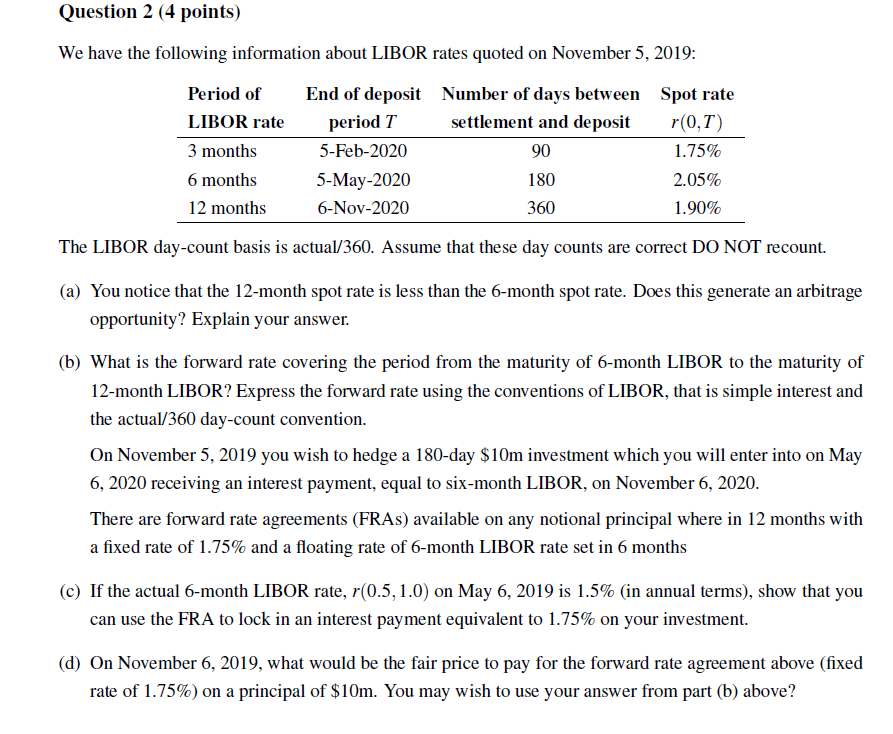

Question 2 (4 points) We have the following information about LIBOR rates quoted on November 5, 2019: Period of End of deposit Number of days between Spot rate LIBOR rate period T settlement and deposit r(0,1) 3 months 5-Feb-2020 90 1.75% 6 months 5-May-2020 180 2.05% 12 months 6-Nov-2020 360 1.90% The LIBOR day-count basis is actual/360. Assume that these day counts are correct DO NOT recount. (a) You notice that the 12-month spot rate is less than the 6-month spot rate. Does this generate an arbitrage opportunity? Explain your answer. (b) What is the forward rate covering the period from the maturity of 6-month LIBOR to the maturity of 12-month LIBOR? Express the forward rate using the conventions of LIBOR, that is simple interest and the actual/360 day-count convention. On November 5, 2019 you wish to hedge a 180-day $10m investment which you will enter into on May 6, 2020 receiving an interest payment, equal to six-month LIBOR, on November 6, 2020. There are forward rate agreements (FRAs) available on any notional principal where in 12 months with a fixed rate of 1.75% and a floating rate of 6-month LIBOR rate set in 6 months (c) If the actual 6-month LIBOR rate, r(0.5, 1.0) on May 6, 2019 is 1.5% (in annual terms), show that you can use the FRA to lock in an interest payment equivalent to 1.75% on your investment. (d) On November 6, 2019, what would be the fair price to pay for the forward rate agreement above (fixed rate of 1.75%) on a principal of $10m. You may wish to use your answer from part (b) above? Question 2 (4 points) We have the following information about LIBOR rates quoted on November 5, 2019: Period of End of deposit Number of days between Spot rate LIBOR rate period T settlement and deposit r(0,1) 3 months 5-Feb-2020 90 1.75% 6 months 5-May-2020 180 2.05% 12 months 6-Nov-2020 360 1.90% The LIBOR day-count basis is actual/360. Assume that these day counts are correct DO NOT recount. (a) You notice that the 12-month spot rate is less than the 6-month spot rate. Does this generate an arbitrage opportunity? Explain your answer. (b) What is the forward rate covering the period from the maturity of 6-month LIBOR to the maturity of 12-month LIBOR? Express the forward rate using the conventions of LIBOR, that is simple interest and the actual/360 day-count convention. On November 5, 2019 you wish to hedge a 180-day $10m investment which you will enter into on May 6, 2020 receiving an interest payment, equal to six-month LIBOR, on November 6, 2020. There are forward rate agreements (FRAs) available on any notional principal where in 12 months with a fixed rate of 1.75% and a floating rate of 6-month LIBOR rate set in 6 months (c) If the actual 6-month LIBOR rate, r(0.5, 1.0) on May 6, 2019 is 1.5% (in annual terms), show that you can use the FRA to lock in an interest payment equivalent to 1.75% on your investment. (d) On November 6, 2019, what would be the fair price to pay for the forward rate agreement above (fixed rate of 1.75%) on a principal of $10m. You may wish to use your answer from part (b) above