Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (a) Write down the definition of an Up and out put option. Is it a path- dependent option? Should it be more

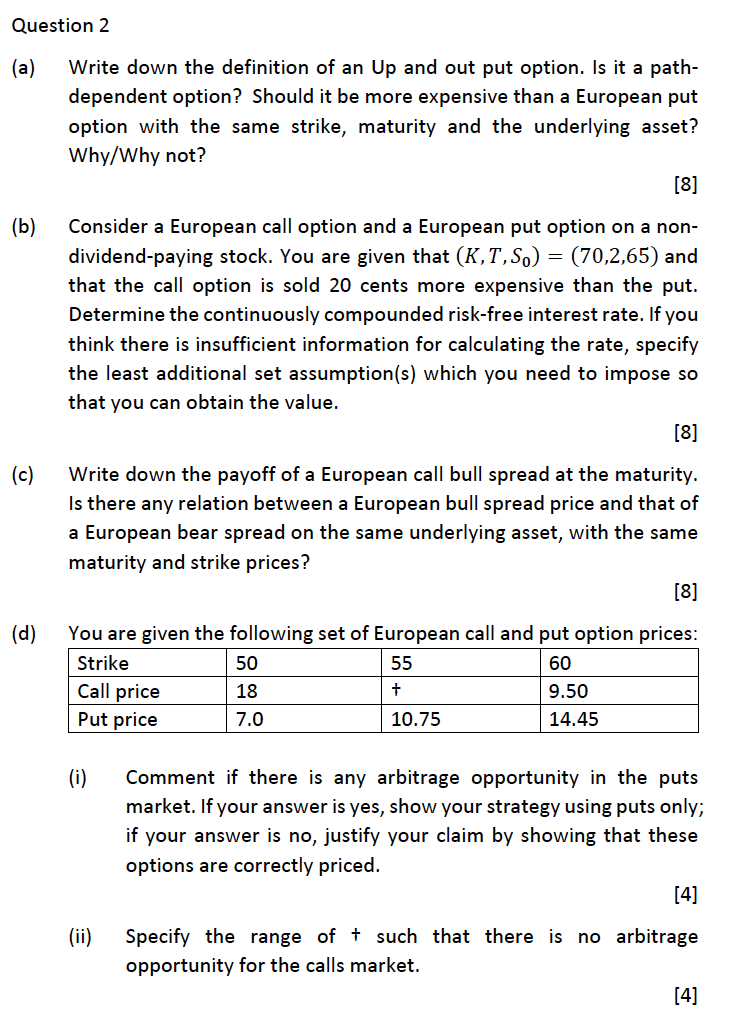

Question 2 (a) Write down the definition of an Up and out put option. Is it a path- dependent option? Should it be more expensive than a European put option with the same strike, maturity and the underlying asset? Why/Why not? [8] (b) Consider a European call option and a European put option on a non- dividend-paying stock. You are given that (K,T,S0) = (70,2,65) and that the call option is sold 20 cents more expensive than the put. Determine the continuously compounded risk-free interest rate. If you think there is insufficient information for calculating the rate, specify the least additional set assumption(s) which you need to impose so that you can obtain the value. (c) (d) [8] Write down the payoff of a European call bull spread at the maturity. Is there any relation between a European bull spread price and that of a European bear spread on the same underlying asset, with the same maturity and strike prices? [8] You are given the following set of European call and put option prices: Strike 50 Call price 18 Put price 7.0 (i) (ii) 55 + 10.75 60 9.50 14.45 Comment if there is any arbitrage opportunity in the puts market. If your answer is yes, show your strategy using puts only; if your answer is no, justify your claim by showing that these options are correctly priced. [4] Specify the range of + such that there is no arbitrage opportunity for the calls market. [4]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started