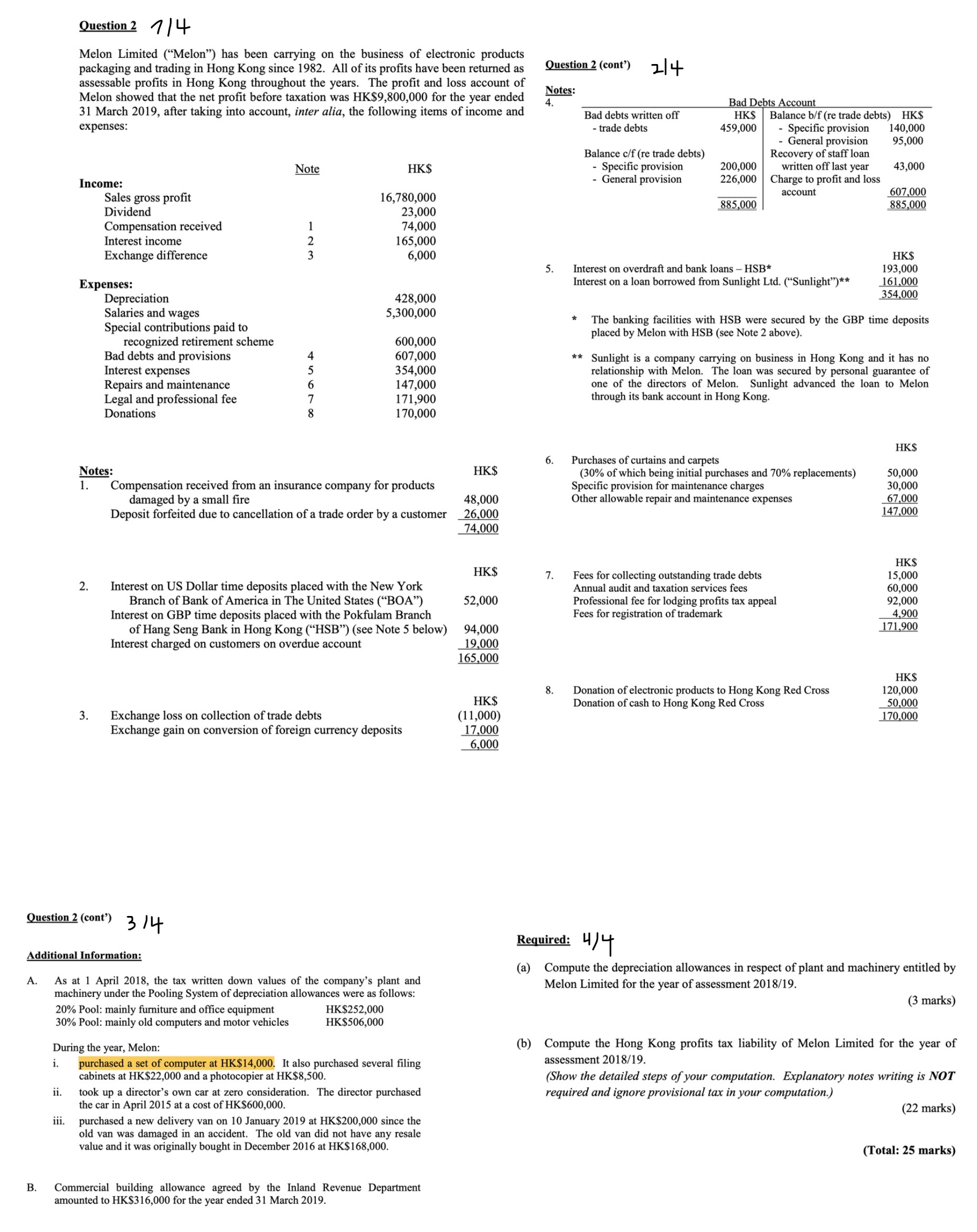

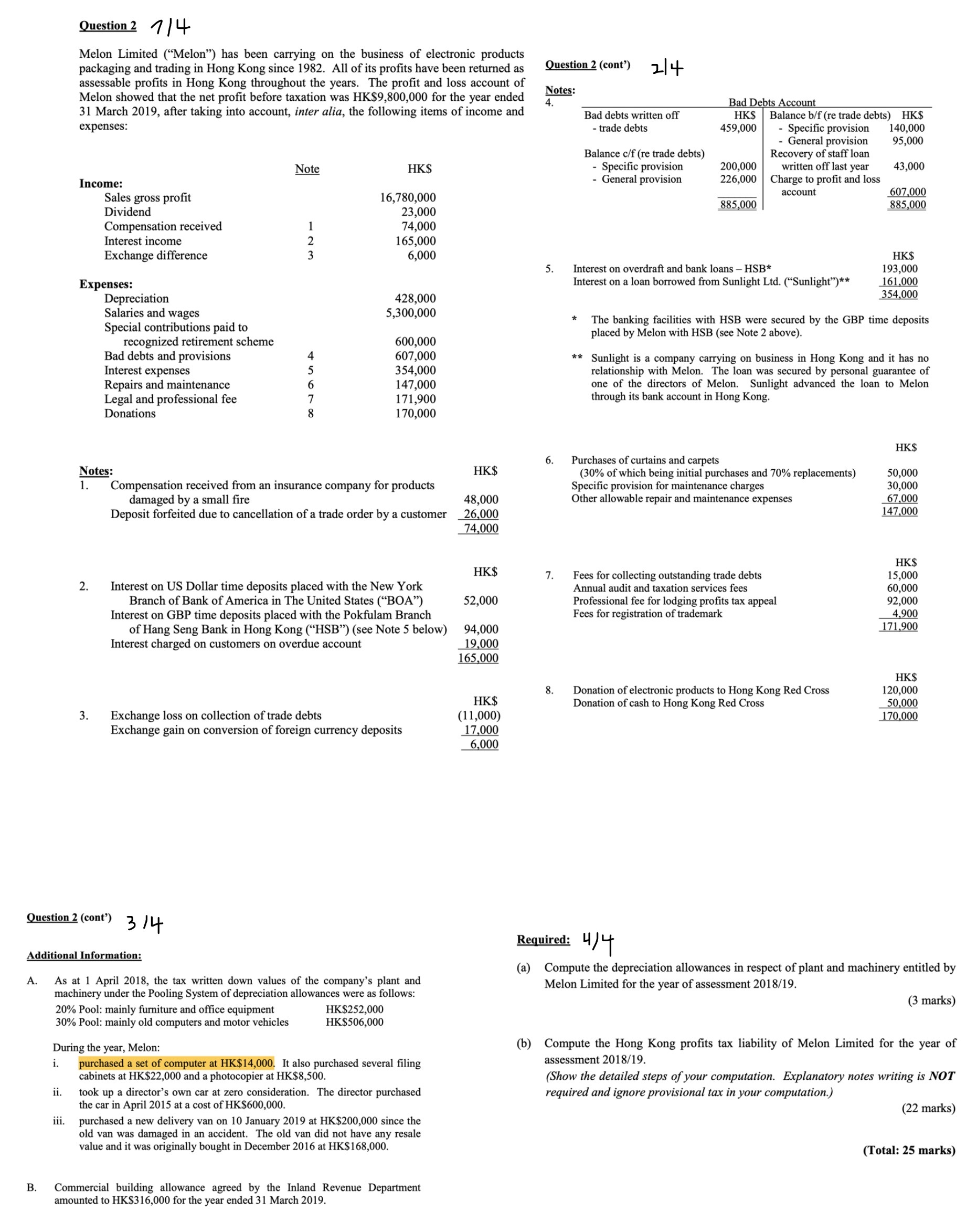

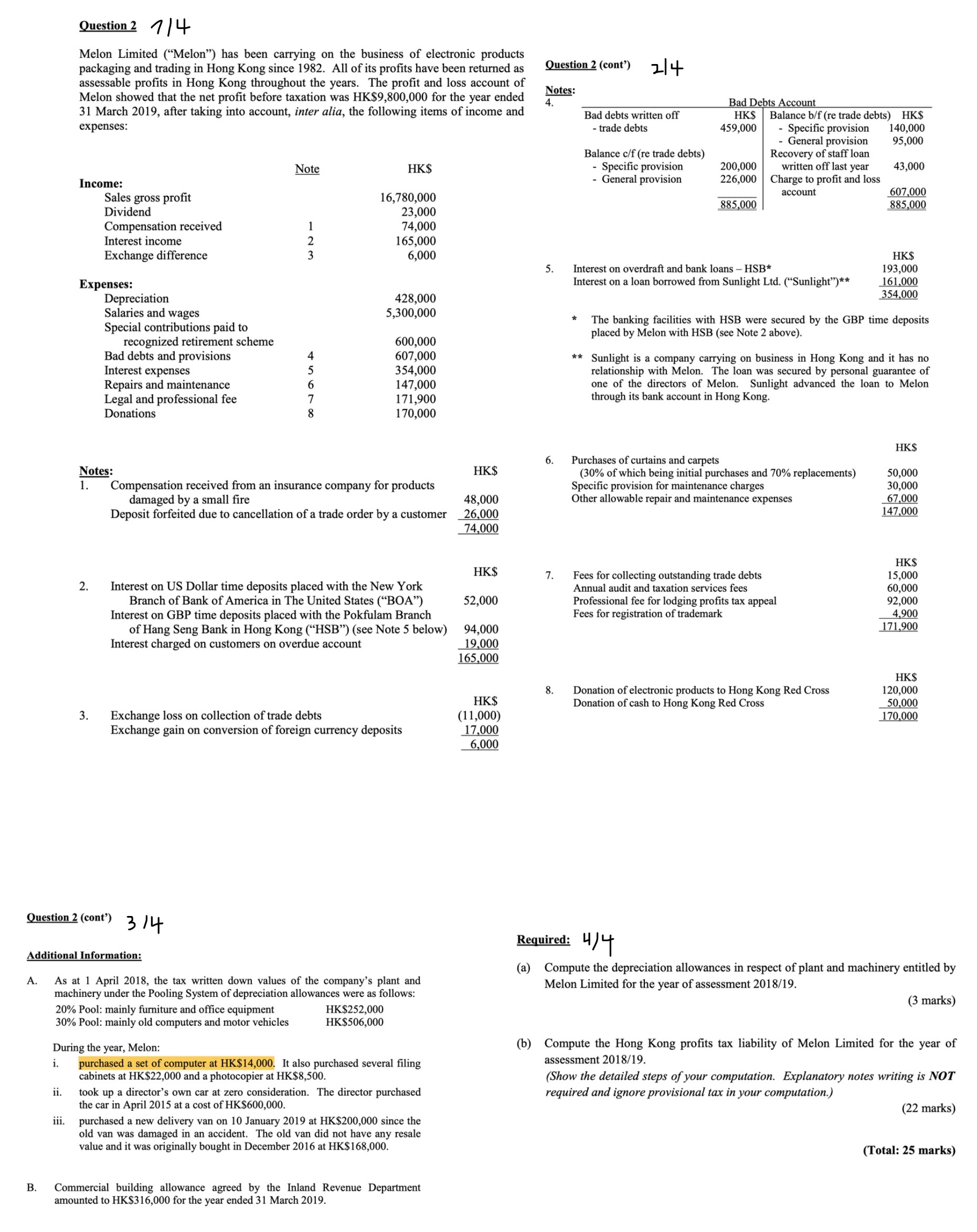

Question 2 7 / 4 Melon Limited ("Melon") has been carrying on the business of electronic products packaging and trading in Hong Kong since 1982. All of its profits have been returned as Question 2 (cont') 2/4 assessable profits in Hong Kong throughout the years. The profit and loss account of Melon showed that the net profit before taxation was HK$9,800,000 for the year ended Notes : 4. Bad Debts Account 31 March 2019, after taking into account, inter alia, the following items of income and Bad debts written off HK$ Balance b/f (re trade debts) HK$ expenses: trade debts 459,000 - Specific provision 140,000 - General provision 95,000 Balance c/f (re trade debts) Recovery of staff loan Note HK$ - Specific provision 200,000 written off last year 43,000 Income: - General provision 226,000 Charge to profit and loss Sales gross profit 16,780,000 account 607.00 Dividend 23,000 885,000 885,000 Compensation received 74,000 Interest income WN - 65,00 Exchange difference 6,000 HK$ 