Question

Question 2 (40 Marks) Danny Dan (40 years) operated a satellite installation business as a sole proprietor. On 1 April in the current year of

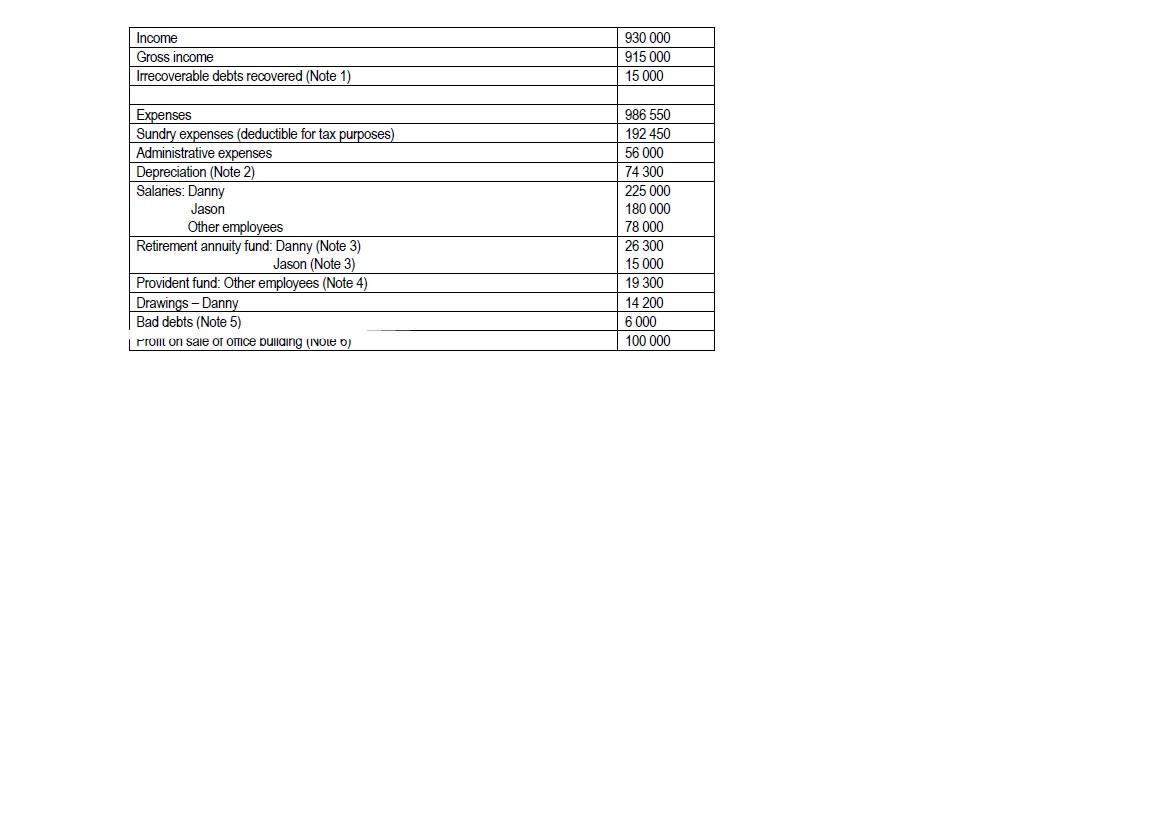

Question 2 (40 Marks) Danny Dan (40 years) operated a satellite installation business as a sole proprietor. On 1 April in the current year of assessment, he decided to enter into a partnership agreement with Jason John (28 years). They agreed to share profits on a 50:50 ratio. The following income and expense items for the current year of assessment relate to the partnership:  Additional Information: a) Irrecoverable debts recovered The irrecoverable debts recovered relates to R15 000 for debtors brought into the partnership by Jason. b) Depreciation Delivery vehicle 1: This vehicle was purchased new by Jason John on 30 May 2016 for R150000. Delivery vehicle 2: This vehicle was purchased second hand in cash by the partnership on 1 April of the current year of assessment (2022), when Jason joined, at a cost of R200 000. In terms of Interpretation Note No. 47, delivery vehicles are written off over a four-year period. The second-hand delivery vehicle was purchased from a person who is registered for VAT purposes. c) Contributions to retirement annuity funds The retirement annuity fund contributions are allowed as a deduction for the partner-ship since they are paid in terms of the partnership agreement. d) Contributions to provident fund The partnership contributes R19 300 on behalf of its employees to a provident fund. e) Bad debts R2 000 of the bad debts relates to a debtor brought into the partnership by Jason. f) Profit on the sale of an office building On 1 April of the current year of assessment Danny bought a new office building at a cost of R2 500 000. Due to economic pressures Danny sold the building and made a capital gain of R100 000. The section 13 allowance on the building is calculated at 5% for the year. g) General All amounts exclude VAT, except where otherwise indicated. The partnership is a registered vendor for VAT purposes. REQUIRED: Calculate the taxable income for Danny Dan for the year of assessment ending February 2022.

Additional Information: a) Irrecoverable debts recovered The irrecoverable debts recovered relates to R15 000 for debtors brought into the partnership by Jason. b) Depreciation Delivery vehicle 1: This vehicle was purchased new by Jason John on 30 May 2016 for R150000. Delivery vehicle 2: This vehicle was purchased second hand in cash by the partnership on 1 April of the current year of assessment (2022), when Jason joined, at a cost of R200 000. In terms of Interpretation Note No. 47, delivery vehicles are written off over a four-year period. The second-hand delivery vehicle was purchased from a person who is registered for VAT purposes. c) Contributions to retirement annuity funds The retirement annuity fund contributions are allowed as a deduction for the partner-ship since they are paid in terms of the partnership agreement. d) Contributions to provident fund The partnership contributes R19 300 on behalf of its employees to a provident fund. e) Bad debts R2 000 of the bad debts relates to a debtor brought into the partnership by Jason. f) Profit on the sale of an office building On 1 April of the current year of assessment Danny bought a new office building at a cost of R2 500 000. Due to economic pressures Danny sold the building and made a capital gain of R100 000. The section 13 allowance on the building is calculated at 5% for the year. g) General All amounts exclude VAT, except where otherwise indicated. The partnership is a registered vendor for VAT purposes. REQUIRED: Calculate the taxable income for Danny Dan for the year of assessment ending February 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started