Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (50 Marks) Ignore value-added tax, dividend tax and any tax implications on the disposal or deemed disposal of shares. Busy Books Ltd

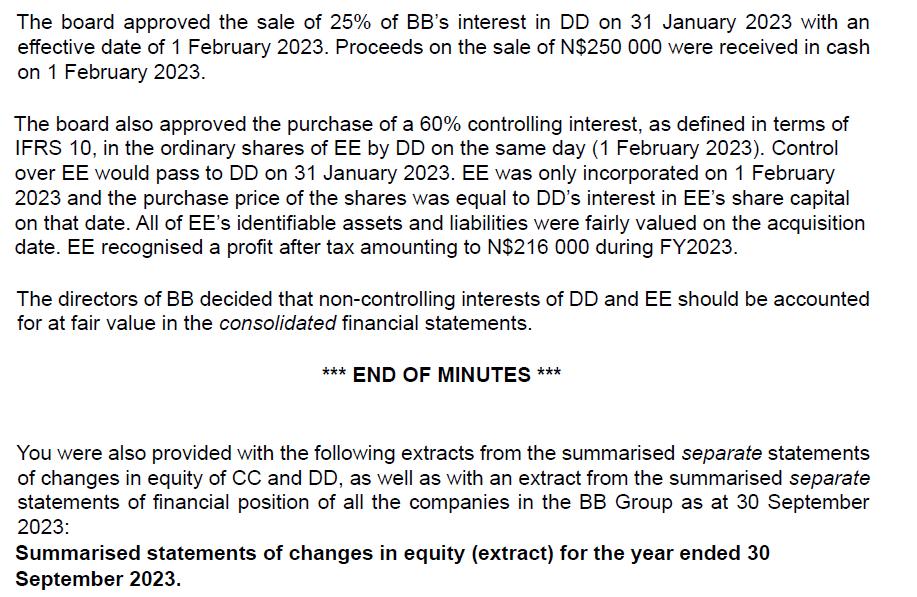

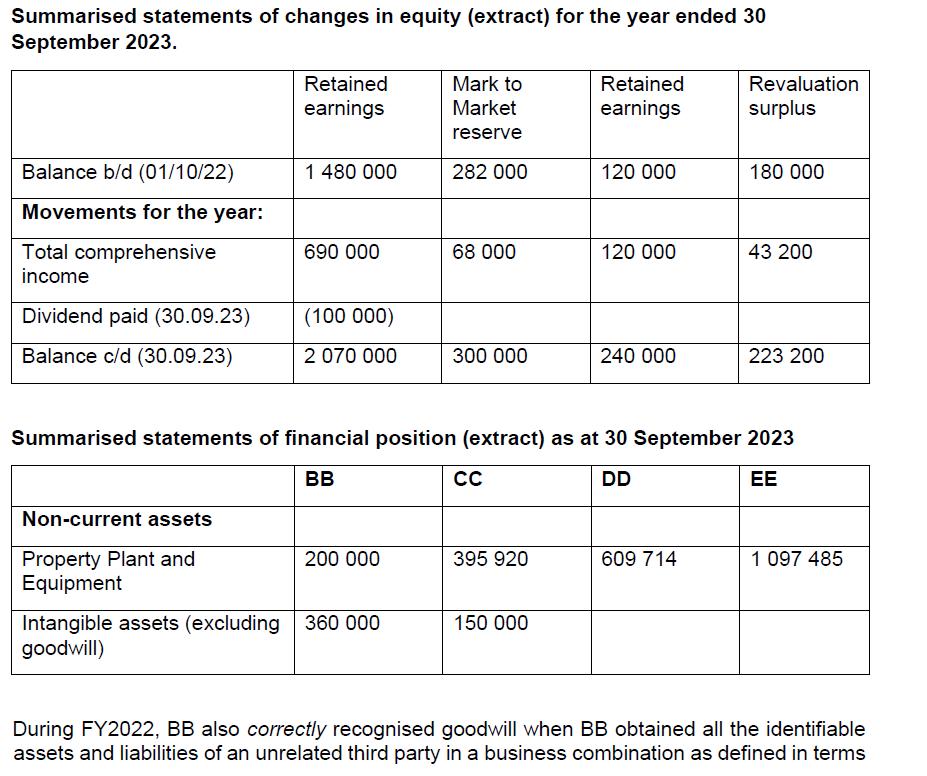

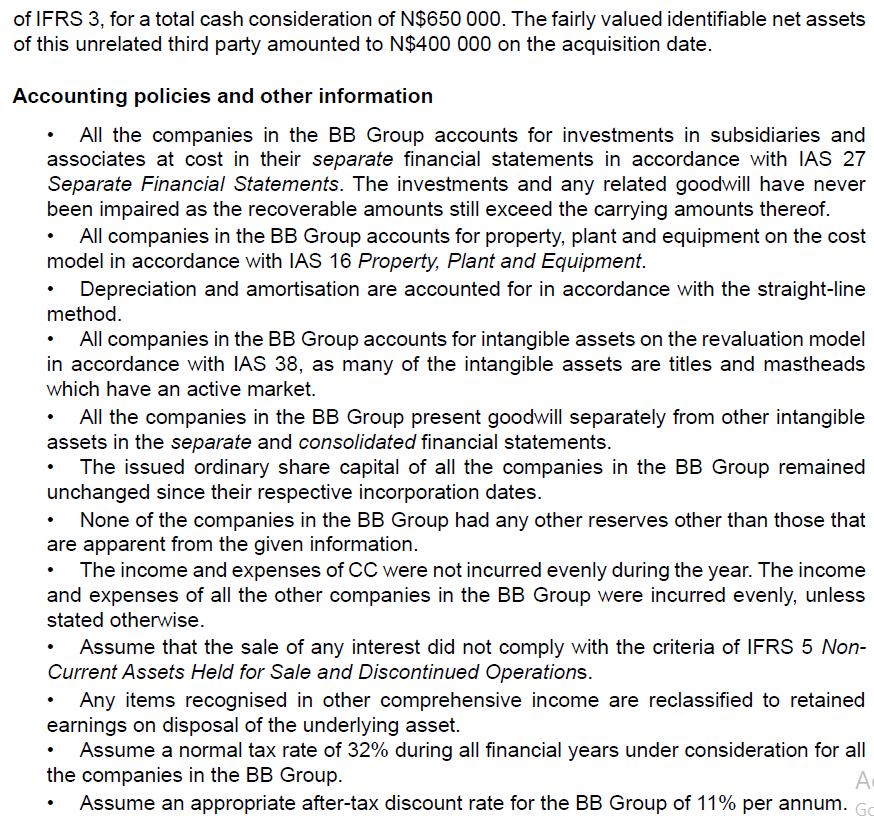

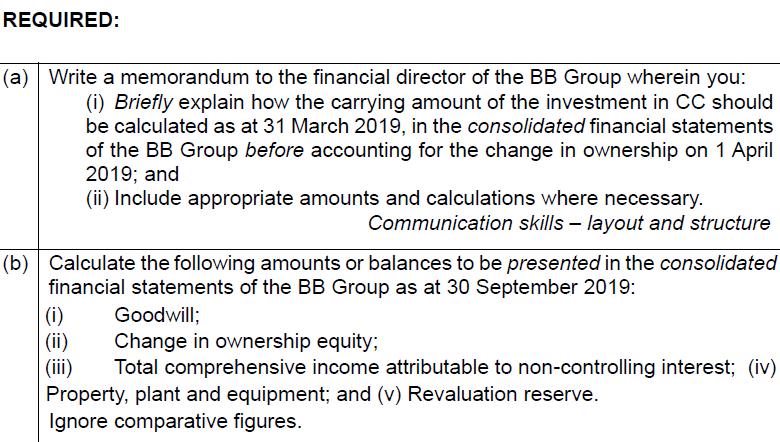

Question 2 (50 Marks) Ignore value-added tax, dividend tax and any tax implications on the disposal or deemed disposal of shares. Busy Books Ltd ('BB') is a Namibian publisher and distributor of books and stationery. BB is the parent company of the Busy Books Ltd Group ('BB Group'). The financial year end ('FY') of all the companies in the BB Group is 30 September. The BB Group as at 30 September 2023 consists of ordinary share investments held by BB in Creative Commons Ltd ('CC') and Delibarate Definition Ltd ('DD'). DD in turn has a controlling interest of 60% in the ordinary shares of Elegent Entries Ltd ('EE'). You, as the financial manager of the BB Group, have collected various company documents to obtain the necessary information about each investment above, which are provided to you below: Date: 31 March 2023 Minutes of directors meeting Attendees: Ms Melandrie Brenkman, Mr Duma Mabutho, Mr Ebrahim Carrim Agenda: Acquisition of a further equity interest in CC Attendees of the meeting were reminded that BB initially obtained a 40% interest in the ordinary shares of CC on 1 October 2016, when CC's equity consisted of issued ordinary share capital of N$1 400 000, retained earnings (debit balance) of N$250 000 and a mark-to- market reserve of N$72 000. The mark-to-market reserve relates to simple investments in equity instruments that are accounted for at fair value through other comprehensive income in terms of IFRS 9 Financial Instruments. Fair value adjustments on these investments are accounted for on 30 September of each year. CC recognised a profit after tax of N$310 000 for the six months ended 31 March 2023. In terms of IAS 28 Investments in Associates and Joint Ventures, BB has exercised significant influence over CC since 1 October 2016. The purchase price of N$480 000 was settled in cash and paid to the previous owners of the shares on 1 October 2016. Ac On 1 October 2016, all identifiable assets and liabilities of CC were fairly valued except for a depreciable item of property, plant and equipment of CC's, which was undervalued by N$150 000. This piece of property, plant and equipment had a remaining useful life of 15 years on 1 October 2016 and an insignificant residual value. Namibian Revenue agents (NamRa) allows 3 years wear-and-tear allowance on this property, plant and equipment item; apportioned for periods shorter than a year. The only intercompany transaction between BB and CC took place on 28 February 2023, when BB sold inventory with a