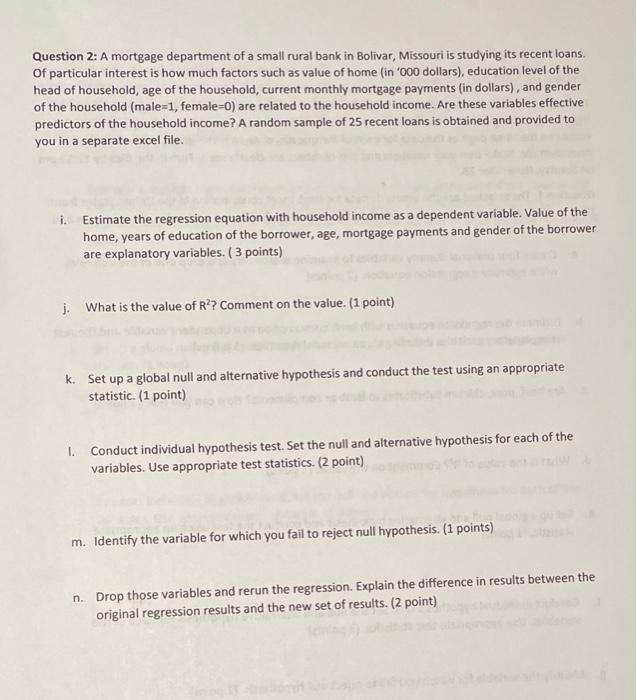

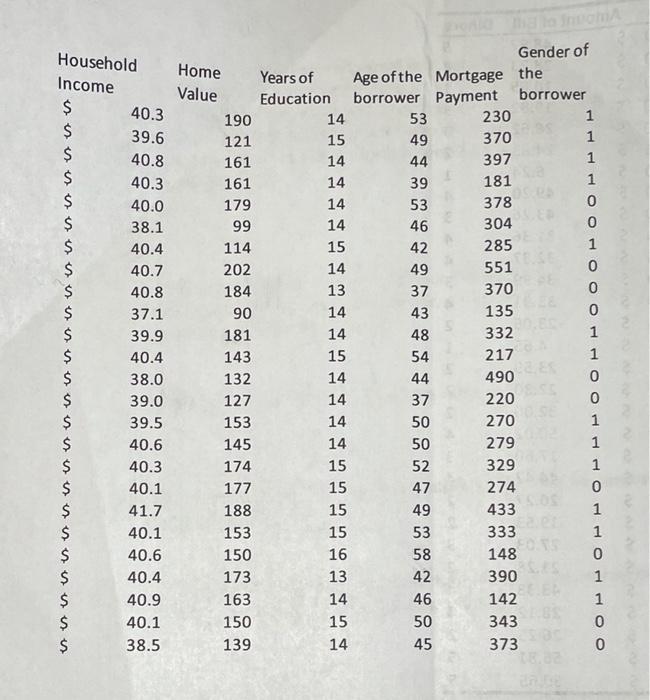

Question 2: A mortgage department of a small rural bank in Bolivar, Missouri is studying its recent loans Of particular interest is how much factors such as value of home (in '000 dollars), education level of the head of household, age of the household, current monthly mortgage payments (in dollars), and gender of the household (male-1, female-0) are related to the household income. Are these variables effective predictors of the household income? A random sample of 25 recent loans is obtained and provided to you in a separate excel file. i. Estimate the regression equation with household income as a dependent variable. Value of the home, years of education of the borrower, age, mortgage payments and der of the borrower are explanatory variables. (3 points) j. What is the value of R? Comment on the value. (1 point) k. Set up a global null and alternative hypothesis and conduct the test using an appropriate statistic. (1 point) I. Conduct individual hypothesis test. Set the null and alternative hypothesis for each of the variables. Use appropriate test statistics. (2 point) m. Identify the variable for which you fail to reject null hypothesis. (1 points) n. Drop those variables and rerun the regression. Explain the difference in results between the original regression results and the new set of results. (2 point) 161 $ $ $ $ $ $ $ $ $ $ $ $ $ $ Household Income $ 40.3 $ 39.6 40.8 40.3 40.0 38.1 40.4 40.7 40.8 37.1 39.9 40.4 38.0 39.0 39.5 40.6 $ 40.3 $ 40.1 $ 41.7 $ 40.1 $ 40.6 $ 40.4 $ 40.9 40.1 $ 38.5 Gender of Home Years of Age of the Mortgage the Value Education borrower Payment borrower 190 14 53 230 1 121 15 49 370 1 161 14 44 397 1 14 39 181 1 179 14 53 378 0 99 14 46 304 0 114 15 42 285 1 202 14 49 551 0 184 13 37 370 0 90 14 43 135 0 181 14 48 332 1 143 15 54 217 1 132 14 44 490 0 127 14 37 220 0 153 14 50 270 1 145 14 279 1 174 15 52 329 1 177 15 47 274 0 188 15 49 433 153 15 53 333 1 150 16 58 148 0 173 13 42 390 1 163 14 46 142 1 150 15 50 343 139 14 45 373 50 1 HOO $ Question 2: A mortgage department of a small rural bank in Bolivar, Missouri is studying its recent loans Of particular interest is how much factors such as value of home (in '000 dollars), education level of the head of household, age of the household, current monthly mortgage payments (in dollars), and gender of the household (male-1, female-0) are related to the household income. Are these variables effective predictors of the household income? A random sample of 25 recent loans is obtained and provided to you in a separate excel file. i. Estimate the regression equation with household income as a dependent variable. Value of the home, years of education of the borrower, age, mortgage payments and der of the borrower are explanatory variables. (3 points) j. What is the value of R? Comment on the value. (1 point) k. Set up a global null and alternative hypothesis and conduct the test using an appropriate statistic. (1 point) I. Conduct individual hypothesis test. Set the null and alternative hypothesis for each of the variables. Use appropriate test statistics. (2 point) m. Identify the variable for which you fail to reject null hypothesis. (1 points) n. Drop those variables and rerun the regression. Explain the difference in results between the original regression results and the new set of results. (2 point) 161 $ $ $ $ $ $ $ $ $ $ $ $ $ $ Household Income $ 40.3 $ 39.6 40.8 40.3 40.0 38.1 40.4 40.7 40.8 37.1 39.9 40.4 38.0 39.0 39.5 40.6 $ 40.3 $ 40.1 $ 41.7 $ 40.1 $ 40.6 $ 40.4 $ 40.9 40.1 $ 38.5 Gender of Home Years of Age of the Mortgage the Value Education borrower Payment borrower 190 14 53 230 1 121 15 49 370 1 161 14 44 397 1 14 39 181 1 179 14 53 378 0 99 14 46 304 0 114 15 42 285 1 202 14 49 551 0 184 13 37 370 0 90 14 43 135 0 181 14 48 332 1 143 15 54 217 1 132 14 44 490 0 127 14 37 220 0 153 14 50 270 1 145 14 279 1 174 15 52 329 1 177 15 47 274 0 188 15 49 433 153 15 53 333 1 150 16 58 148 0 173 13 42 390 1 163 14 46 142 1 150 15 50 343 139 14 45 373 50 1 HOO $