Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (a) The following information is extracted from the accounting records of CISBO Bd as at 30 June 2021: Carrying amount RM'000 Property,

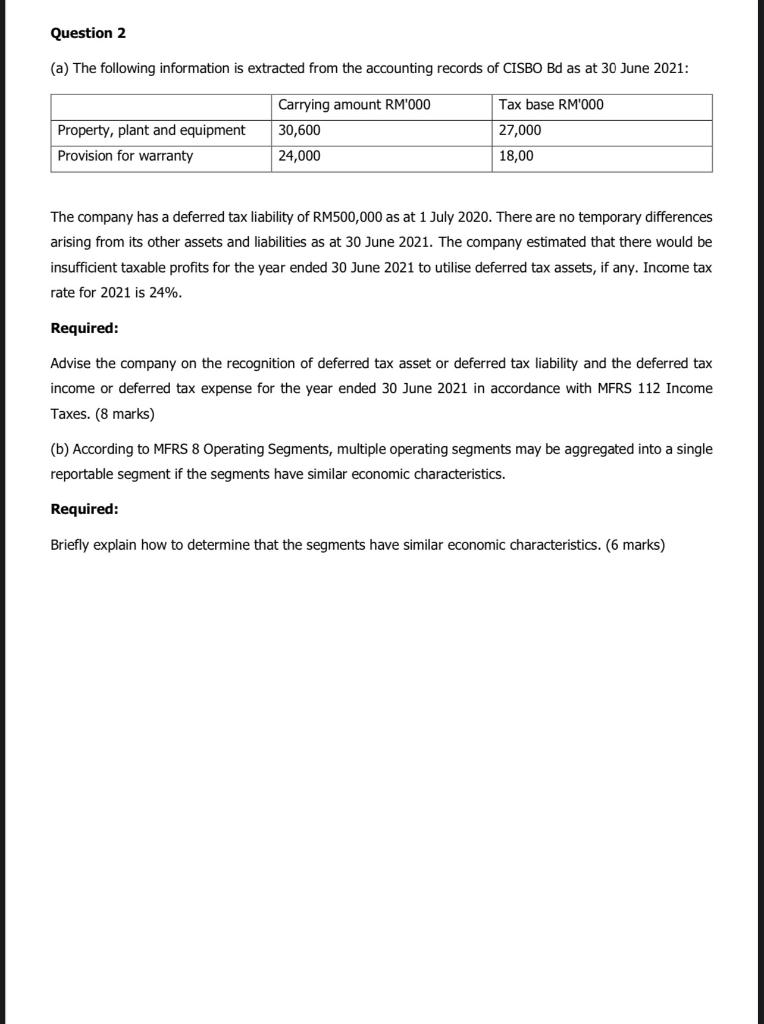

Question 2 (a) The following information is extracted from the accounting records of CISBO Bd as at 30 June 2021: Carrying amount RM'000 Property, plant and equipment 30,600 Provision for warranty 24,000 Tax base RM'000 27,000 18,00 The company has a deferred tax liability of RM500,000 as at 1 July 2020. There are no temporary differences arising from its other assets and liabilities as at 30 June 2021. The company estimated that there would be insufficient taxable profits for the year ended 30 June 2021 to utilise deferred tax assets, if any. Income tax rate for 2021 is 24%. Required: Advise the company on the recognition of deferred tax asset or deferred tax liability and the deferred tax income or deferred tax expense for the year ended 30 June 2021 in accordance with MFRS 112 Income Taxes. (8 marks) (b) According to MFRS 8 Operating Segments, multiple operating segments may be aggregated into a single reportable segment if the segments have similar economic characteristics. Required: Briefly explain how to determine that the segments have similar economic characteristics. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started