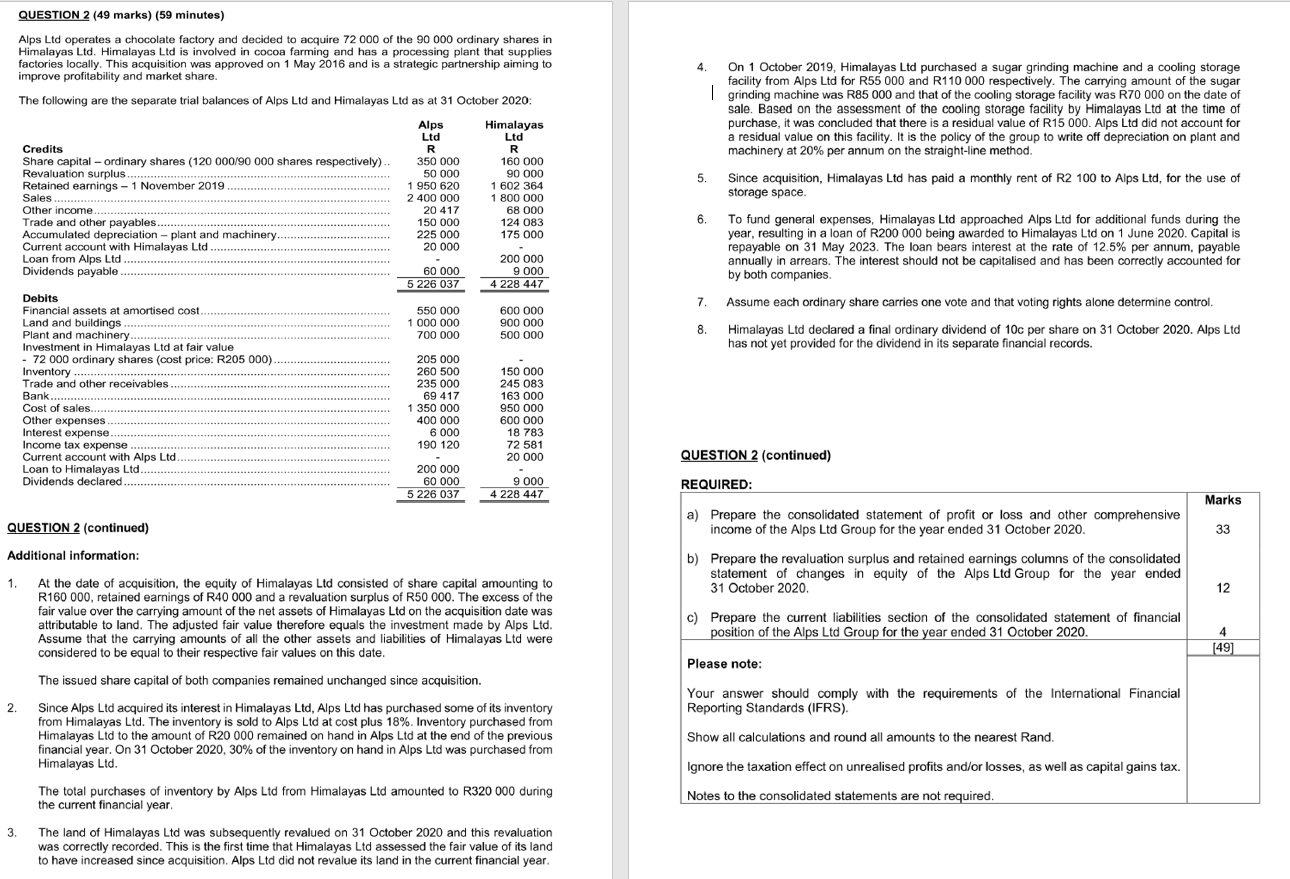

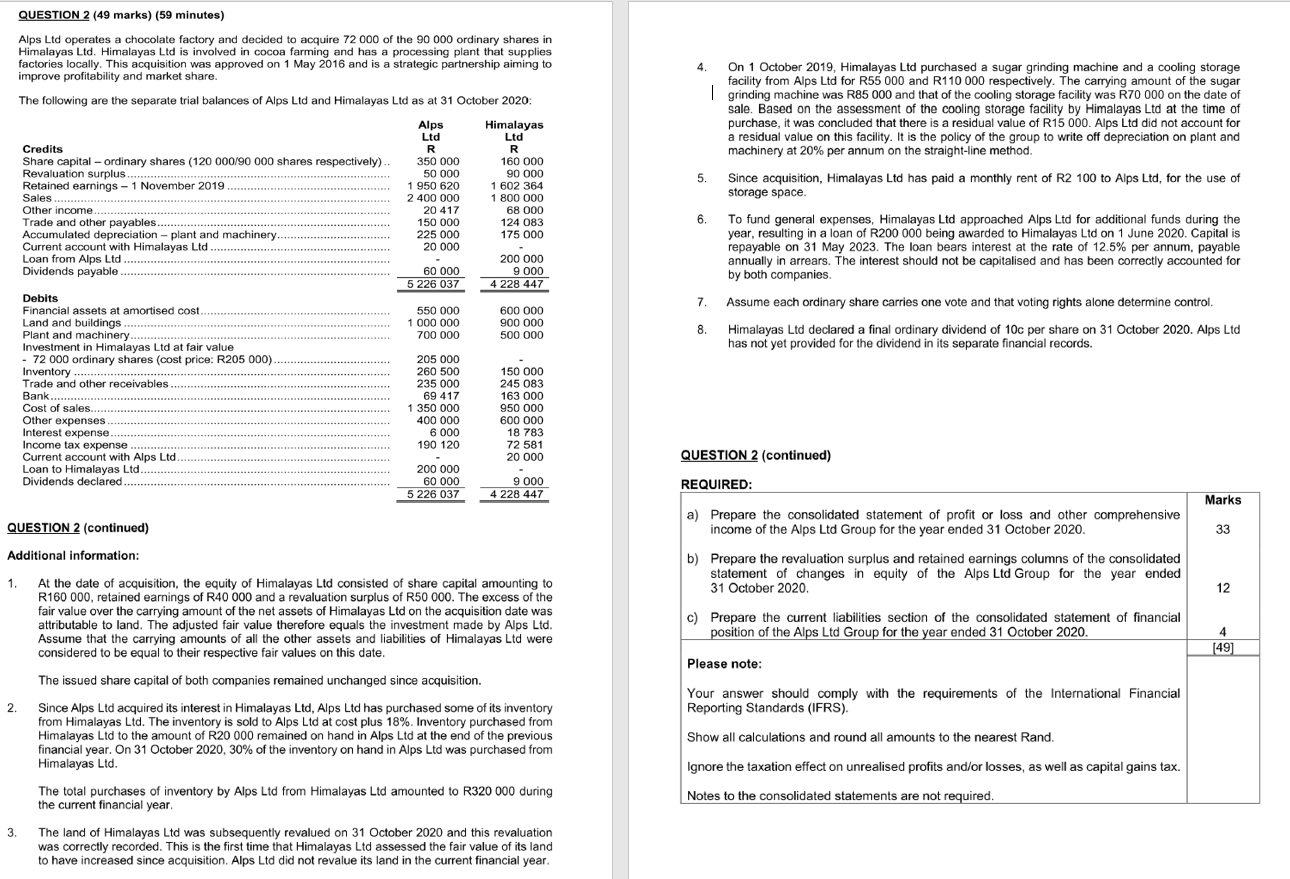

QUESTION 2 (49 marks) (59 minutes) 4. Alps Ltd operates a chocolate factory and decided to acquire 72 000 of the 90 000 ordinary shares in Himalayas Ltd. Himalayas Ltd is involved in cocoa farming and has a processing plant that supplies factories locally. This acquisition was approved on 1 May 2016 and is a strategic partnership aiming to improve profitability and market share. The following are the separate trial balances of Alps Ltd and Himalayas Ltd as at 31 October 2020: Alps Himalayas Ltd Ltd Credits R R Share capital - ordinary shares (120 000/90 000 shares respectively) 350 000 160 000 Revaluation surplus. 50 000 90 000 Retained earnings - 1 November 2019 1 950 620 1 602 364 Sales 2 400 000 1 800 000 Other income... 20 417 68 000 Trade and other payables........ 150 000 124 083 Accumulated depreciation - plant and machinery 225 000 175 000 Current account with Himalayas Ltd 20 000 Loan from Alps Ltd 200 000 Dividends payable 60 000 9 000 5 226 037 4 228 447 Debits Financial assets at amortised cost 550 000 600 000 Land and buildings ............. 1 000 000 900 000 Plant and machinery............. 700 000 500 000 Investment in Himalayas Ltd at fair value - 72 000 ordinary shares (cost price: R205 000). 205 000 Inventory ................. 260 500 150 000 Trade and other receivables 235 000 245 083 Bank... 69 417 163 000 Cost of sales. 1 350 000 950 000 Other expenses 400 000 600 000 Interest expense 6 000 18 783 Income tax expense 190 120 72 581 Current account with Alps Ltd. 20 000 Loan to Himalayas Ltd 200 000 Dividends declared 60 000 9 000 5 226 037 4 228 447 On 1 October 2019, Himalayas Ltd purchased a sugar grinding machine and a cooling storage facility from Alps Ltd for R55 000 and R110 000 respectively. The carrying amount of the sugar | grinding machine was R85 000 and that of the cooling storage facility was R70 000 on the date of sale. Based on the assessment of the cooling storage facility by Himalayas Ltd at the time of purchase, it was concluded that there is a residual value of R15 000. Alps Ltd did not account for a residual value on this facility. It is the policy of the group to write off depreciation on plant and machinery at 20% per annum on the straight-line method. 5. Since acquisition, Himalayas Ltd has paid a monthly rent of R2 100 to Alps Ltd, for the use of storage space 6. To fund general expenses, Himalayas Ltd approached Alps Ltd for additional funds during the year, resulting in a loan of R200 000 being awarded to Himalayas Ltd on 1 June 2020. Capital is repayable on 31 May 2023. The loan bears interest at the rate of 12.5% per annum, payable annually in arrears. The interest should not be capitalised and has been correctly accounted for by both companies. 