carrying amount of N$50 000 to CC for N$68 000. CC has not yet sold any of this inventory at the end of FY2023. All attendees at the meeting approved the agreement between the outside shareholders and BB to acquire a further 40% of the ordinary shares in CC for a purchase price of N$1 800 000, to be paid in cash immediately. The board concluded that the date on which control, as defined in terms of IFRS 10 Consolidated Financial Statements, over CC passes to BB, is 1 April 2023. The remeasurement loss to be recognised in the consolidated financial statements of the BB Group as a result of the additional shares acquired, amounted to N$186 080 on 1 April 2023. On 1 April 2023, the property, plant and equipment item referred to above was still undervalued by N$85 000. Residual value and useful life estimates had not changed since 1 October 2016. The directors of BB decided that non-controlling interests in CC should be accounted for at their proportional share in the consolidated financial statements. Date: 31 January 2023 *** END OF MINUTES *** Minutes of directors meeting Attendees: Ms Christo Koch, Mr Duma Mabutho, Mr Ebrahim Carrim Agenda: Sale of interest in DD and acquisition of an equity interest in EE by DD On 1 October 2021, BB acquired a 100% controlling interest, as defined in terms of IFRS 10, in DD. On this date, the carrying amounts of all of DD's recognised assets and liabilities amounted to N$2 500 000 and N$1 895 000 respectively. The net assets on the acquisition date included credit retained earnings and revaluation reserve balances amounting to N$75 000 and N$30 000 respectively. The revaluation reserve relates to intangible assets that are accounted for on the revaluation model in terms of IAS 38 Intangible Assets. These assets are revalued on 30 September of each year. The purchase price, paid to the former owners of the shares, for the 100% interest in DD was settled as follows: Cash payment of N$500 000 payable on 30 September 2023; and Issue of 64 139 share options in DD with an exercise price of N$20 each and a fair value of N$5 each on 1 October 2021. The fair value of the share options changed to N$6 each on 30 September 2022 and N$7 each on 30 September 2023. On 1 October 2021, the identifiable assets and liabilities of DD were fairly valued in terms of IFRS 3 Business Combinations, except for the following two items: On 1 October 2021, there was a pending lawsuit by another publisher for an amount of N$380 000 for breach of copyright. DD's lawyers confirmed that in the past such claims have not always been successful but that it is more likely than not that the court will rule in the complainant's favour because a present obligation existed for DD due to copyright laws. On the acquisition date, the fair value of the claim amounted to N$180 000. NamRa indicated that they will not allow the