Answered step by step

Verified Expert Solution

Question

1 Approved Answer

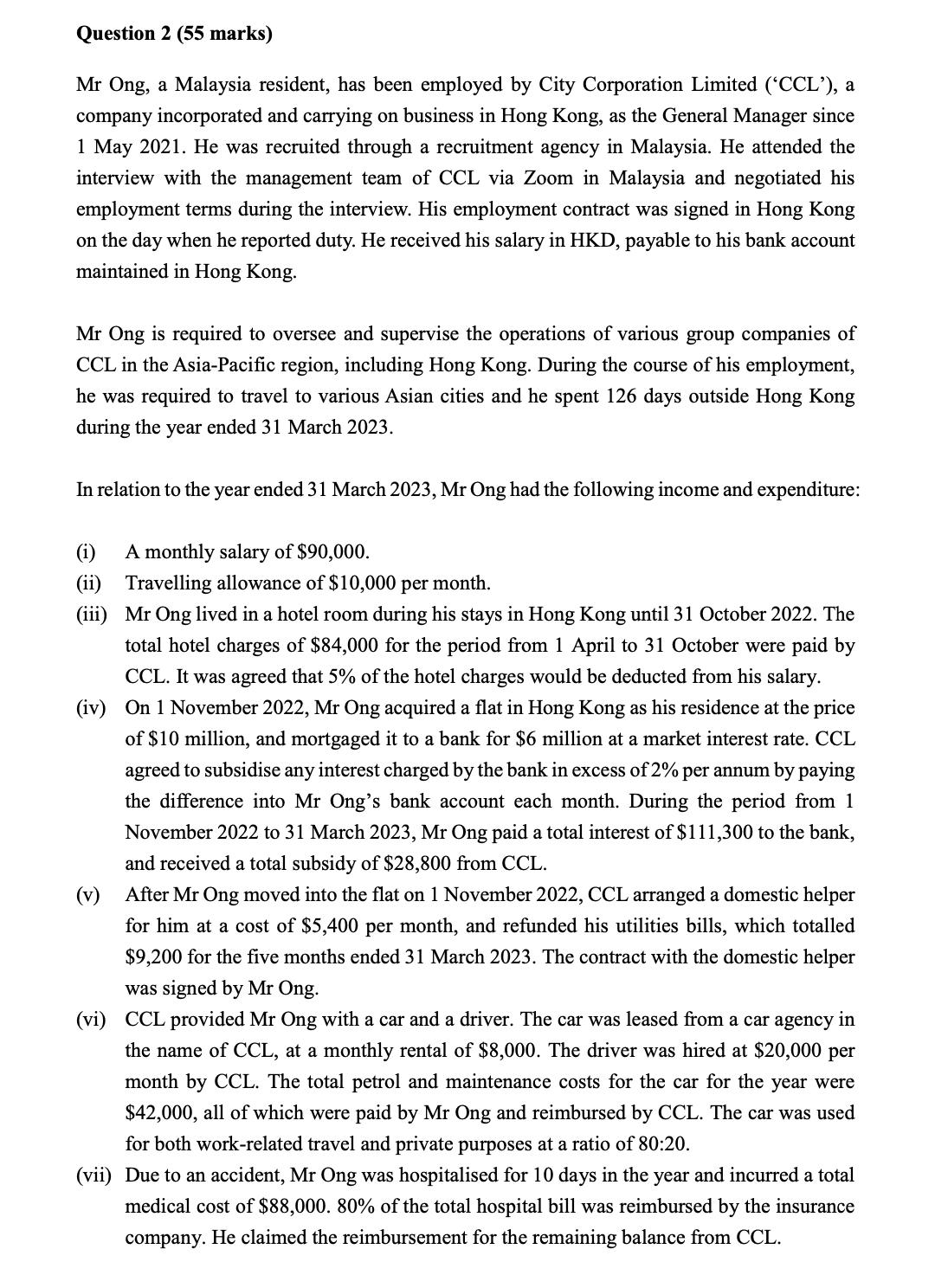

Question 2 (55 marks) Mr Ong, a Malaysia resident, has been employed by City Corporation Limited (*CCL'), a company incorporated and carrying on business