7. Assume each ordinary share carries one vote and that voting rights alone determine control. 8. Himalayas Ltd declared a final ordinary dividend of 10c per share on 31 October 2020. Alps Ltd has not yet provided for the dividend in its separate financial records. QUESTION 2 (continued) REQUIRED: Marks QUESTION 2 (continued) a) Prepare the consolidated statement of profit or loss and other comprehensive income of the Alps Ltd Group for the year ended 31 October 2020. 33 Additional information: b) Prepare the revaluation surplus and retained earnings columns of the consolidated statement of changes in equity of the Alps Ltd Group for the year ended 31 October 2020. 1. 12 c) Prepare the current liabilities section of the consolidated statement of financial position of the Alps Ltd Group for the year ended 31 October 2020. 4 [49] Please note: At the date of acquisition, the equity of Himalayas Ltd consisted of share capital amounting to R160 000, retained earnings of R40 000 and a revaluation surplus of R50 000. The excess of the fair value over the carrying amount of the net assets of Himalayas Ltd on the acquisition date was attributable to land. The adjusted fair value therefore equals the investment made by Alps Ltd. Assume that the carrying amounts of all the other assets and liabilities of Himalayas Ltd were considered to be equal to their respective fair values on this date. The issued share capital of both companies remained unchanged since acquisition. Since Alps Ltd acquired its interest in Himalayas Ltd, Alps Ltd has purchased some of its inventory from Himalayas Ltd. The inventory is sold to Alps Ltd at cost plus 18%. Inventory purchased from Himalayas Ltd to the amount of R20 000 remained on hand in Alps Ltd at the end of the previous financial year. On 31 October 2020, 30% of the inventory on hand in Alps Ltd was purchased from Himalayas Ltd. 2. Your answer should comply with the requirements of the International Financial Reporting Standards (IFRS). Show all calculations and round all amounts to the nearest Rand. . Ignore the taxation effect on unrealised profits and/or losses, as well as capital gains tax. The total purchases of inventory by Alps Ltd from Himalayas Ltd amounted to R320 000 during the current financial year Notes to the consolidated statements are not required. 