payment as a deduction when paid. On 25 March 2023, the court ruled in the favour of DD and the case was dismissed due to insufficient evidence. DD had internally generated mastheads (i.e. titles of books/magazines) which did not meet the recognition criteria in IAS 38. An independent valuer provisionally estimated the fair value of these mastheads to be N$300 000 on 1 October 2021. On 1 October 2021, these mastheads had a remaining useful life of ten years. After obtaining all the relevant information to perform a discounted cash flow valuation, the valuer confirmed on 30 January 2022 that a more appropriate fair value would be N$230 000 on the acquisition date. NamRa already allowed a tax deduction for costs incurred to develop these mastheads. The board approved the sale of 25% of BB's interest in DD on 31 January 2023 with an effective date of 1 February 2023. Proceeds on the sale of N$250 000 were received in cash on 1 February 2023. The board also approved the purchase of a 60% controlling interest, as defined in terms of IFRS 10, in the ordinary shares of EE by DD on the same day (1 February 2023). Control over EE would pass to DD on 31 January 2023. EE was only incorporated on 1 February 2023 and the purchase price of the shares was equal to DD's interest in EE's share capital on that date. All of EE's identifiable assets and liabilities were fairly valued on the acquisition date. EE recognised a profit after tax amounting to N$216 000 during FY2023. The directors of BB decided that non-controlling interests of DD and EE should be accounted for at fair value in the consolidated financial statements. *** END OF MINUTES *** You were also provided with the following extracts from the summarised separate statements of changes in equity of CC and DD, as well as with an extract from the summarised separate statements of financial position of all the companies in the BB Group as at 30 September 2023: Summarised statements of changes in equity (extract) for the year ended 30 September 2023. Summarised statements of changes in equity (extract) for the year ended 30 September 2023. Balance b/d (01/10/22) Movements for the year: Retained earnings Mark to Market Retained earnings Revaluation surplus reserve 1 480 000 282 000 120 000 180 000 Total comprehensive income 690 000 68 000 120 000 43 200 Dividend paid (30.09.23) (100 000) Balance c/d (30.09.23) 2 070 000 300 000 240 000 223 200 Summarised statements of financial position (extract) as at 30 September 2023 BB CC DD EE Non-current assets Property Plant and 200 000 395 920 609 714 1 097 485 Equipment Intangible assets (excluding 360 000 goodwill) 150 000 During FY2022, BB also correctly recognised goodwill when BB obtained all the identifiable assets and liabilities of an unrelated third party in a business combination as defined in terms of IFRS 3, for a total cash