5. Interest on overdraft and bank loans - HSB* 193,000 Expenses interest on a loan borrowed from Sunlight Ltd. ("Sunlight")** 161,00 Depreciation 428,000 354,000 Salaries and wages 5,300,000 Special contributions paid to * The banking facilities with HSB were secured by the GBP time deposits placed by Melon with HSB (see Note 2 above). recognized retirement scheme 600,000 Bad debts and provisions 607,000 ** Sunlight is a company carrying on business in Hong Kong and it has no Interest expenses 354,000 relationship with Melon. The loan was secured by personal guarantee of Repairs and maintenance 47,000 one of the directors of Melon. Sunlight advanced the loan to Melon Legal and professional fee 171,900 through its bank account in Hong Kong. Donations 170,000 HK$ 6. Purchases of curtains and carpets Notes: HK$ (30% of which being initial purchases and 70% replacements) 50,000 1. Compensation received from an insurance company for products Specific provision for maintenance charges 30,000 damaged by a small fire 48,000 Other allowable repair and maintenance expenses 67,000 Deposit forfeited due to cancellation of a trade order by a customer 26,00 47,000 74,000 HK$ HK$ 7. Fees for collecting outstanding trade debts 15,000 2. Interest on US Dollar time deposits placed with the New York Annual audit and taxation services fees 60,000 Branch of Bank of America in The United States ("BOA") 52,00 Professional fee for lodging profits tax appeal 92.000 Interest on GBP time deposits placed with the Pokfulam Branch Fees for registration of trademark 4,900 of Hang Seng Bank in Hong Kong ("HSB") (see Note 5 below) 94,000 171,900 Interest charged on customers on overdue account 19,00 165,000 HK$ 8. Donation of electronic products to Hong Kong Red Cross 120,000 HK$ Donation of cash to Hong Kong Red Cross 50,000 3 . Exchange loss on collection of trade debts (1 1,000) 170,000 Exchange gain on conversion of foreign currency deposits 17,00 6,000 Question 2 (cont') 3 / 4 Required: 4) 4 Additional Information: Compute the depreciation allowances in respect of plant and machinery entitled by A. As at 1 April 2018, the tax written down values of the company's plant and Melon Limited for the year of assessment 2018/19. machinery under the Pooling System of depreciation allowances were as follows: (3 marks) 20% Pool: mainly furniture and office equipment HK$252,000 30% Pool: mainly old computers and motor vehicles HK$506,000 During the year, Melon: (b) Compute the Hong Kong profits tax liability of Melon Limited for the year of i. purchased a set of computer at HK$14,000. It also purchased several filing assessment 2018/19 cabinets at HK$22,000 and a photocopier at HK$8,500. Show the detailed steps of your computation. Explanatory notes writing is NOT ii. took up a director's own car at zero consideration. The director purchased required and ignore provisional tax in your computation.) the car in April 2015 at a cost of HK$600,000. (22 marks) jii. purchased a new delivery van on 10 January 2019 at HK$200,000 since the old van was damaged in an accident. The old van did not have any resale value and it was originally bought in December 2016 at HK$168,000. (Total: 25 marks) B. Commercial building allowance agreed by the Inland Revenue Department amounted to HK$316,000 for the year ended 31 March 2019