Answered step by step

Verified Expert Solution

Question

1 Approved Answer

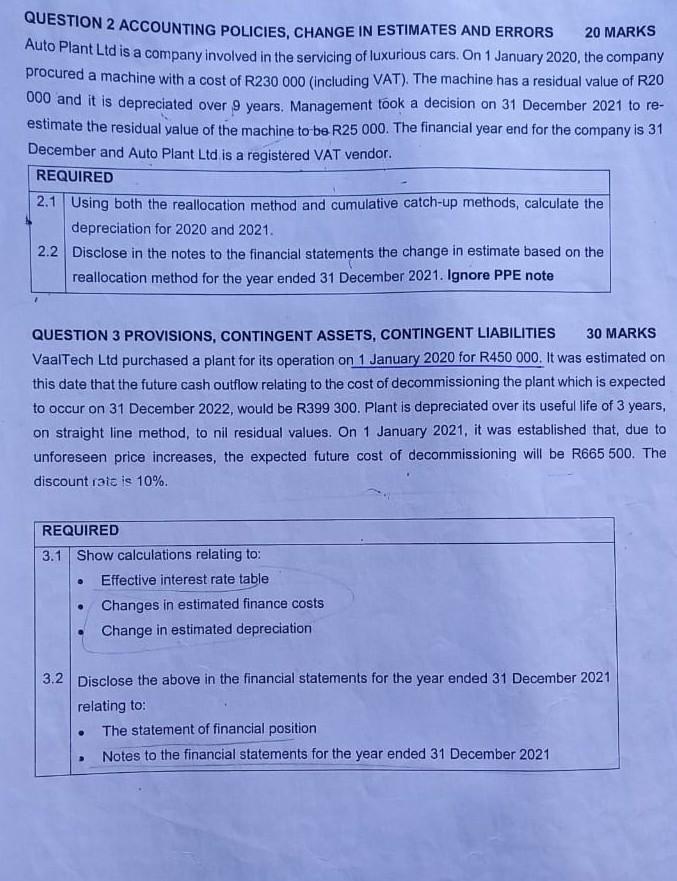

QUESTION 2 ACCOUNTING POLICIES, CHANGE IN ESTIMATES AND ERRORS 20 MARKS Auto Plant Ltd is a company involved in the servicing of luxurious cars. On

QUESTION 2 ACCOUNTING POLICIES, CHANGE IN ESTIMATES AND ERRORS 20 MARKS Auto Plant Ltd is a company involved in the servicing of luxurious cars. On 1 January 2020, the company procured a machine with a cost of R230 000 (including VAT). The machine has a residual value of R20 000 and it is depreciated over 9 years. Management took a decision on 31 December 2021 to reestimate the residual yalue of the machine to be R25000. The financial year end for the company is 31 December and Auto Plant Ltd is a registered VAT vendor. QUESTION 3 PROVISIONS, CONTINGENT ASSETS, CONTINGENT LIABILITIES 30 MARKS VaalTech Ltd purchased a plant for its operation on 1 January 2020 for R450 000. It was estimated on this date that the future cash outflow relating to the cost of decommissioning the plant which is expected to occur on 31 December 2022, would be R399 300. Plant is depreciated over its useful life of 3 years, on straight line method, to nil residual values. On 1 January 2021, it was established that, due to unforeseen price increases, the expected future cost of decommissioning will be R665 500 . The discount raic is \10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started