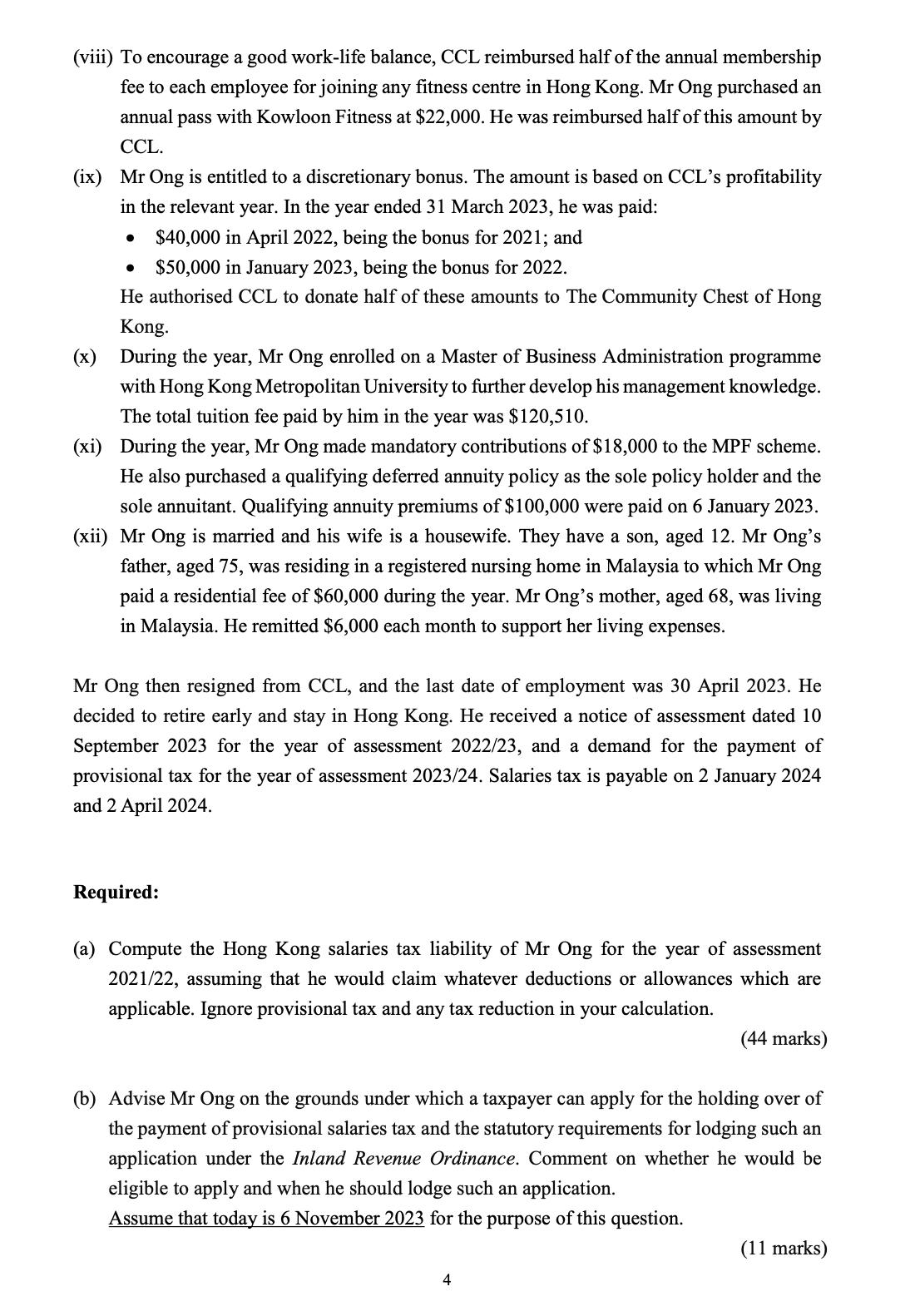

Question 2 (55 marks) Mr Ong, a Malaysia resident, has been employed by City Corporation Limited (*CCL'), a company incorporated and carrying on business in Hong Kong, as the General Manager since 1 May 2021. He was recruited through a recruitment agency in Malaysia. He attended the interview with the management team of CCL via Zoom in Malaysia and negotiated his employment terms during the interview. His employment contract was signed in Hong Kong on the day when he reported duty. He received his salary in HKD, payable to his bank account maintained in Hong Kong. Mr Ong is required to oversee and supervise the operations of various group companies of CCL in the Asia-Pacific region, including Hong Kong. During the course of his employment, he was required to travel to various Asian cities and he spent 126 days outside Hong Kong during the year ended 31 March 2023. In relation to the year ended 31 March 2023, Mr Ong had the following income and expenditure: (i) A monthly salary of $90,000. (ii) Travelling allowance of $10,000 per month. (iii) Mr Ong lived in a hotel room during his stays in Hong Kong until 31 October 2022. The total hotel charges of $84,000 for the period from 1 April to 31 October were paid by CCL. It was agreed that 5% of the hotel charges would be deducted from his salary. (iv) On 1 November 2022, Mr Ong acquired a flat in Hong Kong as his residence at the price of $10 million, and mortgaged it to a bank for $6 million at a market interest rate. CCL agreed to subsidise any interest charged by the bank in excess of 2% per annum by paying the difference into Mr Ong's bank account each month. During the period from 1 November 2022 to 31 March 2023, Mr Ong paid a total interest of $111,300 to the bank, and received a total subsidy of $28,800 from CCL. (v) After Mr Ong moved into the flat on 1 November 2022, CCL arranged a domestic helper for him at a cost of $5,400 per month, and refunded his utilities bills, which totalled $9,200 for the five months ended 31 March 2023. The contract with the domestic helper was signed by Mr Ong. (vi) CCL provided Mr Ong with a car and a driver. The car was leased from a car agency in the name of CCL, at a monthly rental of $8,000. The driver was hired at $20,000 per month by CCL. The total petrol and maintenance costs for the car for the year were $42,000, all of which were paid by Mr Ong and reimbursed by CCL. The car was used for both work-related travel and private purposes at a ratio of 80:20. (vii) Due to an accident, Mr Ong was hospitalised for 10 days in the year and incurred a total medical cost of $88,000. 