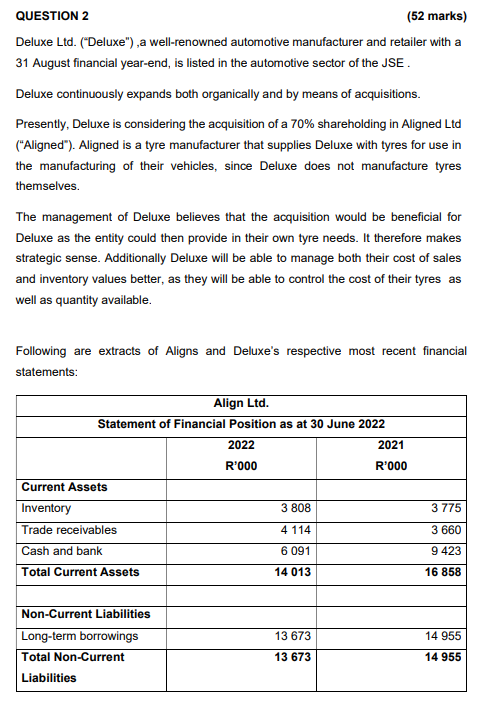

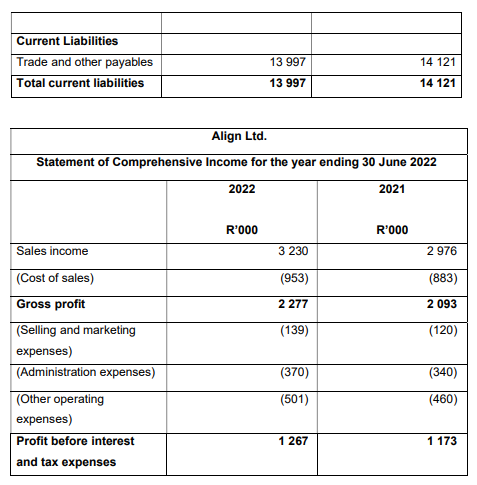

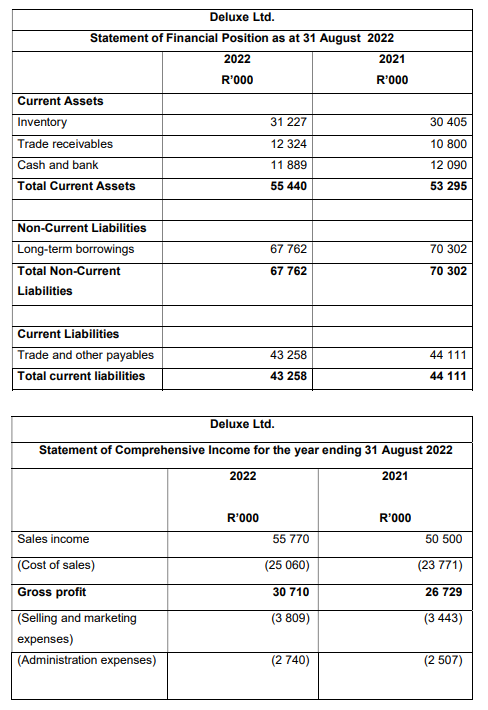

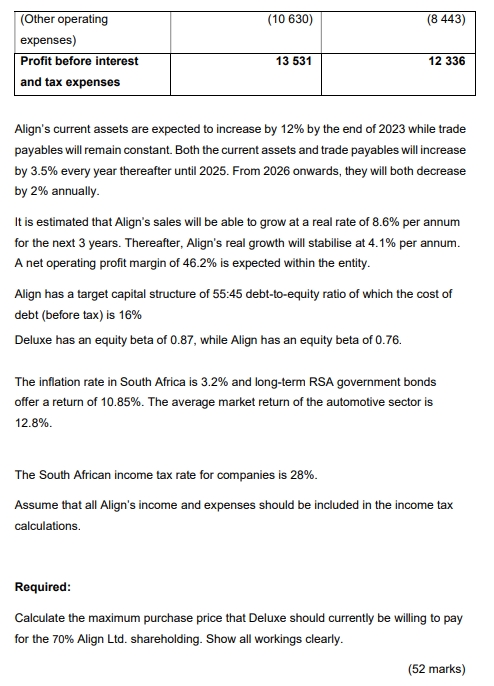

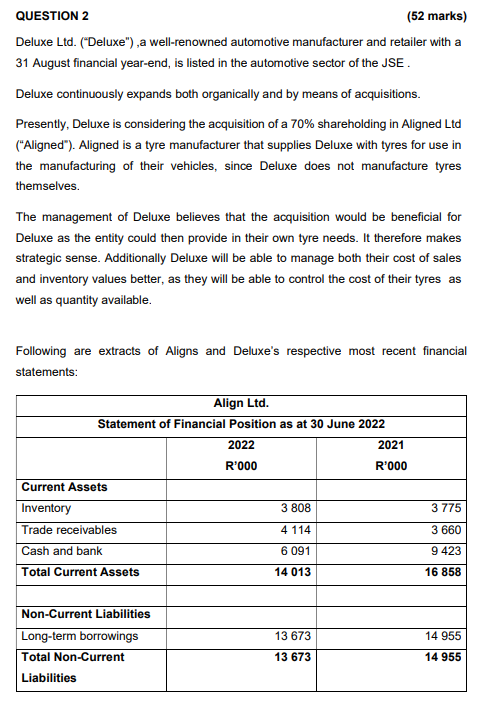

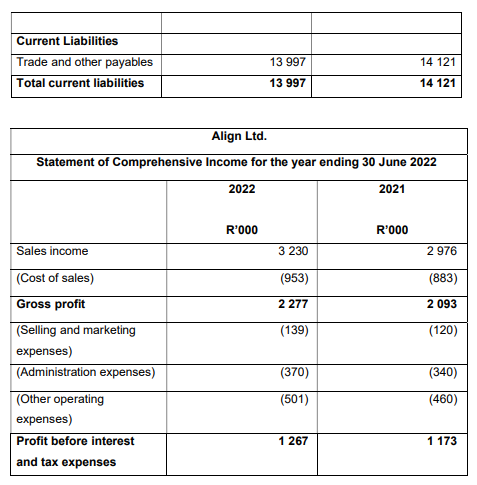

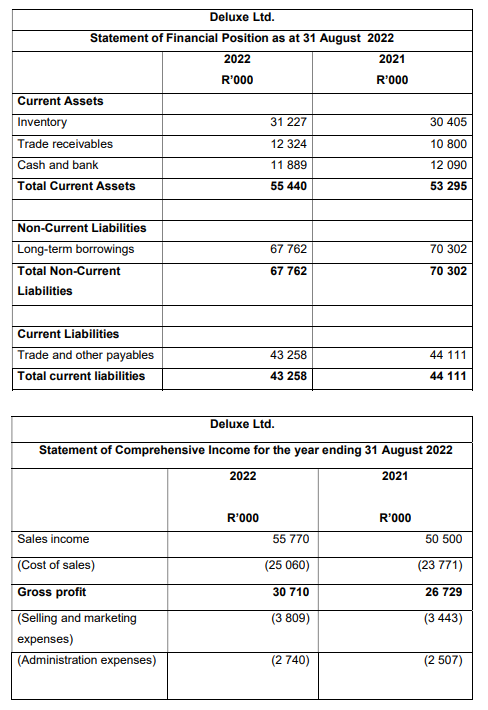

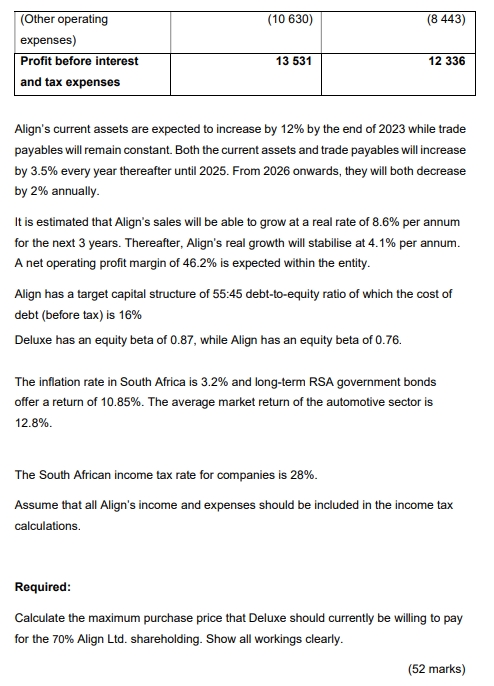

QUESTION 2 (52 marks) Deluxe Ltd. ("Deluxe") , a well-renowned automotive manufacturer and retailer with a 31 August financial year-end, is listed in the automotive sector of the JSE. Deluxe continuously expands both organically and by means of acquisitions. Presently, Deluxe is considering the acquisition of a 70% shareholding in Aligned Ltd ("Aligned"). Aligned is a tyre manufacturer that supplies Deluxe with tyres for use in the manufacturing of their vehicles, since Deluxe does not manufacture tyres themselves. The management of Deluxe believes that the acquisition would be beneficial for Deluxe as the entity could then provide in their own tyre needs. It therefore makes strategic sense. Additionally Deluxe will be able to manage both their cost of sales and inventory values better, as they will be able to control the cost of their tyres as well as quantity available. Following are extracts of Aligns and Deluxe's respective most recent financial statements: \begin{tabular}{|l|r|r|} \hline & & \\ \hline Current Liabilities & & \\ \hline Trade and other payables & 13997 & 14121 \\ \hline Total current liabilities & 13997 & 14121 \\ \hline \end{tabular} Align's current assets are expected to increase by 12% by the end of 2023 while trade payables will remain constant. Both the current assets and trade payables will increase by 