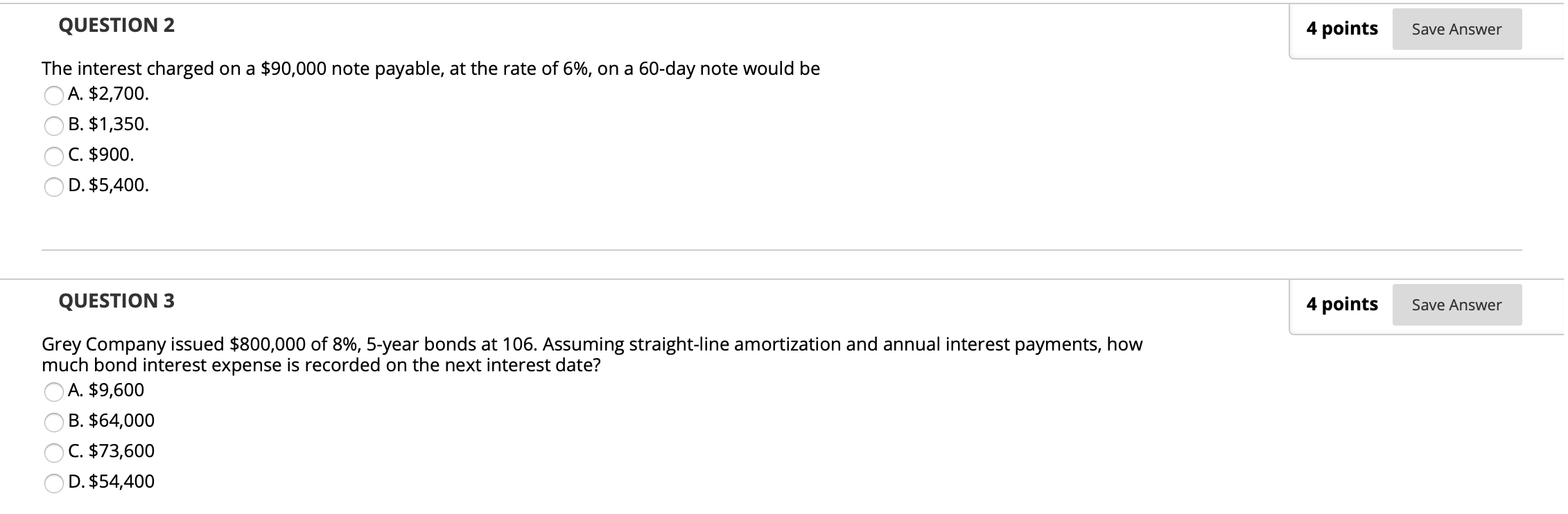

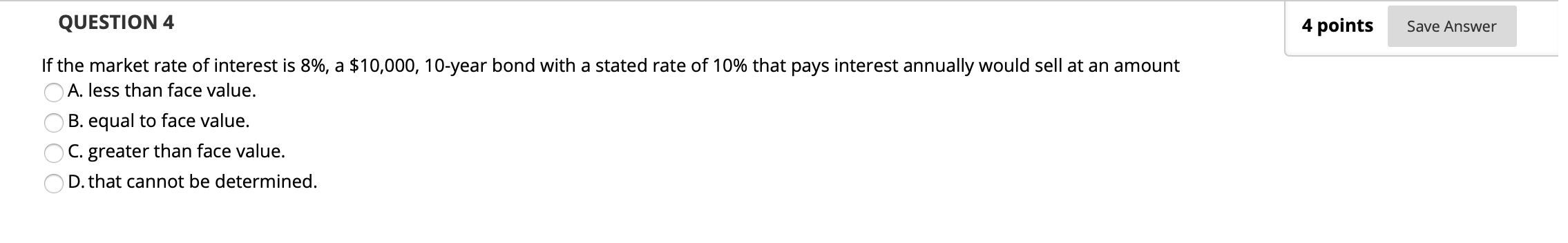

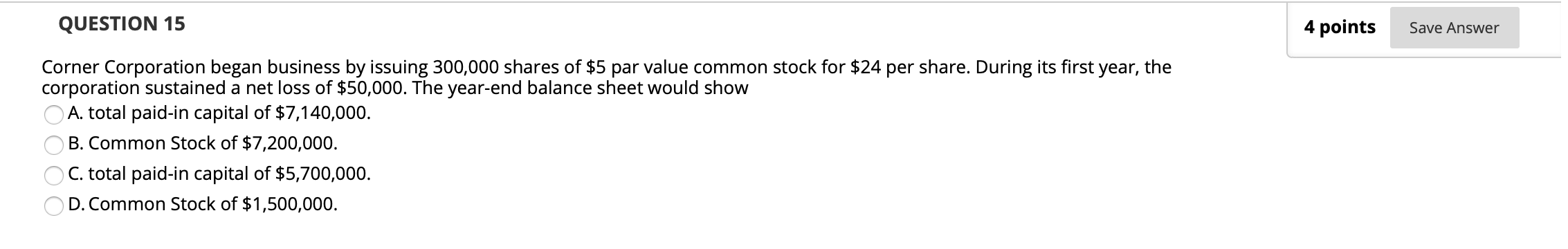

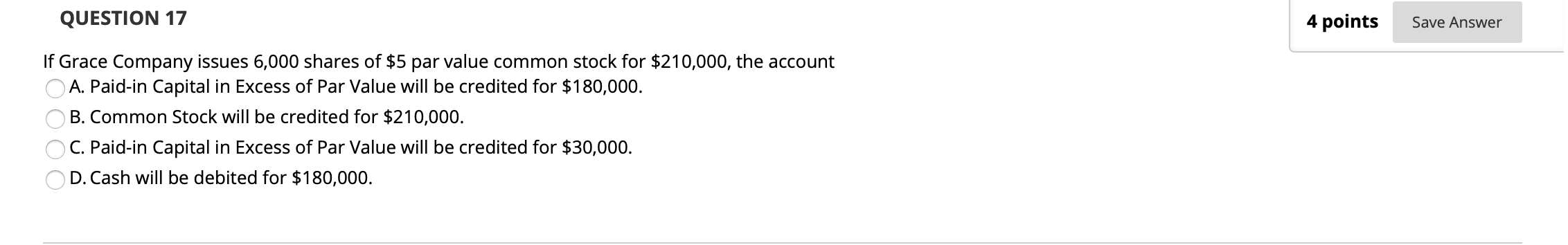

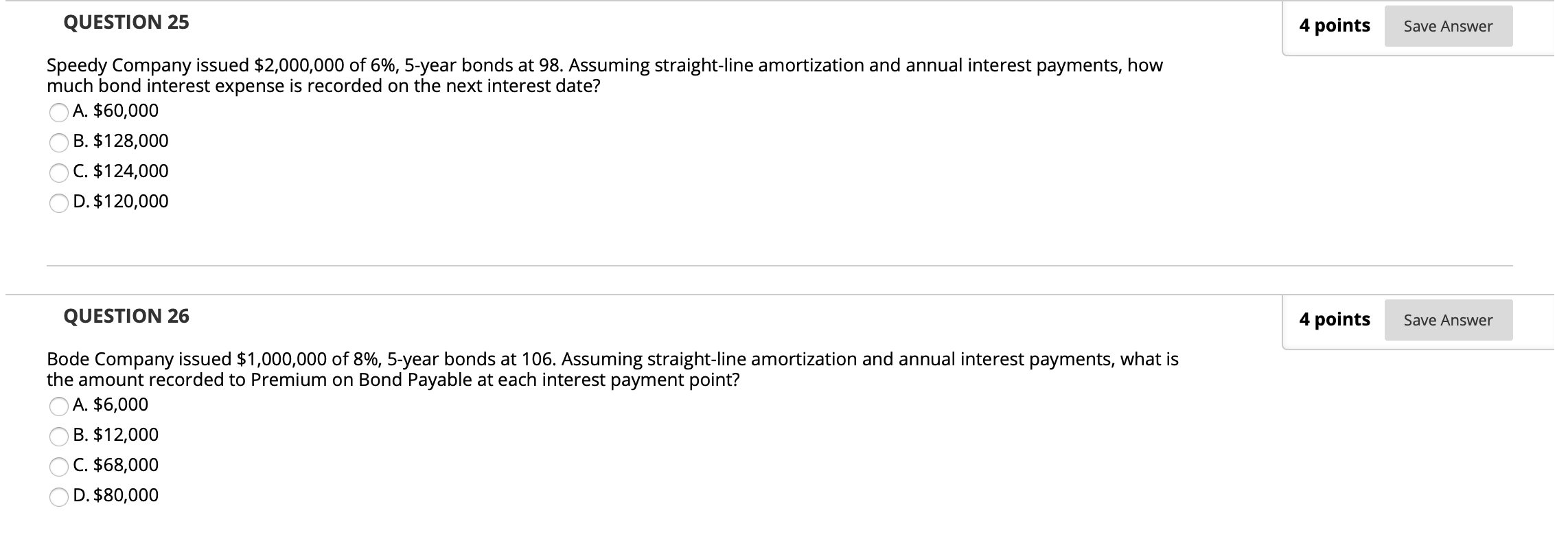

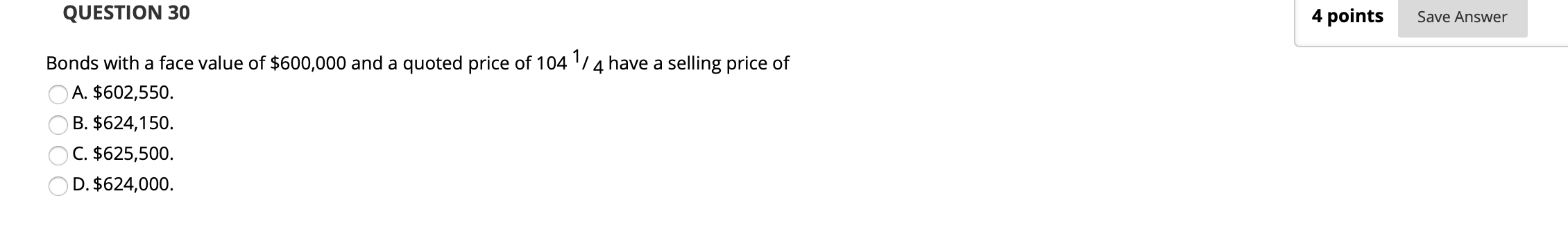

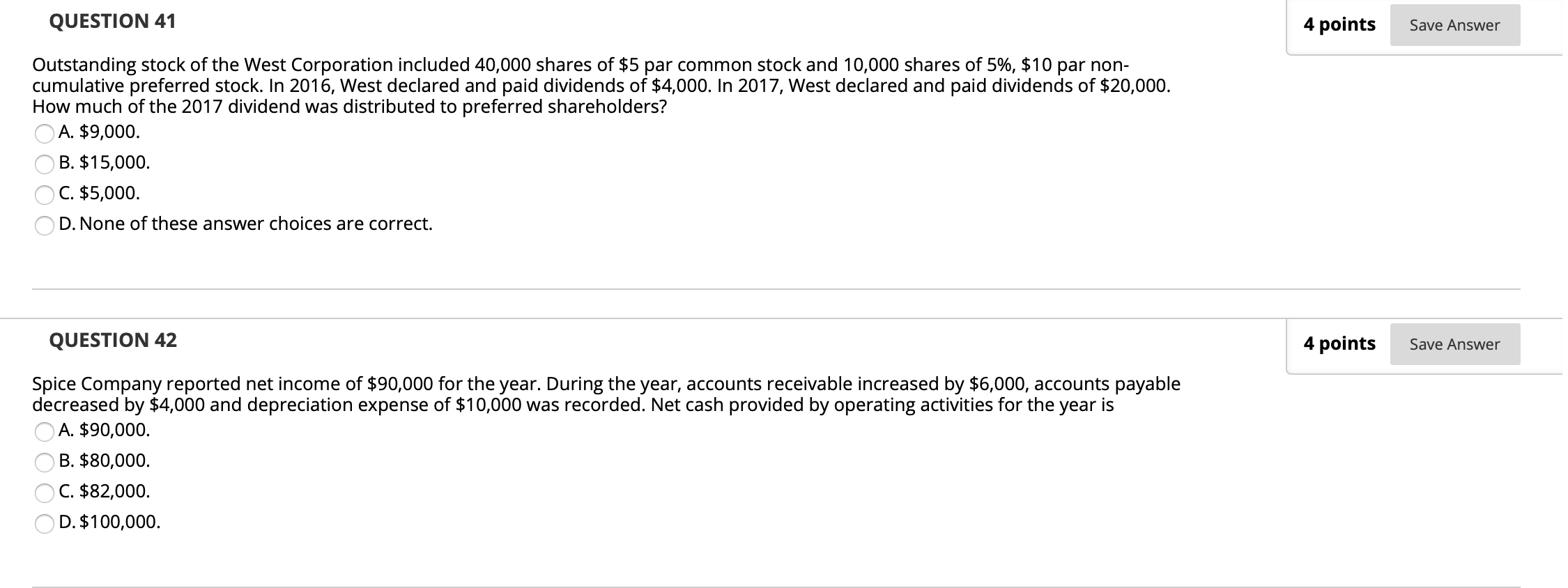

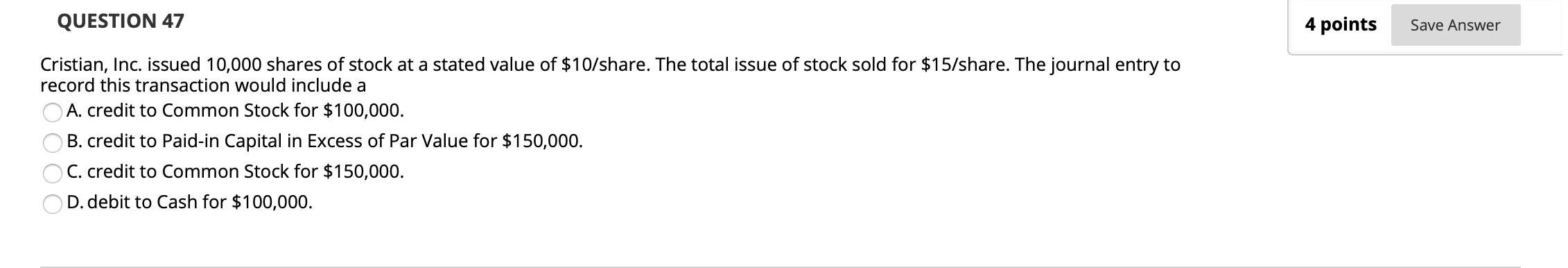

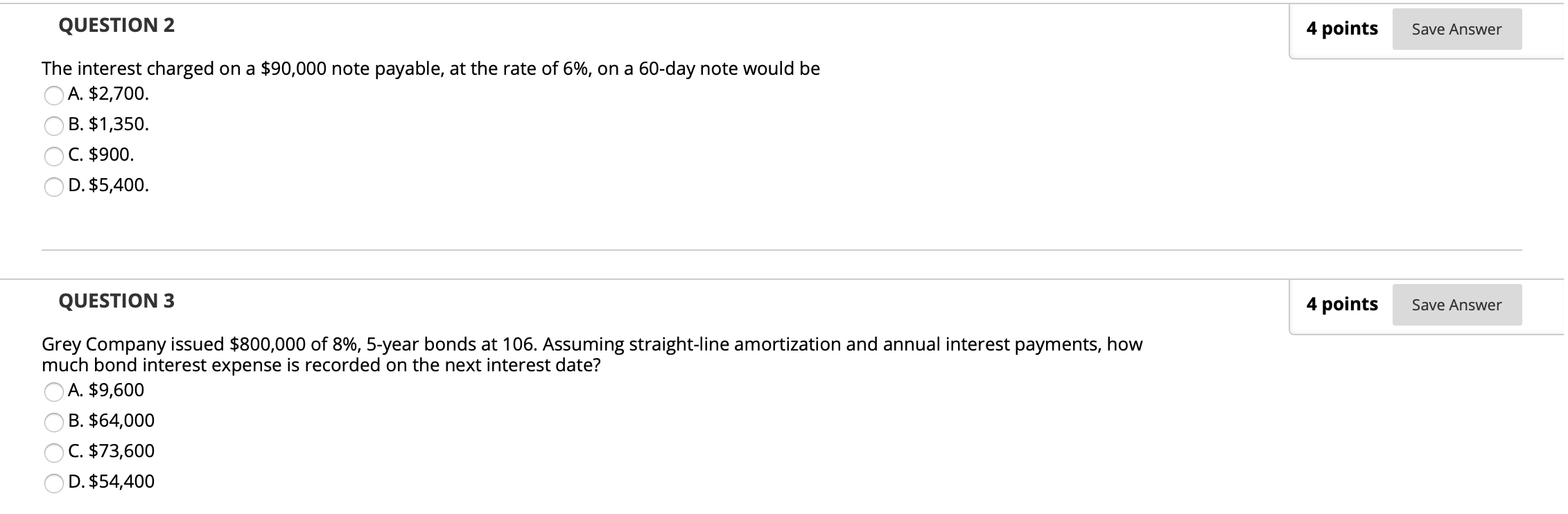

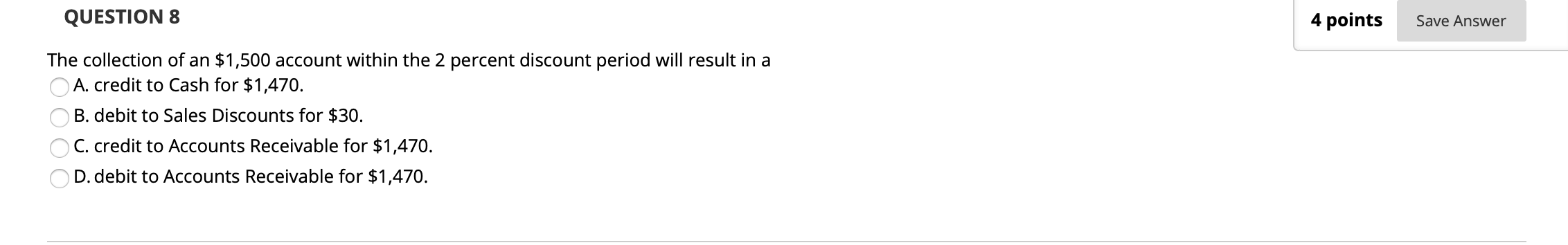

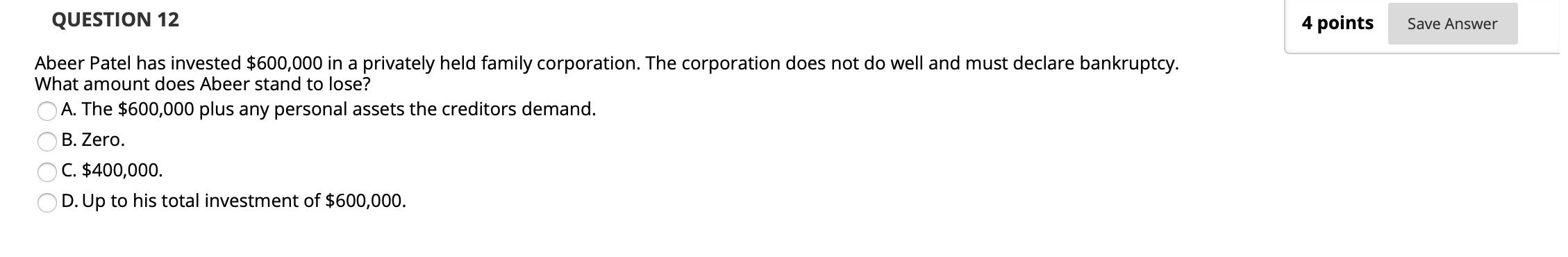

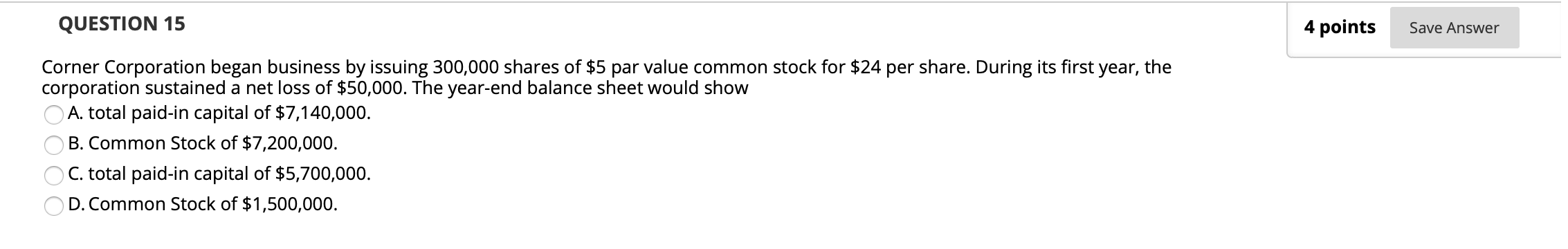

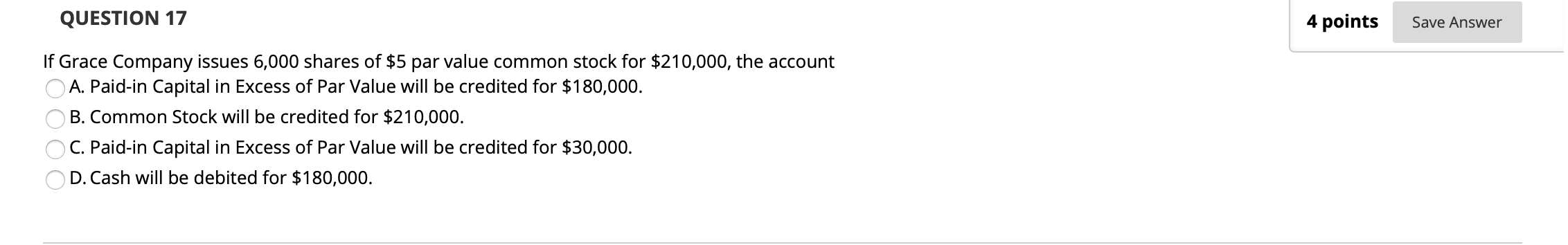

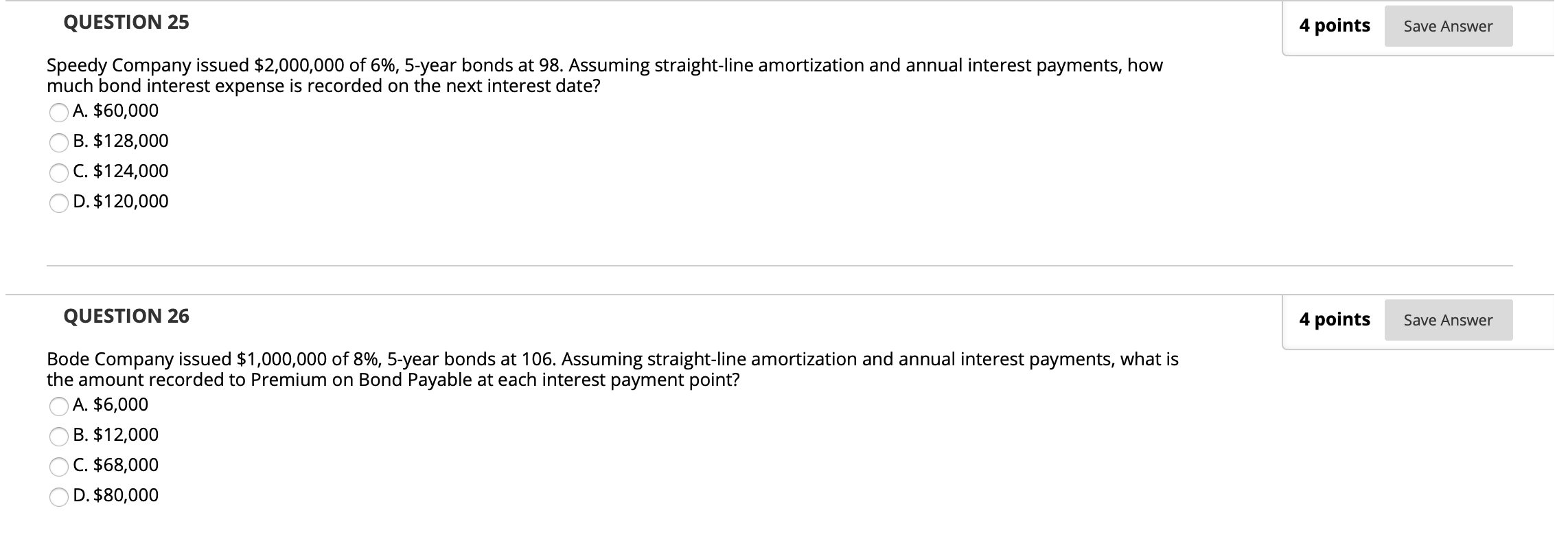