3. The land of Himalayas Ltd was subsequently revalued on 31 October 2020 and this revaluation was correctly recorded. This is the first time that Himalayas Ltd assessed the fair value of its land to have increased since acquisition. Alps Ltd did not revalue its land in the current financial year. QUESTION 2 (49 marks) (59 minutes) 4. Alps Ltd operates a chocolate factory and decided to acquire 72 000 of the 90 000 ordinary shares in Himalayas Ltd. Himalayas Ltd is involved in cocoa farming and has a processing plant that supplies factories locally. This acquisition was approved on 1 May 2016 and is a strategic partnership aiming to improve profitability and market share. The following are the separate trial balances of Alps Ltd and Himalayas Ltd as at 31 October 2020: Alps Himalayas Ltd Ltd Credits R R Share capital - ordinary shares (120 000/90 000 shares respectively) 350 000 160 000 Revaluation surplus. 50 000 90 000 Retained earnings - 1 November 2019 1 950 620 1 602 364 Sales 2 400 000 1 800 000 Other income... 20 417 68 000 Trade and other payables........ 150 000 124 083 Accumulated depreciation - plant and machinery 225 000 175 000 Current account with Himalayas Ltd 20 000 Loan from Alps Ltd 200 000 Dividends payable 60 000 9 000 5 226 037 4 228 447 Debits Financial assets at amortised cost 550 000 600 000 Land and buildings ............. 1 000 000 900 000 Plant and machinery............. 700 000 500 000 Investment in Himalayas Ltd at fair value - 72 000 ordinary shares (cost price: R205 000). 205 000 Inventory ................. 260 500 150 000 Trade and other receivables 235 000 245 083 Bank... 69 417 163 000 Cost of sales. 1 350 000 950 000 Other expenses 400 000 600 000 Interest expense 6 000 18 783 Income tax expense 190 120 72 581 Current account with Alps Ltd. 20 000 Loan to Himalayas Ltd 200 000 Dividends declared 60 000 9 000 5 226 037 4 228 447 On 1 October 2019, Himalayas Ltd purchased a sugar grinding machine and a cooling storage facility from Alps Ltd for R55 000 and R110 000 respectively. The carrying amount of the sugar | grinding machine was R85 000 and that of the cooling storage facility was R70 000 on the date of sale. Based on the assessment of the cooling storage facility by Himalayas Ltd at the time of purchase, it was concluded that there is a residual value of R15 000. Alps Ltd did not account for a residual value on this facility. It is the policy of the group to write off depreciation on plant and machinery at 20% per annum on the straight-line method. 5. Since acquisition, Himalayas Ltd has paid a monthly rent of R2 100 to Alps Ltd, for the use of storage space 6. To fund general expenses, Himalayas Ltd approached Alps Ltd for additional funds during the year, resulting in a loan of R200 000 being awarded to Himalayas Ltd on 1 June 2020. Capital is repayable on 31 May 2023. The loan bears interest at the rate of 12.5% per annum, payable annually in arrears. The interest should not be capitalised and has been correctly accounted for by both companies. 