3.5% every year thereafter until 2025. From 2026 onwards, they will both decrease by 2% annually. It is estimated that Align's sales will be able to grow at a real rate of 8.6% per annum for the next 3 years. Thereafter, Align's real growth will stabilise at 4.1% per annum. A net operating profit margin of 46.2% is expected within the entity. Align has a target capital structure of 55:45 debt-to-equity ratio of which the cost of debt (before tax) is 16% Deluxe has an equity beta of 0.87, while Align has an equity beta of 0.76. The inflation rate in South Africa is 3.2% and long-term RSA government bonds offer a return of 10.85%. The average market return of the automotive sector is 12.8% The South African income tax rate for companies is 28%. Assume that all Align's income and expenses should be included in the income tax calculations. Required: Calculate the maximum purchase price that Deluxe should currently be willing to pay for the 70% Align Ltd. shareholding. Show all workings clearly. (52 marks) QUESTION 2 (52 marks) Deluxe Ltd. ("Deluxe") , a well-renowned automotive manufacturer and retailer with a 31 August financial year-end, is listed in the automotive sector of the JSE. Deluxe continuously expands both organically and by means of acquisitions. Presently, Deluxe is considering the acquisition of a 70% shareholding in Aligned Ltd ("Aligned"). Aligned is a tyre manufacturer that supplies Deluxe with tyres for use in the manufacturing of their vehicles, since Deluxe does not manufacture tyres themselves. The management of Deluxe believes that the acquisition would be beneficial for Deluxe as the entity could then provide in their own tyre needs. It therefore