consideration of N$650 000. The fairly valued identifiable net assets of this unrelated third party amounted to N$400 000 on the acquisition date. Accounting policies and other information All the companies in the BB Group accounts for investments in subsidiaries and associates at cost in their separate financial statements in accordance with IAS 27 Separate Financial Statements. The investments and any related goodwill have never been impaired as the recoverable amounts still exceed the carrying amounts thereof. All companies in the BB Group accounts for property, plant and equipment on the cost model in accordance with IAS 16 Property, Plant and Equipment. Depreciation and amortisation are accounted for in accordance with the straight-line method. All companies in the BB Group accounts for intangible assets on the revaluation model in accordance with IAS 38, as many of the intangible assets are titles and mastheads which have an active market. All the companies in the BB Group present goodwill separately from other intangible the separate and consolidated financial statements. The issued ordinary share capital of all the companies in the BB Group remained unchanged since their respective incorporation dates. None of the companies in the BB Group had any other reserves other than those that are apparent from the given information. The income and expenses of CC were not incurred evenly during the year. The income and expenses of all the other companies in the BB Group were incurred evenly, unless stated otherwise. Assume that the sale of any interest did not comply with the criteria of IFRS 5 Non- Current Assets Held for Sale and Discontinued Operations. Any items recognised in other comprehensive income are reclassified to retained earnings on disposal of the underlying asset. Assume a normal tax rate of 32% during all financial years under consideration for all the companies in the BB Group. A Assume an appropriate after-tax discount rate for the BB Group of 11% per annum. G REQUIRED: (a) Write a memorandum to the financial director of the BB Group wherein you: (i) Briefly explain how the carrying amount of the investment in CC should be calculated as at 31 March 2019, in the consolidated financial statements of the BB Group before accounting for the change in ownership on 1 April 2019; and (ii) Include appropriate amounts and calculations where necessary. Communication skills - layout and structure (b) Calculate the following amounts or balances to be presented in the consolidated financial statements of the BB Group as at 30 September 2019: (i) (ii) (iii) Goodwill; Change in ownership equity; Total comprehensive income attributable to non-controlling interest; (iv) Property, plant and equipment; and (v) Revaluation reserve. Ignore comparative figures.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started