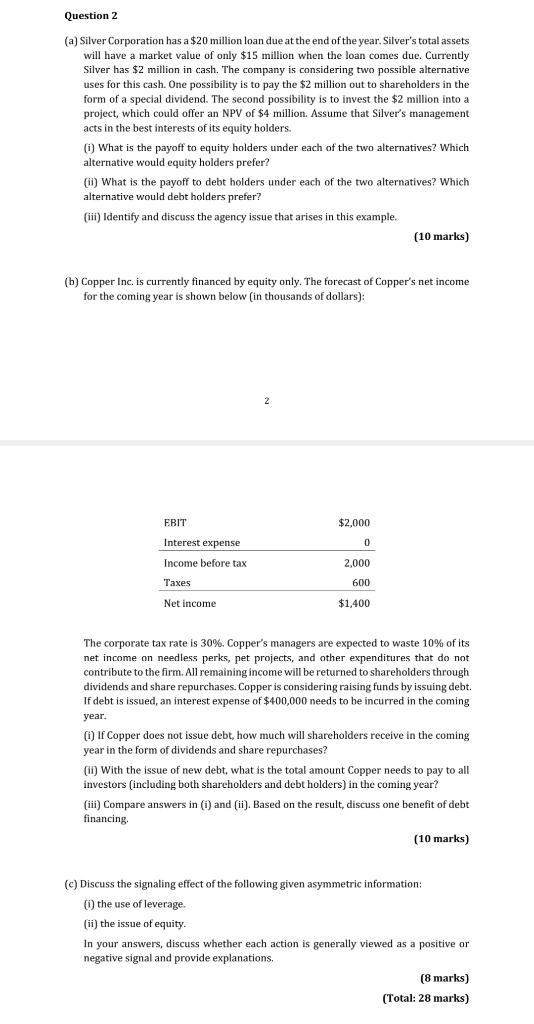

Question 2 (a) Silver Corporation has a $20 million loan due at the end of the year. Silver's total assets will have a market value of only $15 million when the loan comes due. Currently Silver has $2 million in cash. The company is considering two possible alternative uses for this cash. One possibility is to pay the $2 million out to shareholders in the form of a special dividend. The second possibility is to invest the $2 million into a project, which could offer an NPV of $4 million. Assume that Silver's management acts in the best interests of its equity holders. (i) What is the payoff to equity holders under each of the two alternatives? Which alternative would equity holders prefer? (ii) What is the payoff to debt holders under each of the two alternatives? Which alternative would debt holders prefer? (iii) Identify and discuss the agency issue that arises in this example. (10 marks) (b) Copper Inc. is currently financed by equity only. The forecast of Copper's net income for the coming year is shown below (in thousands of dollars): 2 The corporate tax rate is 30%. Copper's managers are expected to waste 10% of its net income on needless perks, pet projects, and other expenditures that do not contribute to the firm. All remaining income will be returned to shareholders through dividends and share repurchases. Copper is considering raising funds by issuing debt. If debt is issued, an interest expense of $400,000 needs to be incurred in the coming year. (i) If Copper does not issue debt, how much will shareholders receive in the coming year in the form of dividends and share repurchases? (ii) With the issue of new debt, what is the total amount Copper needs to pay to all investors (including both shareholders and debt holders) in the coming year? (iii) Compare answers in (i) and (ii). Based on the result, discuss one benefit of debt financing. (10 marks) (c) Discuss the signaling effect of the following given asymmetric information: (i) the use of leverage. (ii) the issue of equity. In your answers, discuss whether each action is generally viewed as a positive or negative signal and provide explanations. (8 marks) (Total: 28 marks)