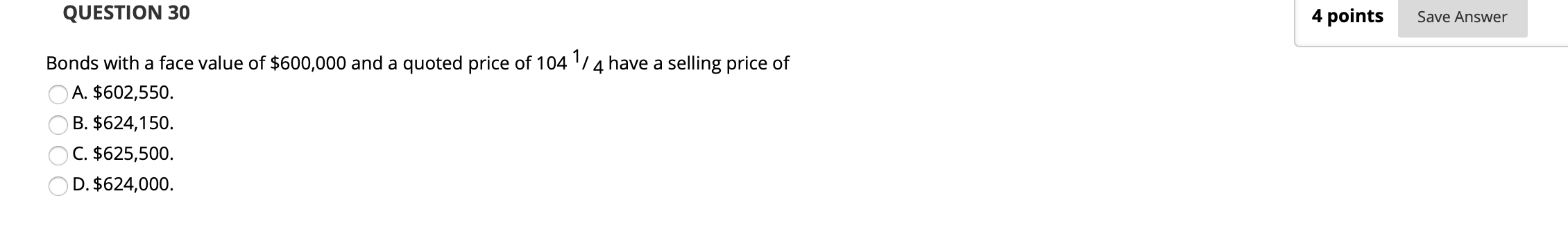

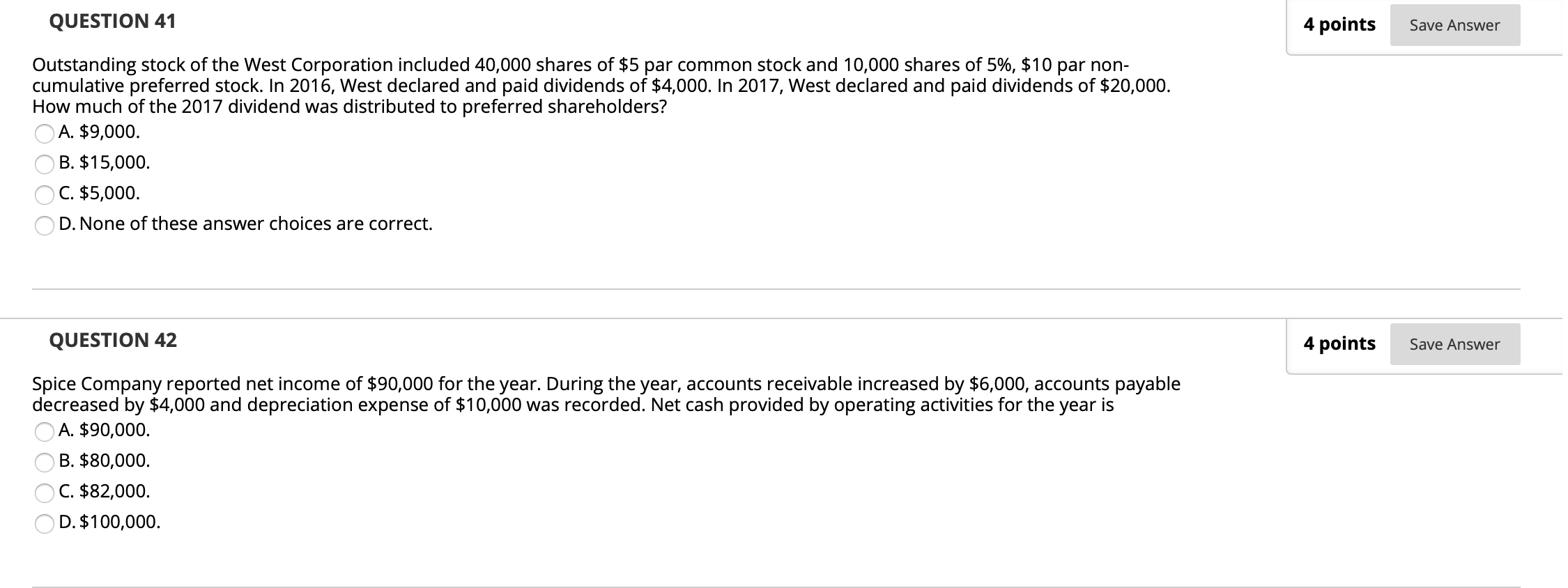

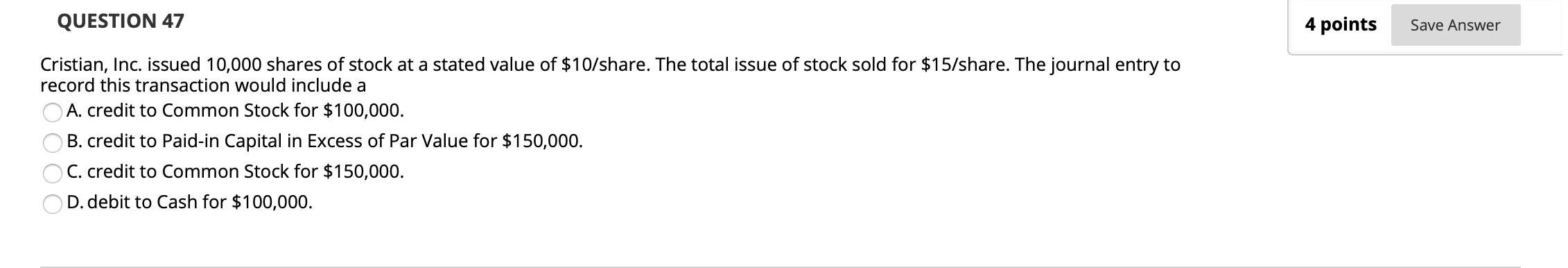

QUESTION 2 4 points Save Answer The interest charged on a $90,000 note payable, at the rate of 6%, on a 60-day note would be OA. $2,700. B. $1,350. C. $900. D. $5,400. QUESTION 3 4 points Save Answer Grey Company issued $800,000 of 8%, 5-year bonds at 106. Assuming straight-line amortization and annual interest payments, how much bond interest expense is recorded on the next interest date? A. $9,600 B. $64,000 C. $73,600 OD. $54,400 QUESTION 4 4 points Save