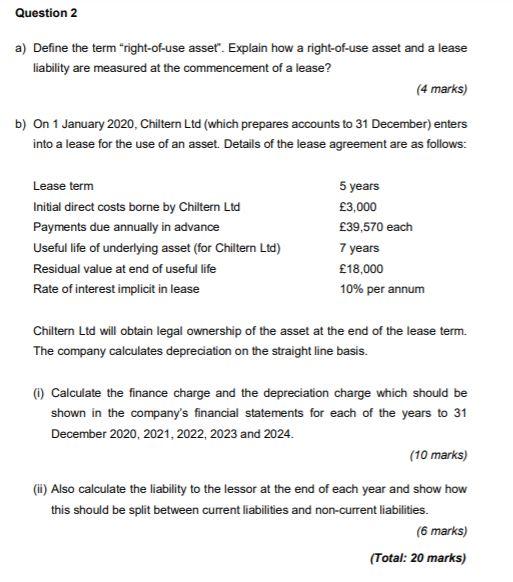

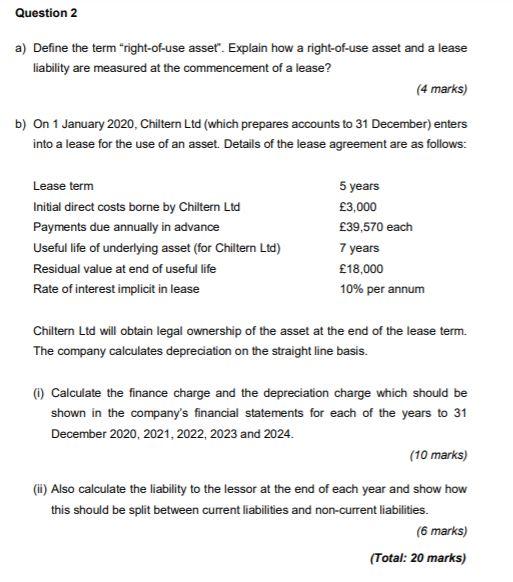

Question 2 a) Define the term "right-of-use asset". Explain how a right-of-use asset and a lease liability are measured at the commencement of a lease? (4 marks) b) On 1 January 2020, Chiltern Ltd (which prepares accounts to 31 December) enters into a lease for the use of an asset. Details of the lease agreement are as follows: Lease term Initial direct costs borne by Chiltern Ltd Payments due annually in advance Useful life of underlying asset (for Chiltern Ltd) Residual value at end of useful life Rate of interest implicit in lease 5 years 3,000 39,570 each 7 years 18,000 10% per annum Chiltern Ltd will obtain legal ownership of the asset at the end of the lease term The company calculates depreciation on the straight line basis. ) Calculate the finance charge and the depreciation charge which should be shown in the company's financial statements for each of the years to 31 December 2020 2021 2022 2023 and 2024. (10 marks) (1) Also calculate the liability to the lessor at the end of each year and show how this should be split between current liabilities and non-current liabilities. (6 marks) (Total: 20 marks) Question 2 a) Define the term "right-of-use asset". Explain how a right-of-use asset and a lease liability are measured at the commencement of a lease? (4 marks) b) On 1 January 2020, Chiltern Ltd (which prepares accounts to 31 December) enters into a lease for the use of an asset. Details of the lease agreement are as follows: Lease term Initial direct costs borne by Chiltern Ltd Payments due annually in advance Useful life of underlying asset (for Chiltern Ltd) Residual value at end of useful life Rate of interest implicit in lease 5 years 3,000 39,570 each 7 years 18,000 10% per annum Chiltern Ltd will obtain legal ownership of the asset at the end of the lease term The company calculates depreciation on the straight line basis. ) Calculate the finance charge and the depreciation charge which should be shown in the company's financial statements for each of the years to 31 December 2020 2021 2022 2023 and 2024. (10 marks) (1) Also calculate the liability to the lessor at the end of each year and show how this should be split between current liabilities and non-current liabilities. (6 marks) (Total: 20 marks)