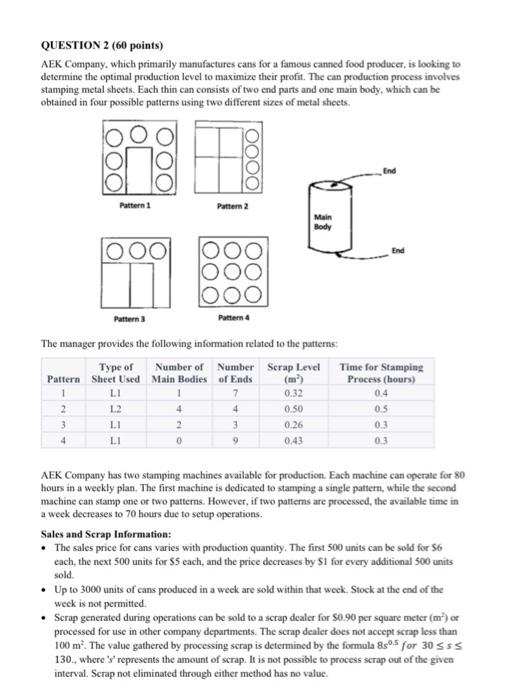

QUESTION 2 (60 points) AEK Company, which primarily manufactures cans for a famous canned food producer, is looking to determine the optimal production level to maximize their profit. The can production process involves stamping metal sheets. Each thin can consists of two end parts and one main body, which can be obtained in four possible patterns using two different sizes of metal sheets. The manager provides the following information related to the patterns: AEK Company has two stamping machines available for production. Each machine can operate for 80 hours in a weekly plan. The first machine is dedicated to stamping a single pattern, while the second machine can stamp one or two patterns. However, if two patterns are processed, the available time in a week decreases to 70 hours due to setup operations. Sales and Scrap Information: - The sales price for cans varies with production quantity. The first 500 units can be sold for $6 each, the next 500 units for $5 each, and the price decreases by $1 for every additional 500 units sold. - Up to 3000 units of cans produced in a week are sold within that wock. Stock at the end of the week is not permitted. - Scrap generated during operations can be sold to a scrap dealer for $0.90 per square meter (m2) or processed for use in other company departments. The scrap dealer does not accept scrap less than 100m2. The value gathered by processing scrap is determined by the formula 8s0,5 for 30s 130., where ' s ' represents the amount of scrap. It is not possible to process scrap out of the given interval. Scrap not eliminated through either method has no value. Materials and Holding Costs: - Metal sheets can be purchased in batches of 30 sheets. The cost for L1 sheets is \$5, and for L2 sheets, it's \$9. - At the beginning of the week, there is no stock. - Each unused main body in stock at the end of the week incurs a stock-holding cost of $0.3. - Each unused end in stock at the end of the week incurs a stock-holding cost of $0.15. - Each unused metal sheet in stock at the end of the week incurs a stock-holding cost of $0.5 for L1 and $0.9 for L2. a) Write a Mixed Integer Programming (MIP) model to maximize the company's profit per week. Profit is calculated as Sales Revenue + Scrap Sales + Scrap Value - Sheet Purchasing Cost Holding Costs. Please clearly identify and explain the decision variables, objective function, and constraints in your model. Hint: Convert the non-linear function for value of scrap to piecewise linear function to add in the model. b) Solve the formulated model using ExcelSolver or OpenSolver. c) Interpret the result