Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 ( 9 marks, 1 1 minutes ) Mrs Gummy Bear ( a South African resident ) died on 1 5 February 2 0

QUESTION marks, minutes

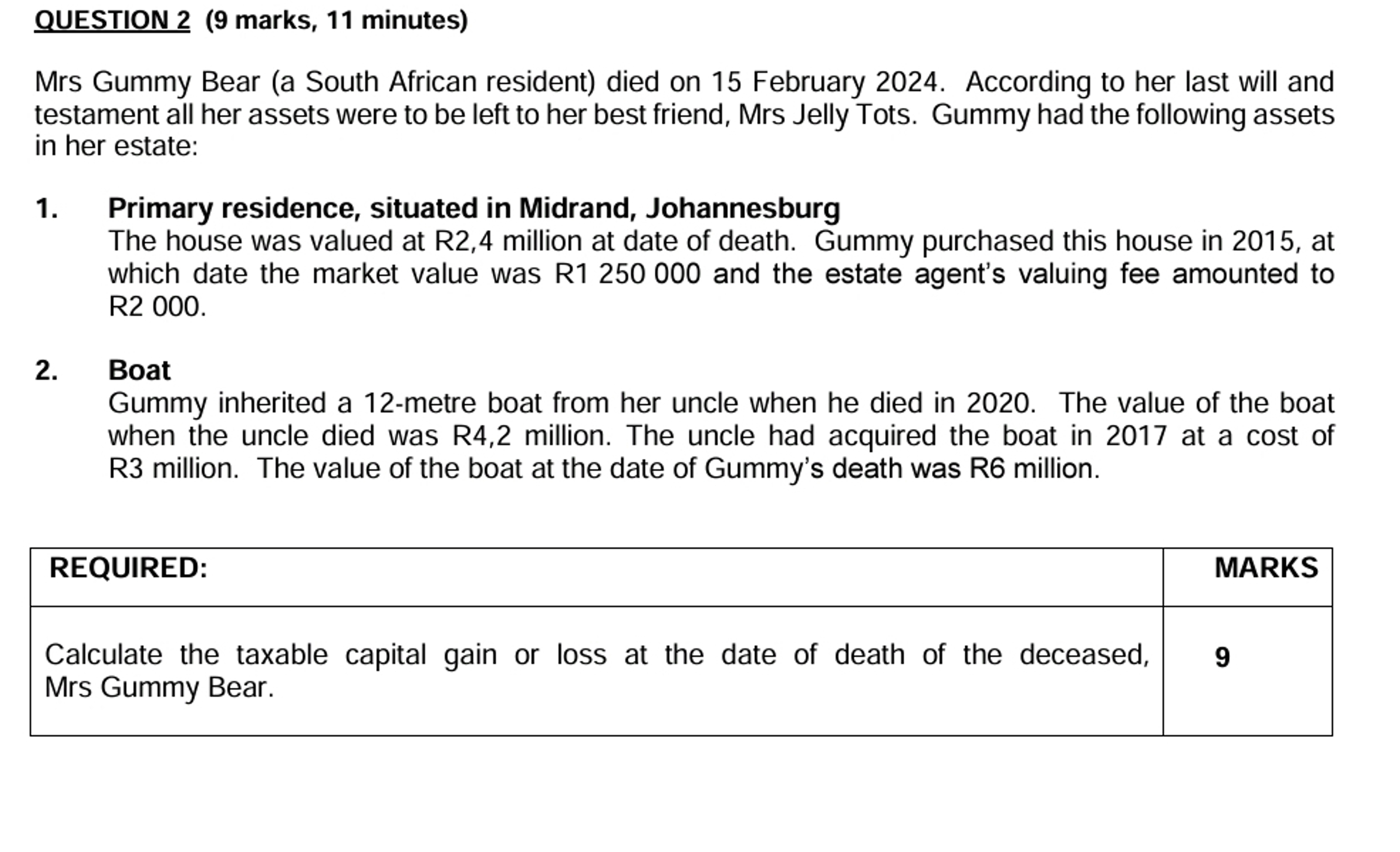

Mrs Gummy Bear a South African resident died on February According to her last will and

testament all her assets were to be left to her best friend, Mrs Jelly Tots. Gummy had the following assets

in her estate:

Primary residence, situated in Midrand, Johannesburg

The house was valued at R million at date of death. Gummy purchased this house in at

which date the market value was R and the estate agent's valuing fee amounted to

R

Boat

Gummy inherited a metre boat from her uncle when he died in The value of the boat

when the uncle died was R million. The uncle had acquired the boat in at a cost of

R million. The value of the boat at the date of Gummy's death was R million.

Calculate the taxable capital gain or loss at the date of death of the deceased,

Mrs Gummy Bear.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started