand name. The company is planning the next year's production and sales of a particular phone, namely "Fphone, with the following information. $ per unit $ in total Selling price 6,000 Direct materials 2,950 Direct labour costs Manufacturing overheads - Variable Manufacturing overheads - Fixed 57,500,000 Selling and administrative overheads - Variable Selling and administrative overheads - Fixed 5,500,000 800 330 120 Both production and sales volume are budgeted at 50,000 units. Due to a recent launch of a new product, "MM", by a competitor, the sales of Fphone are expected to be adversely affected. In a directors meeting. Peter and Mary, two managing directors have proposed following strategies to tackle the situation Peter Reduce the selling price by 20% to maintain the same volume of sales. Some cheaper direct materials should be used to reduce the direct materials by $50 per unit. To maintain the same quality of the product, an increase of $500,000 in fixed manufacturing overheads would be incurred. Mary Maintain the same selling price. Spend an extra fixed amount of $25,000,000 on advertisement in order to increase the sales by 5%. Required: (a) Calculate the following for Fung Limited (before the launch of "MM" by the competitor): (1) the contribution margin ratio; (ii) the annual operating income; (iii) the break-even sales volume (in units and in S); and (iv) the margin of safety (in $). (14 marks) (b) For each of the strategies proposed by Peter and Mary: (1) prepare a statement to calculate the new annual operating income. (9 marks) (11) calculate the new break-even sales volume (in units). (Note: Round up your calculations to an integer.) (5 marks) (111) comment and advise the management which strategy should be selected by comparing the new annual operating income and new break-even sales volume (in units) calculated in (1) and (ii) above, (5 marks) (c) How can Cost-Volume-Profit analysis assist managers to make decisions? (2 marks) (Total 35 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started