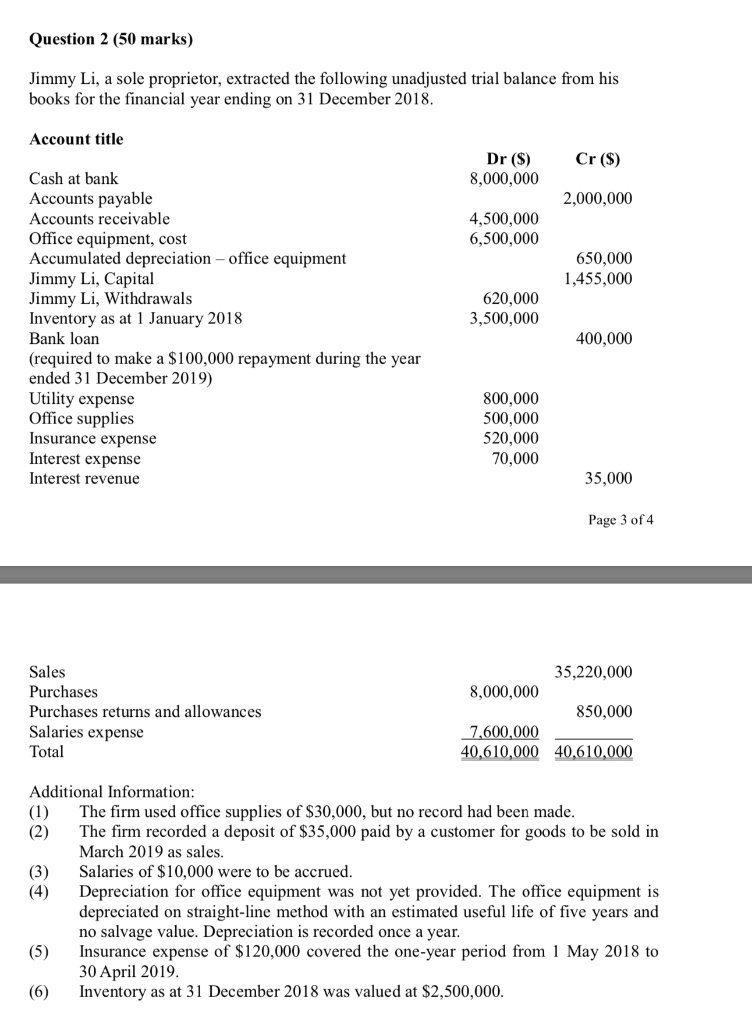

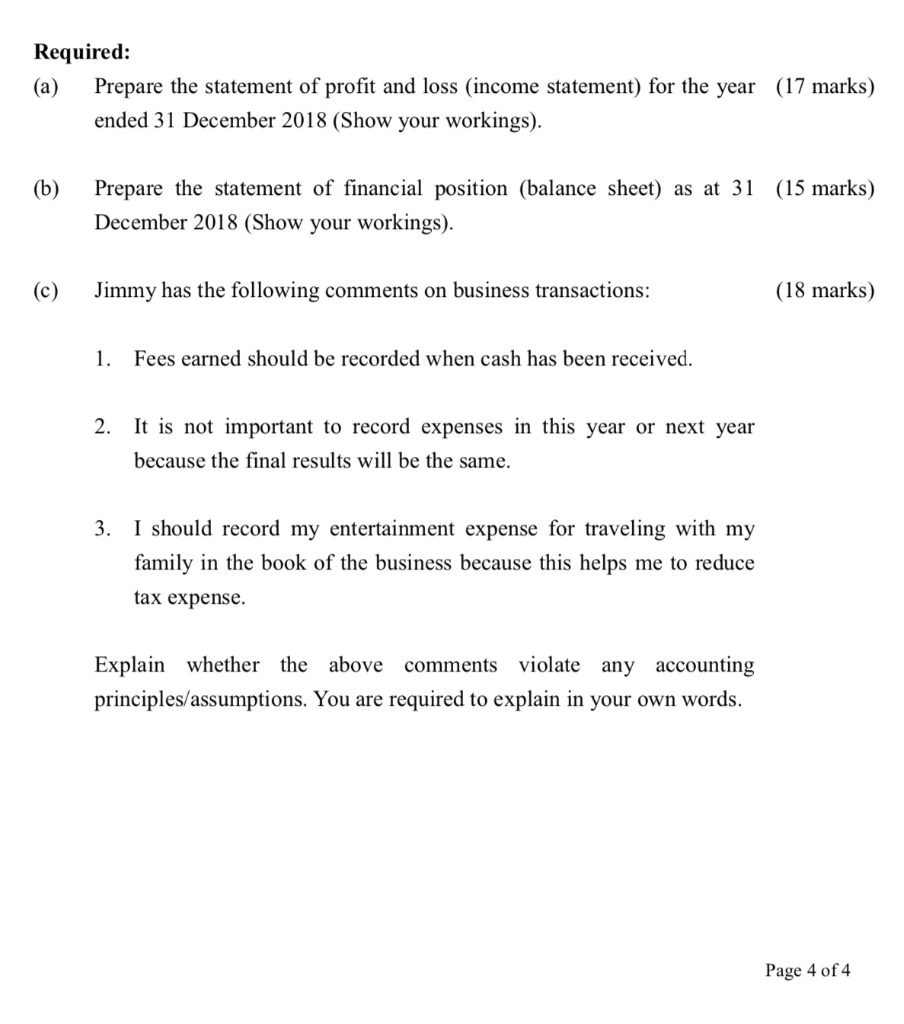

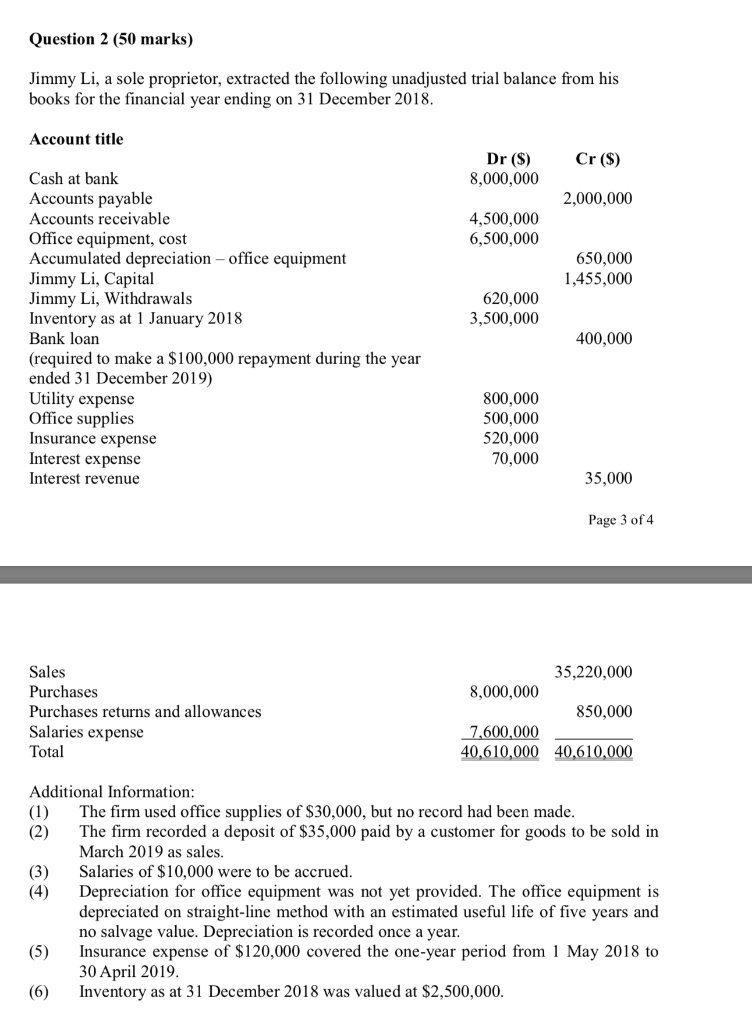

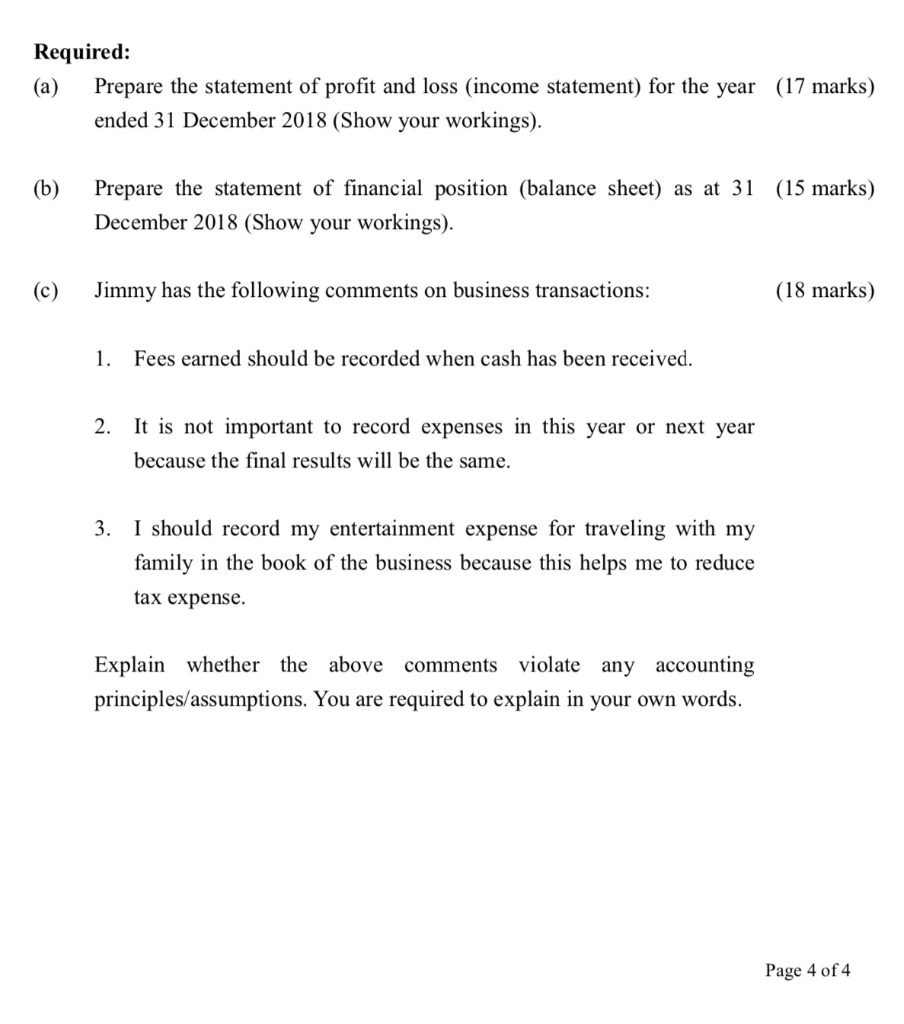

Question 2 (50 marks) Jimmy Li, a sole proprietor, extracted the following unadjusted trial balance from his books for the financial year ending on 31 December 2018. Account title Cr ($) Dr ($) 8,000,000 2,000,000 4,500,000 6,500,000 650,000 1,455,000 620,000 3,500,000 Cash at bank Accounts payable Accounts receivable Office equipment, cost Accumulated depreciation - office equipment Jimmy Li, Capital Jimmy Li, Withdrawals Inventory as at 1 January 2018 Bank loan (required to make a $100,000 repayment during the year ended 31 December 2019) Utility expense Office supplies Insurance expense Interest expense Interest revenue 400,000 