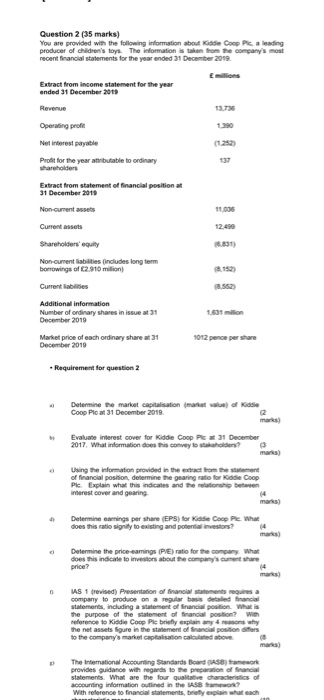

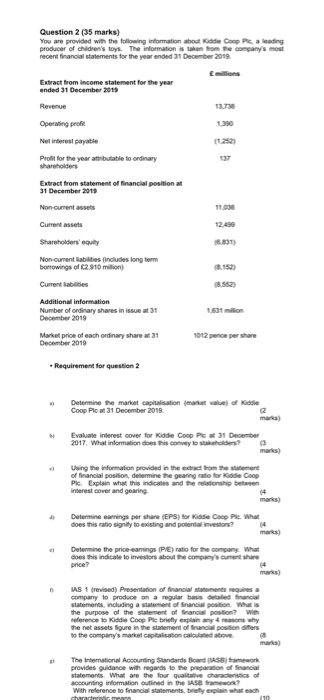

Question 2 (35 marks) You are provided with the following information about Kade Coop Plc a leading producer of children's toys. The information is taken from the company's most recent financial statements for the year ended 31 December 2019 Extract from income statement for the year ended 31 December 2013 Revue 13,736 Operating profil Net interest payable Profit for the year attributable to ordinary shareholders Extract from statement of financial position at 31 December 2015 Non-current assets 11.000 Current assets 12.499 Shareholders' equity Non-current abilities includes long term borrowings of 62.910 million) Current Babies Number of ordinary shares in issue at 31 December 2019 1591 on Market price of each ordinary share at 31 December 2019 1012 penge per share - Requirement for question 2 . Determine e market capitation manat Coop Plc at 31 December 2019 of Kose Evaluate interest cover for Kiddie Coop Pic at 31 December 2017. What information does this convey t h en? 3 Using the information provided in the act from the of financial position, de mine the geg e e Coop Plc. Explain what this indicates and the ship between interest cover and gearing Determine earnings per share (EPS) for addie Coop Plc. What does this ratio signity to existing and potential investors? Determine the price-eamings (PE) ratio for the company What does this indicate to investors about the company's price? US 1 (revised) Presentation of financial m ent requires a company to produce on a regular basis detailed financial statements including a w on of brand position. What is the purpose of the statement of transposition with Reference to Kiddie Coop Piebriefly explain s why to the company's market capitalisation calculated above marks) The Interational Accounting Standards Board (ASB) t work provides guidance with regards to the preparation of financial statements. What are the four qualitative characteristics of accounting information outlined in the IAS a With reference to financial statements, rely explain what each Question 2 (35 marks) You are provided with the following information about Coop PC a leading producer of children's toys. The information e n for the company's most recent financial statements for the year ended 31 December 2019 Extract from income statement for the year ended 31 December 2019 Revue 11.16 Operating profit Net interest payable Profit for the year atributable to ordinary Shangholders Extract from statement of financial position at 31 December 2015 Current assets 12.499 Shareholders' equity 531) Non-current abilities includes long term borrowings of C2.910 million) Current abides Additional information Number of ordinary shares in issue at 31 December 2019 1.531 million Market price of each ordinary share at 31 December 2019 1012 percepershare Requirement for question 2 Determine the market capt Coop Plc at 31 December 2019 ion of Kiddie Evaluate interest cover for Kiddie Coop PC 2017. What information does this convey to t December 3 h e Using the information provided in the extract from the statement of financial position determine the gearing for Kode Coop Pic Explain what this indicates and the ship b aten interest cover and gearing Determine earnings per share (EPS) for Coop Ple. What does this ratio signity to existing and potential investors? (4 Determine the price-eamings (PE) ratio for the company What does this indicate to investors about the company's current s e US 1 (revised) Presentation of financial statements requires a company to produce on a regular bas e d financial statements, including a watement of Snacal position. What is the purpose of the statement of financial position with Reference to Kiddie Coop Plebrity explain s why the net assets gure in the statement of facial position offers to the company's market capitalisation calculated above mark) The International Accounting Standards Board (AS) provides guidance with regards to the preparation of financial statements. What are the four qualitative characteristics of accounting information outlined in the ASB ? With reference to financial statements, briefly explain what each