Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 A dairy cooperative certifies its farmers depending upon the quality of the milk delivered. There are 2 quality criteria; a) quality A-highest quality

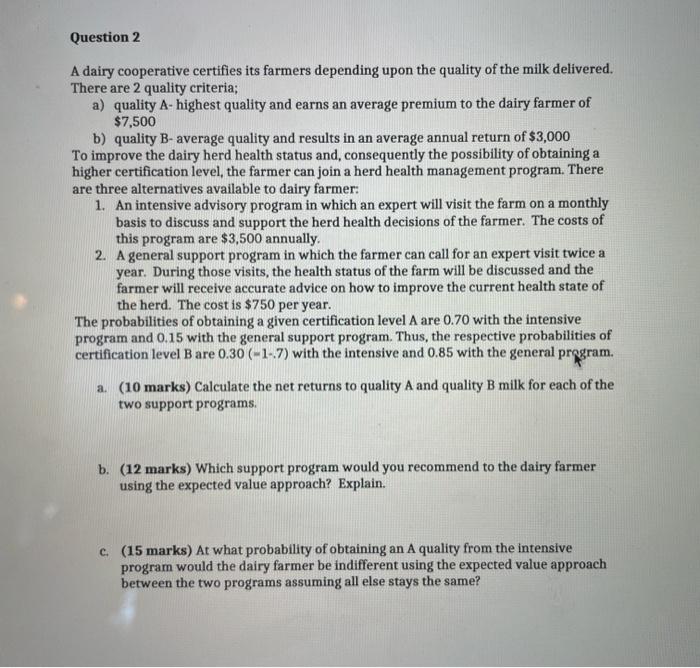

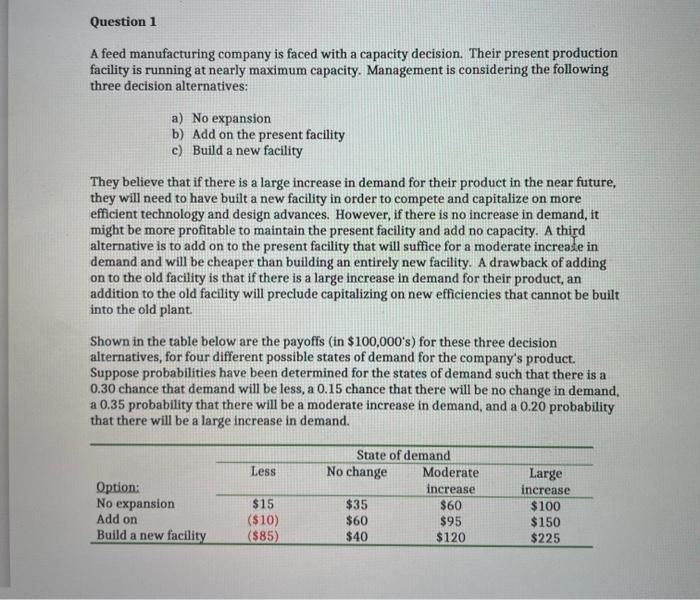

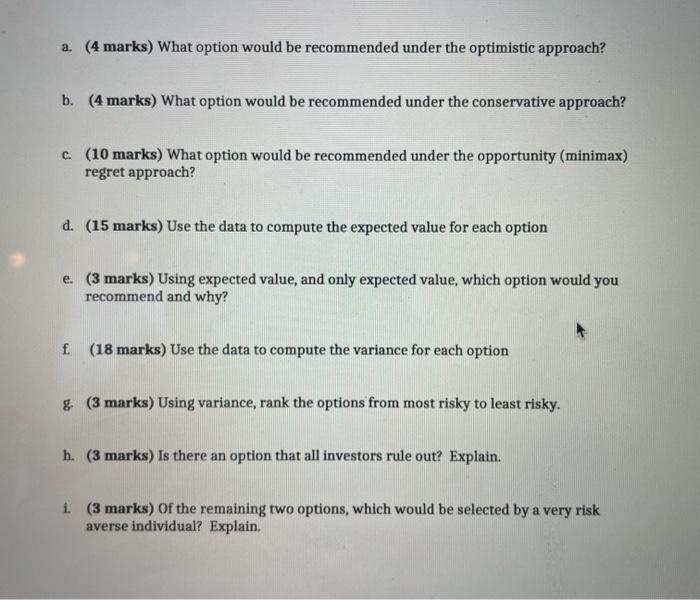

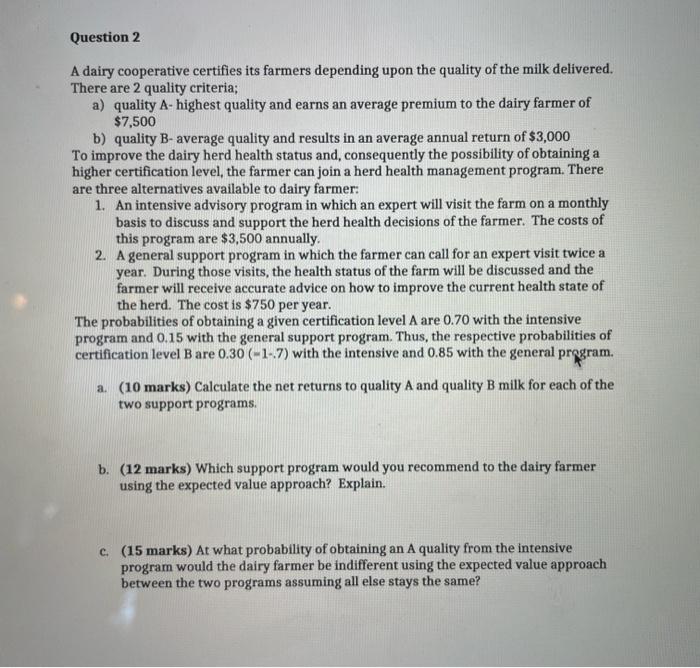

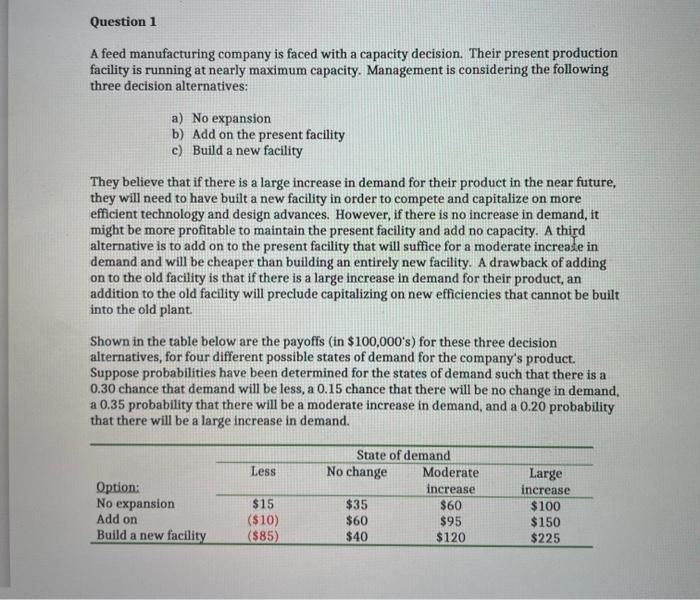

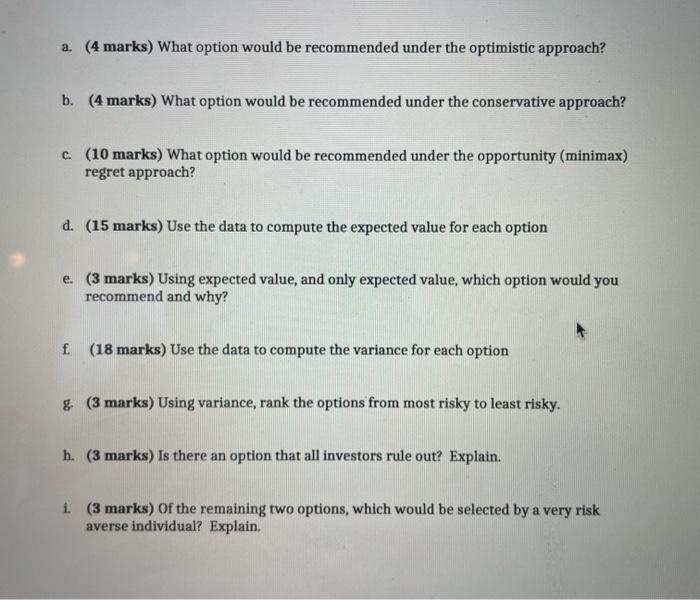

Question 2 A dairy cooperative certifies its farmers depending upon the quality of the milk delivered. There are 2 quality criteria; a) quality A-highest quality and earns an average premium to the dairy farmer of $7,500 b) quality B-average quality and results in an average annual return of $3,000 To improve the dairy herd health status and, consequently the possibility of obtaining a higher certification level, the farmer can join a herd health management program. There are three alternatives available to dairy farmer: 1. An intensive advisory program in which an expert will visit the farm on a monthly basis to discuss and support the herd health decisions of the farmer. The costs of this program are $3,500 annually. 2. A general support program in which the farmer can call for an expert visit twice a year. During those visits, the health status of the farm will be discussed and the farmer will receive accurate advice on how to improve the current health state of the herd. The cost is $750 per year. The probabilities of obtaining a given certification level A are 0.70 with the intensive program and 0.15 with the general support program. Thus, the respective probabilities of certification level Bare 0.30 (-1- 7) with the intensive and 0.85 with the general program. a. (10 marks) Calculate the net returns to quality A and quality B milk for each of the two support programs. b. (12 marks) Which support program would you recommend to the dairy farmer using the expected value approach? Explain. c. (15 marks) At what probability of obtaining an A quality from the intensive program would the dairy farmer be indifferent using the expected value approach between the two programs assuming all else stays the same? Question 1 A feed manufacturing company is faced with a capacity decision. Their present production facility is running at nearly maximum capacity. Management is considering the following three decision alternatives: a) No expansion b) Add on the present facility c) Build a new facility They believe that if there is a large increase in demand for their product in the near future, they will need to have built a new facility in order to compete and capitalize on more efficient technology and design advances. However, if there is no increase in demand, it might be more profitable to maintain the present facility and add no capacity. A third alternative is to add on to the present facility that will suffice for a moderate increase in demand and will be