Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (6 points) Two industrial robot options are currently proposed to be purchased for the assembly company. The followings are the information about

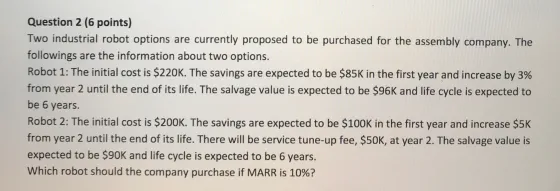

Question 2 (6 points) Two industrial robot options are currently proposed to be purchased for the assembly company. The followings are the information about two options. Robot 1: The initial cost is $220K. The savings are expected to be $85K in the first year and increase by 3% from year 2 until the end of its life. The salvage value is expected to be $96K and life cycle is expected to be 6 years. Robot 2: The initial cost is $200K. The savings are expected to be $100K in the first year and increase $5K from year 2 until the end of its life. There will be service tune-up fee, $50K, at year 2. The salvage value is expected to be $90K and life cycle is expected to be 6 years. Which robot should the company purchase if MARR is 10%?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine which robot the company should purchase we need to compare the present worth PW of the costs and savings associated with each option The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started