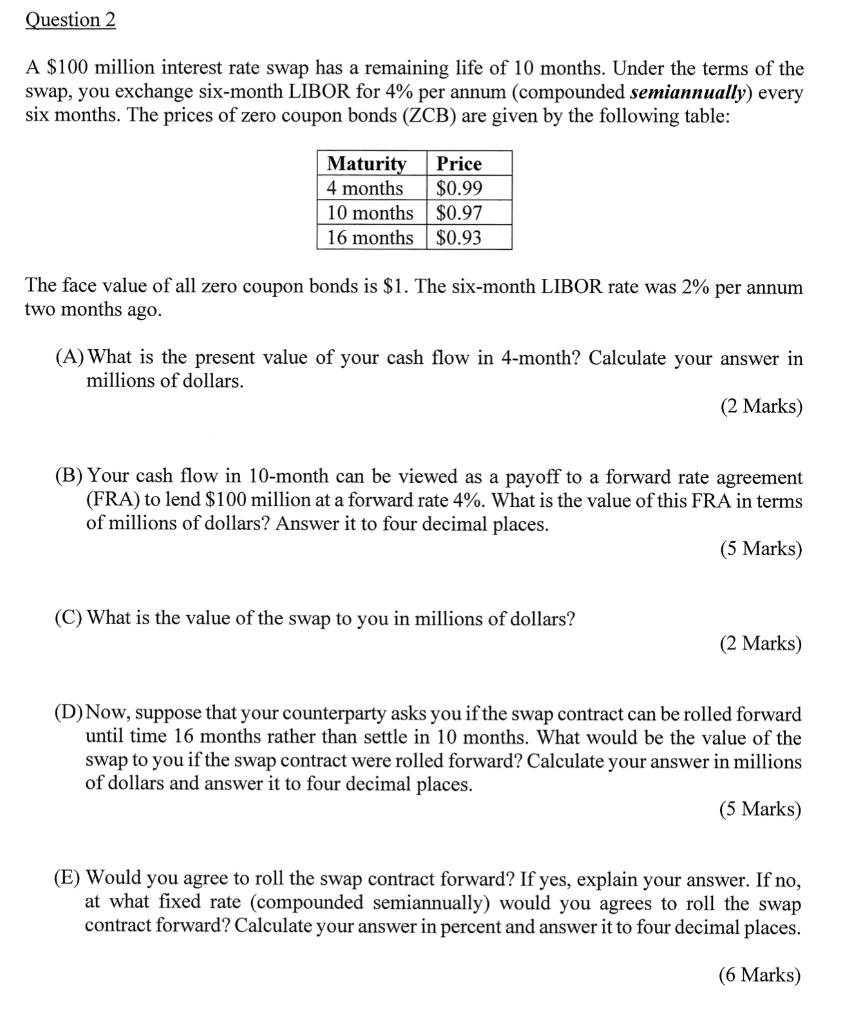

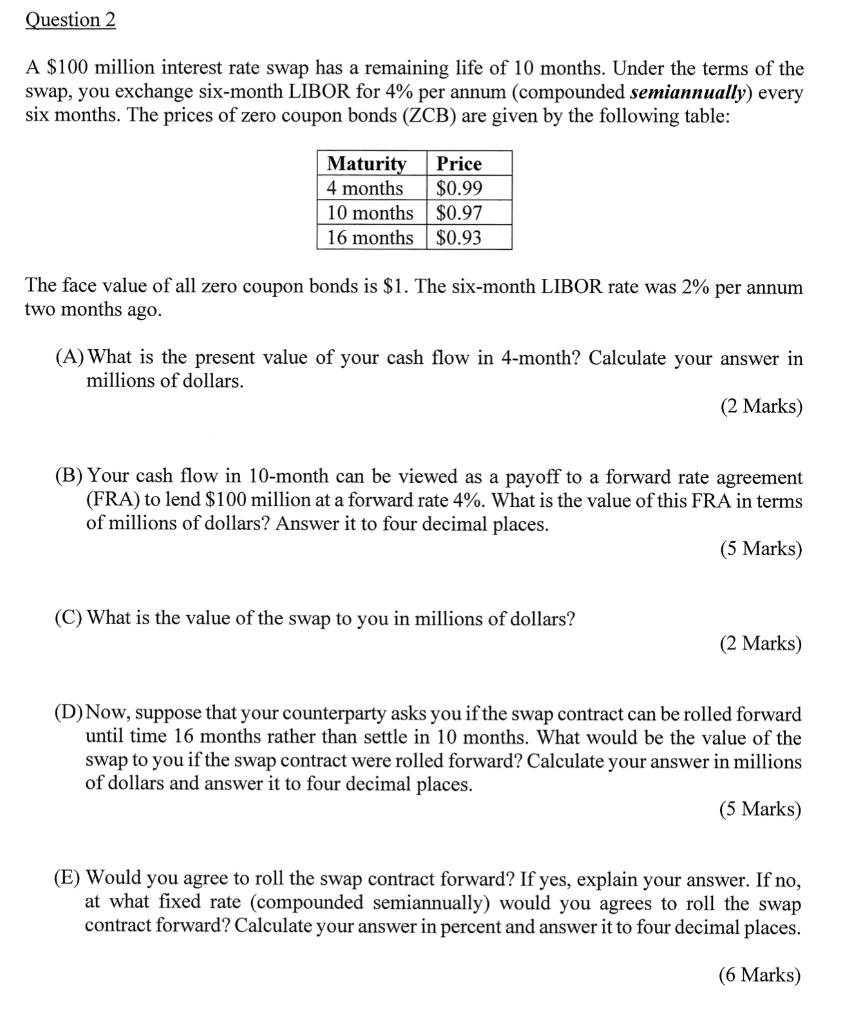

Question 2 A $100 million interest rate swap has a remaining life of 10 months. Under the terms of the swap, you exchange six-month LIBOR for 4% per annum (compounded semiannually) every six months. The prices of zero coupon bonds (ZCB) are given by the following table: Maturity Price 4 months $0.99 10 months $0.97 16 months $0.93 The face value of all zero coupon bonds is $1. The six-month LIBOR rate was 2% per annum two months ago. (A) What is the present value of your cash flow in 4-month? Calculate your answer in millions of dollars. (2 Marks) (B) Your cash flow in 10-month can be viewed as a payoff to a forward rate agreement (FRA) to lend $100 million at a forward rate 4%. What is the value of this FRA in terms of millions of dollars? Answer it to four decimal places. (5 Marks) (C) What is the value of the swap to you in millions of dollars? (2 Marks) (D)Now, suppose that your counterparty asks you if the swap contract can be rolled forward until time 16 months rather than settle in 10 months. What would be the value of the swap to you if the swap contract were rolled forward? Calculate your answer in millions of dollars and answer it to four decimal places. (5 Marks) (E) Would you agree to roll the swap contract forward? If yes, explain your answer. If no, at what fixed rate (compounded semiannually) would you agrees to roll the swap contract forward? Calculate your answer in percent and