Question

Question 2 (40 marks) (Suggested time: 40 minutes) On 1 April 2021, Tencent stock price was $630 Tencent: 630 call $26.00; 600 call $43.80; 660

Question 2 (40 marks) (Suggested time: 40 minutes)

On 1 April 2021, Tencent stock price was $630 Tencent: 630 call $26.00; 600 call $43.80; 660 call $14.30 and Tencent. 630 put $22.90; 600 put $11.27; 660 put $41.70. Both call and put options are expired at 29 April 2021. (1 contract = 100 shares) You bought 200 shares of Tencent at $630 with total cost $126,000. You constructed 1 contract of an Out of The Money (OTM) covered call strategy You constructed 1 contract of an In of The Money (ITM) protective put strategy.

2a) Explain with arguments of your investment expectation of the OTM covered call strategy. Which call option do you select? 2b) Explain with arguments of your investment expectation of the ITM protective put strategy. Which put option do you select?

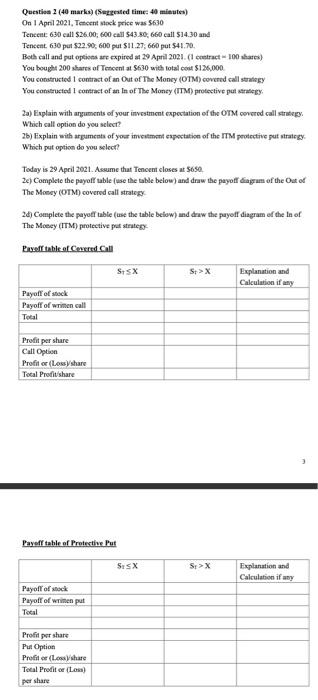

Today is 29 April 2021. Assume that Tencent closes at $650. 2c) Complete the payoff table (use the table below) and draw the payoff diagram of the Out of The Money (OTM) covered call strategy.

2d) Complete the payoff table (use the table below) and draw the payoff diagram of the In of The Money (ITM) protective put strategy.

Payoff table of Covered Call

Payoff of stock Payoff of written call Total

Profit per share Call Option Profit or (Loss)/share Total Profit/share

ST X

ST > X

Explanation and Calculation if anyl

Payoff table of Protective Put

Payoff of stock Payoff of written put Total

Profit per share Put Option Profit or (Loss)/share Total Profit or (Loss) per share

ST X

ST > X

Explanation and Calculation if any

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started