makes strategic sense. Additionally Deluxe will be able to manage both their cost of sales and inventory values better, as they will be able to control the cost of their tyres as well as quantity available. Following are extracts of Aligns and Deluxe's respective most recent financial statements: \begin{tabular}{|l|r|r|} \hline & & \\ \hline Current Liabilities & & \\ \hline Trade and other payables & 13997 & 14121 \\ \hline Total current liabilities & 13997 & 14121 \\ \hline \end{tabular} Align's current assets are expected to increase by 12% by the end of 2023 while trade payables will remain constant. Both the current assets and trade payables will increase by 3.5% every year thereafter until 2025. From 2026 onwards, they will both decrease by 2% annually. It is estimated that Align's sales will be able to grow at a real rate of 8.6% per annum for the next 3 years. Thereafter, Align's real growth will stabilise at 4.1% per annum. A net operating profit margin of 46.2% is expected within the entity. Align has a target capital structure of 55:45 debt-to-equity ratio of which the cost of debt (before tax) is 16% Deluxe has an equity beta of 0.87, while Align has an equity beta of 0.76. The inflation rate in South Africa is 3.2% and long-term RSA government bonds offer a return of 10.85%. The average market return of the automotive sector is 12.8% The South African income tax rate for companies is 28%. Assume that all Align's income and expenses should be included in the income tax calculations. Required: Calculate the maximum purchase price that Deluxe should currently be willing to pay for the 70% Align Ltd. shareholding. Show all workings clearly. (52 marks)