cheaper than building an entirely new facility. A drawback of adding on to the old facility is that if there is a large increase in demand for their product, an addition to the old facility will preclude capitalizing on new efficiencies that cannot be built into the old plant. Shown in the table below are the payoffs (in $100,000's) for these three decision alternatives, for four different possible states of demand for the company's product. Suppose probabilities have been determined for the states of demand such that there is a 0.30 chance that demand will be less, a 0.15 chance that there will be no change in demand, a 0.35 probability that there will be a moderate increase in demand, and a 0.20 probability that there will be a large increase in demand. Less Option: No expansion Add on Build a new facility State of demand No change Moderate increase $35 $60 $60 $95 $40 $120 $15 ($10) ($85) Large increase $100 $150 $225 a. (4 marks) What option would be recommended under the optimistic approach? b. (4 marks) What option would be recommended under the conservative approach? C. (10 marks) What option would be recommended under the opportunity (minimax) regret approach? d. (15 marks) Use the data to compute the expected value for each option e. (3 marks) Using expected value, and only expected value, which option would you recommend and why? f. (18 marks) Use the data to compute the variance for each option g. (3 marks) Using variance, rank the options from most risky to least risky. h. (3 marks) Is there an option that all investors rule out? Explain. i (3 marks) of the remaining two options, which would be selected by a very risk averse individual? Explain

Question 2 A dairy cooperative certifies its farmers depending upon the quality of the milk delivered. There are 2 quality criteria; a) quality A-highest quality and earns an average premium to the dairy farmer of $7,500 b) quality B-average quality and results in an average annual return of $3,000 To improve the dairy herd health status and, consequently the possibility of obtaining a higher certification level, the farmer can join a herd health management program. There are three alternatives available to dairy farmer: 1. An intensive advisory program in which an expert will visit the farm on a monthly basis to discuss and support the herd health decisions of the farmer. The costs of this program are $3,500 annually. 2. A general support program in which the farmer can call for an expert visit twice a year. During those visits, the health status of the farm will be discussed and the farmer will receive accurate advice on how to improve the current health state of the herd. The cost is $750 per year. The probabilities of obtaining a given certification level A are 0.70 with the intensive program and 0.15 with the general support program. Thus, the respective probabilities of certification level Bare 0.30 (-1- 7) with the intensive and 0.85 with the