80% of the total hospital bill was reimbursed by the insurance company. He claimed the reimbursement for the remaining balance from CCL. (viii) To encourage a good work-life balance, CCL reimbursed half of the annual membership fee to each employee for joining any fitness centre in Hong Kong. Mr Ong purchased an annual pass with Kowloon Fitness at $22,000. He was reimbursed half of this amount by CCL. (ix) Mr Ong is entitled to a discretionary bonus. The amount is based on CCL's profitability in the relevant year. In the year ended 31 March 2023, he was paid: $40,000 in April 2022, being the bonus for 2021; and $50,000 in January 2023, being the bonus for 2022. He authorised CCL to donate half of these amounts to The Community Chest of Hong Kong. (x) During the year, Mr Ong enrolled on a Master of Business Administration programme with Hong Kong Metropolitan University to further develop his management knowledge. The total tuition fee paid by him in the year was $120,510. (xi) During the year, Mr Ong made mandatory contributions of $18,000 to the MPF scheme. He also purchased a qualifying deferred annuity policy as the sole policy holder and the sole annuitant. Qualifying annuity premiums of $100,000 were paid on 6 January 2023. (xii) Mr Ong is married and his wife is a housewife. They have a son, aged 12. Mr Ong's father, aged 75, was residing in a registered nursing home in Malaysia to which Mr Ong paid a residential fee of $60,000 during the year. Mr Ong's mother, aged 68, was living in Malaysia. He remitted $6,000 each month to support her living expenses. Mr Ong then resigned from CCL, and the last date of employment was 30 April 2023. He decided to retire early and stay in Hong Kong. He received a notice of assessment dated 10 September 2023 for the year of assessment 2022/23, and a demand for the payment of provisional tax for the year of assessment 2023/24. Salaries tax is payable on 2 January 2024 and 2 April 2024. Required: (a) Compute the Hong Kong salaries tax liability of Mr Ong for the year of assessment 2021/22, assuming that he would claim whatever deductions or allowances which are applicable. Ignore provisional tax and any tax reduction in your calculation. (44 marks) (b) Advise Mr Ong on the grounds under which a taxpayer can apply for the holding over of the payment of provisional salaries tax and the statutory requirements for lodging such an application under the Inland Revenue Ordinance. Comment on whether he would be eligible to apply and when he should lodge such an application. Assume that today is 6 November 2023 for the purpose of this question. 4 (11 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started