Answered step by step

Verified Expert Solution

Question

1 Approved Answer

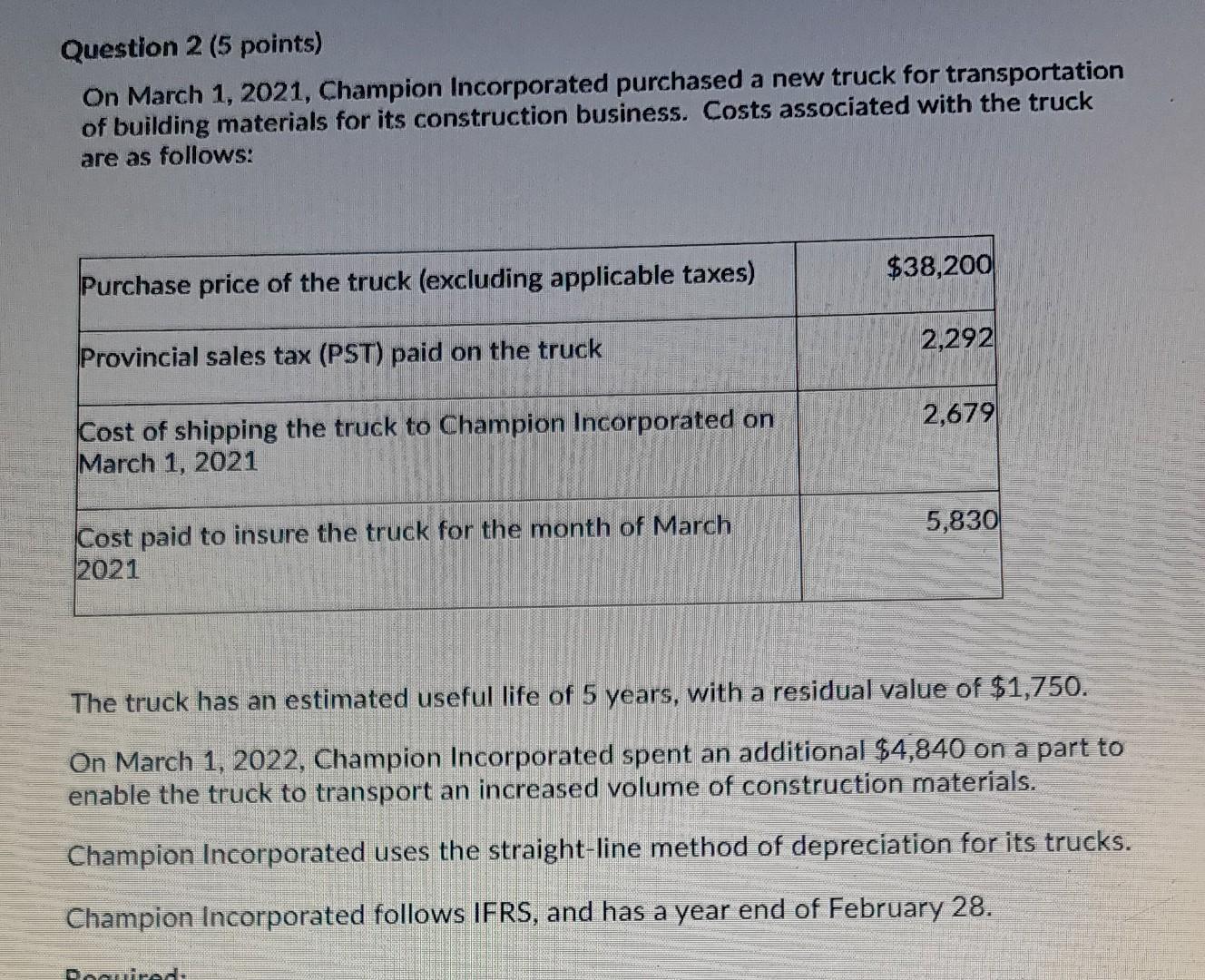

Question 2 (5 points) On March 1, 2021, Champion Incorporated purchased a new truck for transportation of building materials for its construction business. Costs associated

Question 2 (5 points) On March 1, 2021, Champion Incorporated purchased a new truck for transportation of building materials for its construction business. Costs associated with the truck are as follows: $38,200 Purchase price of the truck (excluding applicable taxes) 2,292 Provincial sales tax (PST) paid on the truck 2,679 Cost of shipping the truck to Champion Incorporated on March 1, 2021 5,830 Cost paid to insure the truck for the month of March 2021 The truck has an estimated useful life of 5 years, with a residual value of $1,750. On March 1, 2022, Champion Incorporated spent an additional $4,840 on a part to enable the truck to transport an increased volume of construction materials. Champion Incorporated uses the straight-line method of depreciation for its trucks. Champion Incorporated follows IFRS, and has a year end of February 28. Dopod Required: 1. Calculate the depreciation expense on the truck for the year ended February 28, 2022. (3 marks) 2. Calculate depreciation expense on the truck for the year ended February 28, 2023. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started