Answered step by step

Verified Expert Solution

Question

1 Approved Answer

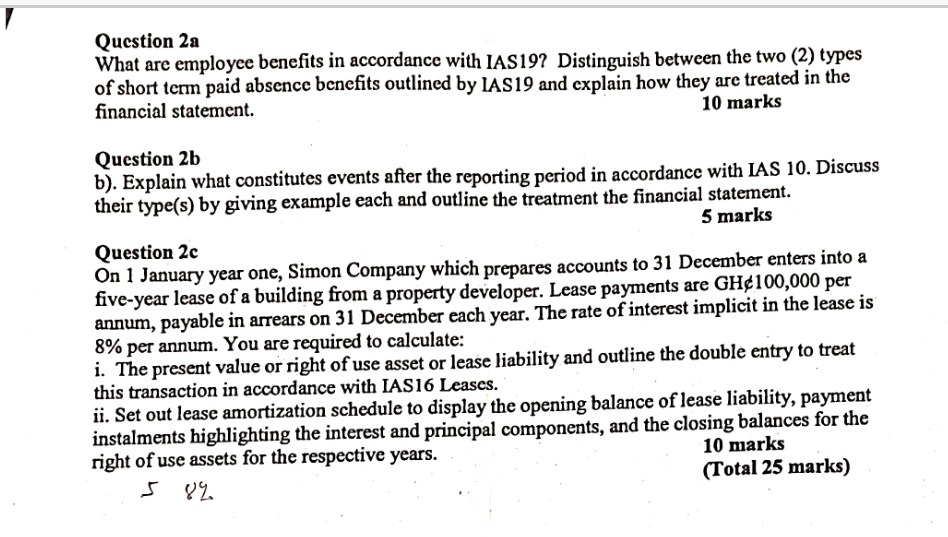

Question 2 a What are employee benefits in accordance with IAS 1 9 ? Distinguish between the two ( 2 ) types of short term

Question a

What are employee benefits in accordance with IAS Distinguish between the two types of short term paid absence benefits outlined by IAS and explain how they are treated in the financial statement.

marks

Question b

b Explain what constitutes events after the reporting period in accordance with IAS Discuss their types by giving example each and outline the treatment the financial statement.

marks

Question c

On January year one, Simon Company which prepares accounts to December enters into a fiveyear lease of a building from a property developer. Lease payments are GH& per annum, payable in arrears on December each year. The rate of interest implicit in the lease is per annum. You are required to calculate:

i The present value or right of use asset or lease liability and outline the double entry to treat this transaction in accordance with IAS Leases.

ii Set out lease amortization schedule to display the opening balance of lease liability, payment instalments highlighting the interest and principal components, and the closing balances for the right of use assets for the respective years.

marks

Total marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started