800,000 500,000 520,000 70,000 35,000 Page 3 of 4 Sales Purchases Purchases returns and allowances Salaries expense Total 35,220,000 8,000,000 850,000 7,600,000 40,610,000 40,610,000 Additional Information: (1) The firm used office supplies of $30,000, but no record had been made. (2) The firm recorded a deposit of $35,000 paid by a customer for goods to be sold in March 2019 as sales. (3) Salaries of $10,000 were to be accrued. (4) Depreciation for office equipment was not yet provided. The office equipment is depreciated on straight-line method with an estimated useful life of five years and no salvage value. Depreciation is recorded once a year. (5) Insurance expense of $120,000 covered the one-year period from 1 May 2018 to 30 April 2019. Inventory as at 31 December 2018 was valued at $2,500,000. (6) Required: (a) Prepare the statement of profit and loss (income statement) for the year (17 marks) ended 31 December 2018 (Show your workings). (b) Prepare the statement of financial position (balance sheet) as at 31 (15 marks) December 2018 (Show your workings). Jimmy has the following comments on business transactions: (18 marks) 1. Fees earned should be recorded when cash has been received. 2. It is not important to record expenses in this year or next year because the final results will be the same. 3. I should record my entertainment expense for traveling with my family in the book of the business because this helps me to reduce tax expense. Explain whether the above comments violate any accounting principles/assumptions. You are required to explain in your own words. Page 4 of 4