answer it to four decimal places. (6 Marks) Question 2 A $100 million interest rate swap has a remaining life of 10 months. Under the terms of the swap, you exchange six-month LIBOR for 4% per annum (compounded semiannually) every six months. The prices of zero coupon bonds (ZCB) are given by the following table: Maturity Price 4 months $0.99 10 months $0.97 16 months $0.93 The face value of all zero coupon bonds is $1. The six-month LIBOR rate was 2% per annum two months ago. (A) What is the present value of your cash flow in 4-month? Calculate your answer in millions of dollars. (2 Marks) (B) Your cash flow in 10-month can be viewed as a payoff to a forward rate agreement (FRA) to lend $100 million at a forward rate 4%. What is the value of this FRA in terms of millions of dollars? Answer it to four decimal places. (5 Marks) (C) What is the value of the swap to you in millions of dollars? (2 Marks) (D)Now, suppose that your counterparty asks you if the swap contract can be rolled forward until time 16 months rather than settle in 10 months. What would be the value of the swap to you if the swap contract were rolled forward? Calculate your answer in millions of dollars and answer it to four decimal places. (5 Marks) (E) Would you agree to roll the swap contract forward? If yes, explain your answer. If no, at what fixed rate (compounded semiannually) would you agrees to roll the swap contract forward? Calculate your answer in percent and answer it to four decimal places. (6 Marks)