general program. a. (10 marks) Calculate the net returns to quality A and quality B milk for each of the two support programs. b. (12 marks) Which support program would you recommend to the dairy farmer using the expected value approach? Explain. c. (15 marks) At what probability of obtaining an A quality from the intensive program would the dairy farmer be indifferent using the expected value approach between the two programs assuming all else stays the same? Question 1 A feed manufacturing company is faced with a capacity decision. Their present production facility is running at nearly maximum capacity. Management is considering the following three decision alternatives: a) No expansion b) Add on the present facility c) Build a new facility They believe that if there is a large increase in demand for their product in the near future, they will need to have built a new facility in order to compete and capitalize on more efficient technology and design advances. However, if there is no increase in demand, it might be more profitable to maintain the present facility and add no capacity. A third alternative is to add on to the present facility that will suffice for a moderate increase in demand and will be cheaper than building an entirely new facility. A drawback of adding on to the old facility is that if there is a large increase in demand for their product, an addition to the old facility will preclude capitalizing on new efficiencies that cannot be built into the old plant. Shown in the table below are the payoffs (in $100,000's) for these three decision alternatives, for four different possible states of demand for the company's product. Suppose probabilities have been determined for the states of demand such that there is a 0.30 chance that demand will be less, a 0.15 chance that there will be no change in demand, a 0.35 probability that there will be a moderate increase in demand, and a 0.20 probability that there will be a large increase in demand. Less Option: No expansion Add on Build a new facility State of demand No change Moderate increase $35 $60 $60 $95 $40 $120 $15 ($10) ($85) Large increase $100 $150 $225 a. (4 marks) What option would be recommended under the optimistic approach? b. (4 marks) What option would be recommended under the conservative approach? C. (10 marks) What option would be recommended under the opportunity (minimax) regret approach? d. (15 marks) Use the data to compute the expected value for each option e. (3 marks) Using expected value, and only expected value, which option would you recommend and why? f. (18 marks) Use the data to compute the variance for each option g. (3 marks) Using variance, rank the options from most risky to least risky. h. (3 marks) Is there an option that all investors rule out? Explain. i (3 marks) of the remaining two options, which would be selected by a very risk averse individual? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started