Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 (a) Dry Batteries Ltd. produces one product, a rechargeable battery for use in radios. Last year, 100,000 batteries were sold at K2,000 each.

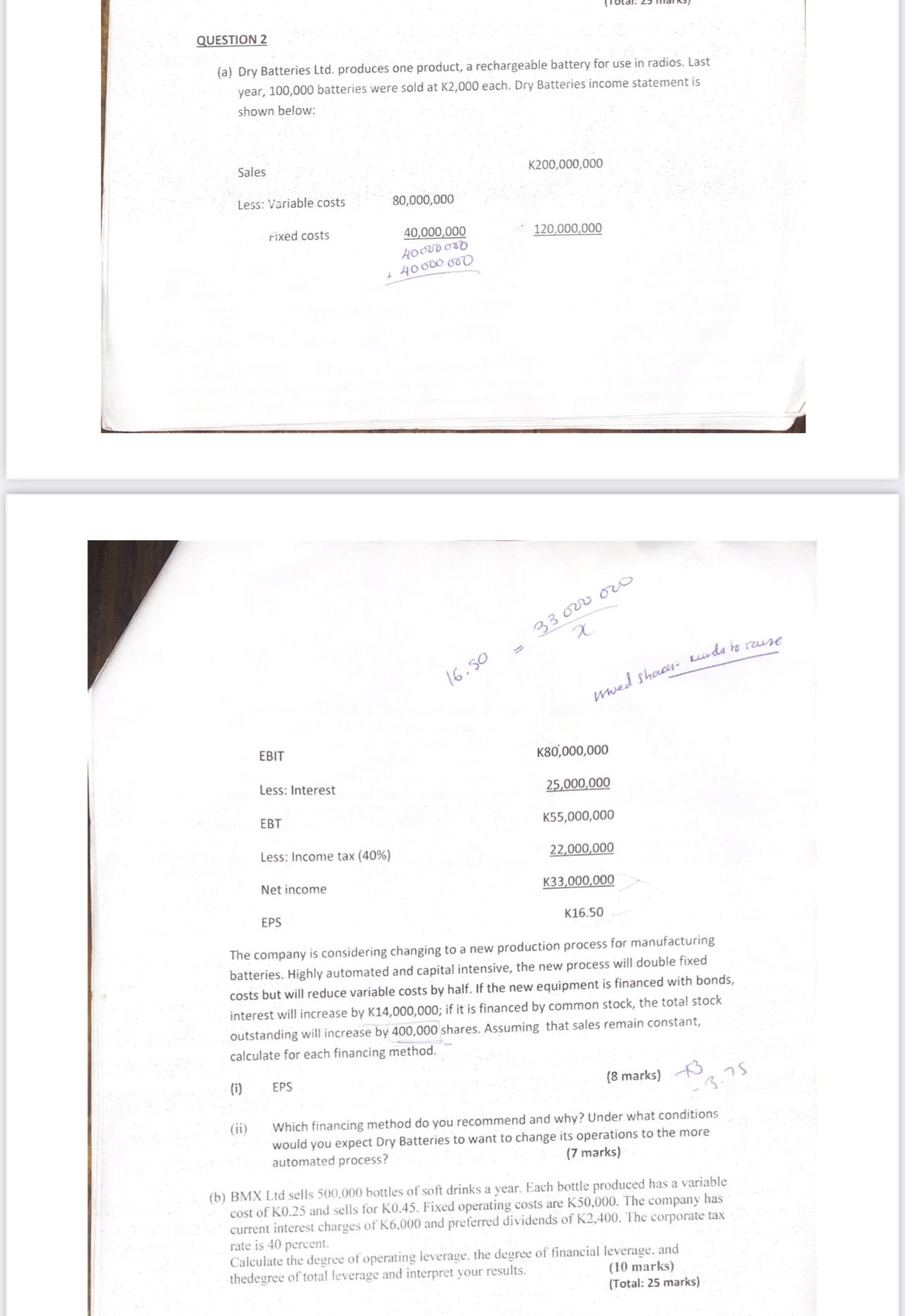

QUESTION 2 (a) Dry Batteries Ltd. produces one product, a rechargeable battery for use in radios. Last year, 100,000 batteries were sold at K2,000 each. Dry Batteries income statement is shown below: The company is considering changing to a new production process for manufacturing batteries. Highly automated and capital intensive, the new process will double fixed costs but will reduce variable costs by half. If the new equipment is financed with bonds, interest will increase by K14,000,000; if it is financed by common stock, the total stock outstanding will increase by 400,000 shares. Assuming that sales remain constant, calculate for each financing method. (i) EPS (8 marks) (ii) Which financing method do you recommend and why? Under what conditions would you expect Dry Batteries to want to change its operations to the more automated process? (7 marks) (b) BMX Ltd sells 500,000 bottles of soft drinks a year. Each bottle produced has a variable cost of K 0.25 and sells for K0.45. Fixed operating costs are K50,000. The company has current interest charges of K6,000 and preferred dividends of K2,400. The corporate tax rate is 40 percent. Calculate the degree of operating leverage, the degree of financial leverage, and thedegree of total leverage and interpret your results. (10 marks) (Total: 25 marks)

QUESTION 2 (a) Dry Batteries Ltd. produces one product, a rechargeable battery for use in radios. Last year, 100,000 batteries were sold at K2,000 each. Dry Batteries income statement is shown below: The company is considering changing to a new production process for manufacturing batteries. Highly automated and capital intensive, the new process will double fixed costs but will reduce variable costs by half. If the new equipment is financed with bonds, interest will increase by K14,000,000; if it is financed by common stock, the total stock outstanding will increase by 400,000 shares. Assuming that sales remain constant, calculate for each financing method. (i) EPS (8 marks) (ii) Which financing method do you recommend and why? Under what conditions would you expect Dry Batteries to want to change its operations to the more automated process? (7 marks) (b) BMX Ltd sells 500,000 bottles of soft drinks a year. Each bottle produced has a variable cost of K 0.25 and sells for K0.45. Fixed operating costs are K50,000. The company has current interest charges of K6,000 and preferred dividends of K2,400. The corporate tax rate is 40 percent. Calculate the degree of operating leverage, the degree of financial leverage, and thedegree of total leverage and interpret your results. (10 marks) (Total: 25 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started