Answered step by step

Verified Expert Solution

Question

1 Approved Answer

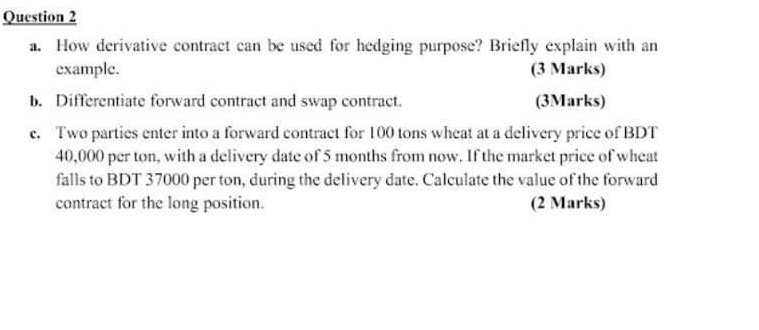

Question 2 a . How derivative contract can be used for hedging purpose? Briefly explain with an example. ( 3 Marks ) b . Differentiate

Question

a How derivative contract can be used for hedging purpose? Briefly explain with an example.

Marks

b Differentiate forward contract and swap contract.

Marks

c Two parties enter into a forward contract for tons wheat at a delivery price of BDT per ton, with a delivery date of months from now. If the market price of wheat falls to BDT per ton, during the delivery date. Calculate the value of the forward contract for the long position.

Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started