Answer If the market rate of interest is 8%, a $10,000, 10-year bond with a stated rate of 10% that pays interest annually would sell at an amount A. less than face value. B. equal to face value. C. greater than face value. D. that cannot be determined. QUESTION 8 4 points Save Answer The collection of an $1,500 account within the 2 percent discount period will result in a A. credit to Cash for $1,470. B. debit to Sales Discounts for $30. C. credit to Accounts Receivable for $1,470. D. debit to Accounts Receivable for $1,470. QUESTION 12 4 points Save Answer Abeer Patel has invested $600,000 in a privately held family corporation. The corporation does not do well and must declare bankruptcy. What amount does Abeer stand to lose? A. The $600,000 plus any personal assets the creditors demand. B. Zero. C. $400,000. D. Up to his total investment of $600,000. QUESTION 15 4 points Save Answer year, the Corner Corporation began business by issuing 300,000 shares of $5 par value common stock for $24 per share. During its first corporation sustained a net loss of $50,000. The year-end balance sheet would show A. total paid-in capital of $7,140,000. B. Common Stock of $7,200,000. C. total paid-in capital of $5,700,000. D. Common Stock of $1,500,000. QUESTION 17 4 points Save Answer If Grace Company issues 6,000 shares of $5 par value common stock for $210,000, the account A. Paid-in Capital in Excess of Par Value will be credited for $180,000. B. Common Stock will be credited for $210,000. C. Paid-in Capital in Excess of Par Value will be credited for $30,000. D. Cash will be debited for $180,000. QUESTION 25 4 points Save Answer Speedy Company issued $2,000,000 of 6%, 5-year bonds at 98. Assuming straight-line amortization and annual interest