Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 a) Are dividends irrelevant? Contrast the basic arguments about dividend policy advanced by Miller and Modigliani and by Gordon and Lintner. (4

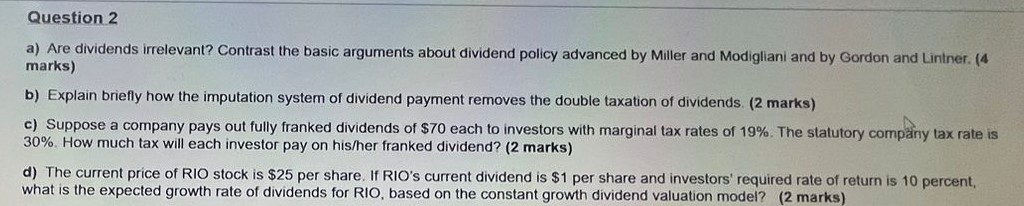

Question 2 a) Are dividends irrelevant? Contrast the basic arguments about dividend policy advanced by Miller and Modigliani and by Gordon and Lintner. (4 marks) b) Explain briefly how the imputation system of dividend payment removes the double taxation of dividends. (2 marks) c) Suppose a company pays out fully franked dividends of $70 each to investors with marginal tax rates of 19%. The statutory company tax rate is 30%. How much tax will each investor pay on his/her franked dividend? (2 marks) d) The current price of RIO stock is $25 per share. If RIO's current dividend is $1 per share and investors' required rate of return is 10 percent, what is the expected growth rate of dividends for RIO, based on the constant growth dividend valuation model? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started