7. Assume each ordinary share carries one vote and that voting rights alone determine control. 8. Himalayas Ltd declared a final ordinary dividend of 10c per share on 31 October 2020. Alps Ltd has not yet provided for the dividend in its separate financial records. QUESTION 2 (continued) REQUIRED: Marks QUESTION 2 (continued) a) Prepare the consolidated statement of profit or loss and other comprehensive income of the Alps Ltd Group for the year ended 31 October 2020. 33 Additional information: b) Prepare the revaluation surplus and retained earnings columns of the consolidated statement of changes in equity of the Alps Ltd Group for the year ended 31 October 2020. 1. 12 c) Prepare the current liabilities section of the consolidated statement of financial position of the Alps Ltd Group for the year ended 31 October 2020. 4 [49] Please note: At the date of acquisition, the equity of Himalayas Ltd consisted of share capital amounting to R160 000, retained earnings of R40 000 and a revaluation surplus of R50 000. The excess of the fair value over the carrying amount of the net assets of Himalayas Ltd on the acquisition date was attributable to land. The adjusted fair value therefore equals the investment made by Alps Ltd. Assume that the carrying amounts of all the other assets and liabilities of Himalayas Ltd were considered to be equal to their respective fair values on this date. The issued share capital of both companies remained unchanged since acquisition. Since Alps Ltd acquired its interest in Himalayas Ltd, Alps Ltd has purchased some of its inventory from Himalayas Ltd. The inventory is sold to Alps Ltd at cost plus 18%. Inventory purchased from Himalayas Ltd to the amount of R20 000 remained on hand in Alps Ltd at the end of the previous financial year. On 31 October 2020, 30% of the inventory on hand in Alps Ltd was purchased from Himalayas Ltd. 2. Your answer should comply with the requirements of the International Financial Reporting Standards (IFRS). Show all calculations and round all amounts to the nearest Rand. . Ignore the taxation effect on unrealised profits and/or losses, as well as capital gains tax. The total purchases of inventory by Alps Ltd from Himalayas Ltd amounted to R320 000 during the current financial year Notes to the consolidated statements are not required. 3. The land of Himalayas Ltd was subsequently revalued on 31 October 2020 and this revaluation was correctly recorded. This is the first time that Himalayas Ltd assessed the fair value of its land to have increased since acquisition. Alps Ltd did not revalue its land in the current financial year