payments, how much bond interest expense is recorded on the next interest date? A. $60,000 B. $128,000 C. $124,000 D. $120,000 QUESTION 26 4 points Save Answer Bode Company issued $1,000,000 of 8%, 5-year bonds at 106. Assuming straight-line amortization and annual interest payments, what is the amount recorded to Premium on Bond Payable at each interest payment point? A. $6,000 B. $12,000 C. $68,000 D. $80,000 QUESTION 30 4 points Save Answer Bonds with a face value of $600,000 and a quoted price of 104 1/4 have a selling price of A. $602,550. B. $624,150. C. $625,500. D. $624,000. QUESTION 41 4 points Save Answer Outstanding stock of the West Corporation included 40,000 shares of $5 par common stock and 10,000 shares of 5%, $10 par non- cumulative preferred stock. In 2016, West declared and paid dividends of $4,000. In 2017, West declared and paid dividends of $20,000. How much of the 2017 dividend was distributed to preferred shareholders? A. $9,000. B. $15,000. C. $5,000. D. None of these answer choices are correct. QUESTION 42 4 points Save Answer Spice Company reported net income of $90,000 for the year. During the year, accounts receivable increased by $6,000, accounts payable decreased by $4,000 and depreciation expense of $10,000 was recorded. Net cash provided by operating activities for the year is A. $90,000. B. $80,000. C. $82,000. D. $100,000. QUESTION 47 4 points Save Answer Cristian, Inc. issued 10,000 shares of stock at a stated value of $10/share. The total issue of stock sold for $15/share. The journal entry to record this transaction would include a A. credit to Common Stock for $100,000. B. credit to Paid-in Capital in Excess of Par Value for $150,000. C. credit to Common Stock for $150,000. D. debit to Cash for $100,000