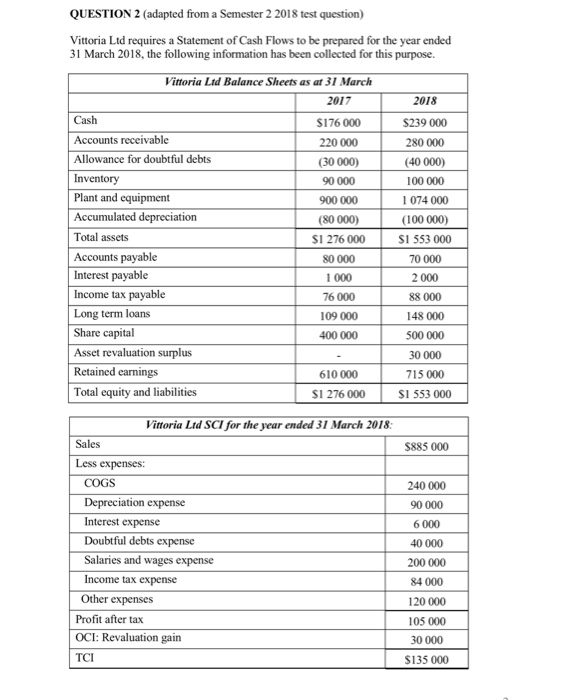

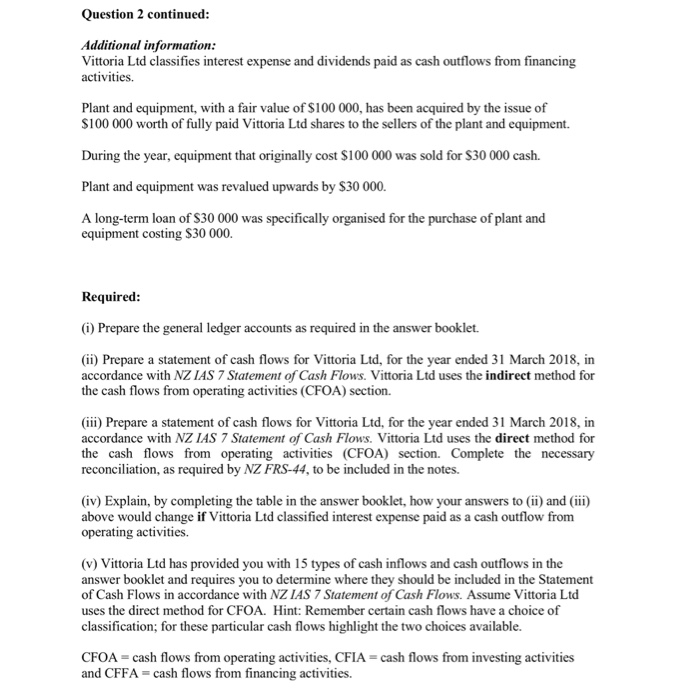

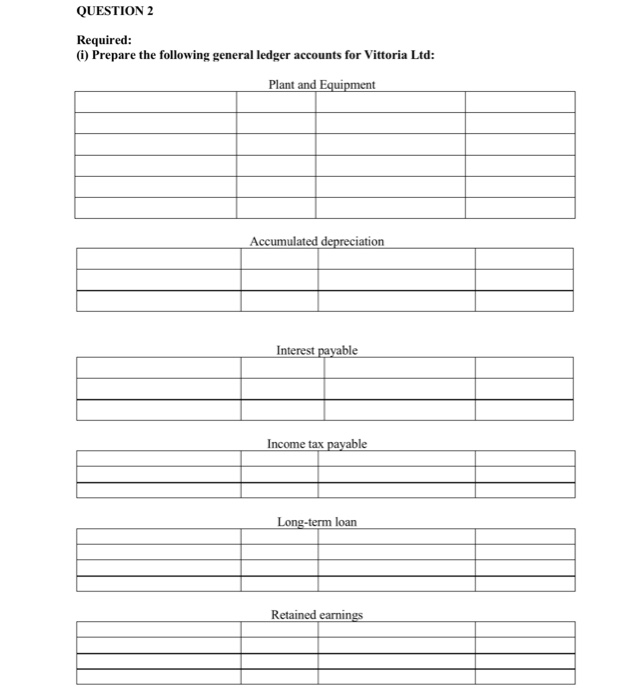

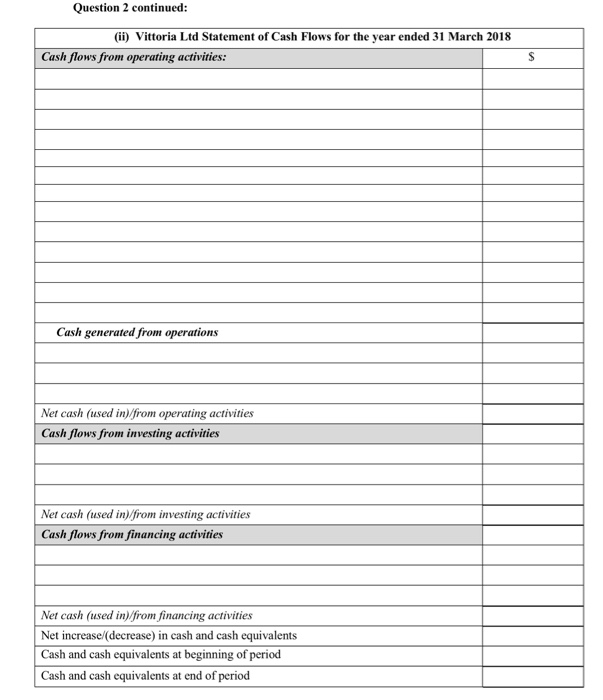

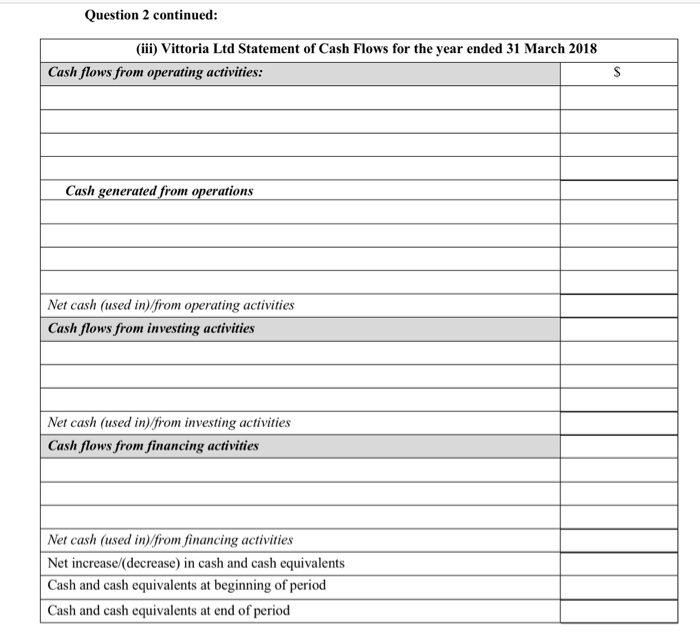

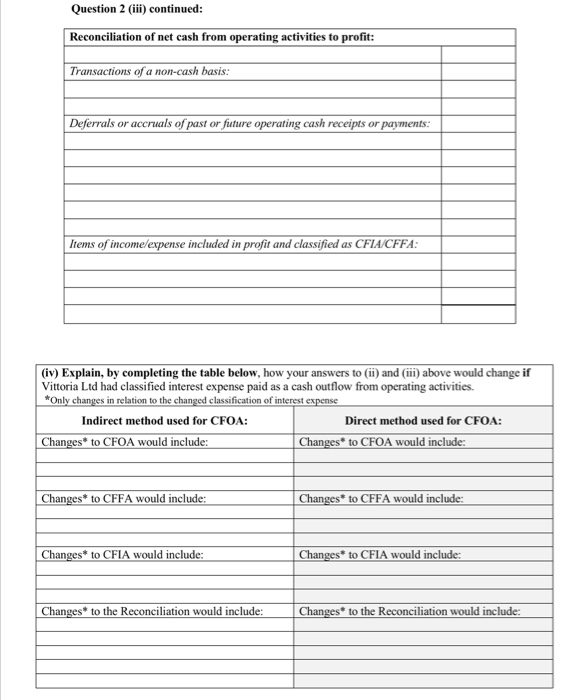

QUESTION 2 (adapted from a Semester 2 2018 test question) Vittoria Ltd requires a Statement of Cash Flows to be prepared for the year ended 31 March 2018, the following information has been collected for this purpose. Vittoria Ltd Balance Sheets as at 31 March Cash Accounts receivable Allowance for doubtful debts Inventory Plant and equipment Accumulated depreciation Total assets Accounts payable Interest payable Income tax payable Long term loans Share capital Asset revaluation surplus Retained carnings Total equity and liabilities 2017 S176 000 220 000 (30 000) 90 000 900 000 (80000) S1 276 000 80 000 1 000 76 000 109 000 400 000 2018 $239 000 280 000 (40 000) 100 000 1 074 000 (100 000) S1 553 000 70000 2 000 88 000 148 000 500 000 30 000 715 000 S1 553 000 610 000 S1 276 000 Vittoria Ltd SCI for the year ended 31 March 2018 Sales 885 000 Less expenses: COGS Depreciation expense Interest expense Doubtful debts expense Salaries and wages expense Income tax expense Other expenses 240 000 90 000 6 000 40 000 200 000 84 000 120 000 105 000 30000 $135 000 Profit after tax OCI: Revaluation gairn TCI Question 2 continued Additional information Vittoria Ltd classifies interest expense activities. and dividends paid as cash outflows from financing Plant and equipment, with a fair value of $100 000, has been acquired by the issue of S100 000 worth of fully paid Vittoria Ltd shares to the sellers of the plant and equipment. During the year, equipment that originally cost $100 000 was sold for $30 000 cash. Plant and equipment was revalued upwards by $30 000. A long-term loan of S30 000 was specifically organised for the purchase of plant and equipment costing S30 000. Required (i) Prepare the general ledger accounts as required in the answer booklet. (ii) Prepare a statement of cash flows for Vittoria Ltd, for the year ended 31 March 2018, in accordance with NZ IAS 7 Statement of Cash Flows. Vittoria Ltd uses the indirect method for the cash flows from operating activities (CFOA) section. (iii) Prepare a statement of cash flows for Vittoria Ltd, for the year ended 31 March 2018, in accordance with NZ IAS 7 Statement of Cash Flows. Vittoria Ltd uses the direct method for the cash flows from operating activities (CFOA) section. Complete the necessary reconciliation, as required by NZ FRS-44, to be included in the notes. (iv) Explain, by completing the table in the answer booklet, how your answers to (ii) and (iii) above would change if Vittoria Ltd classified interest expense paid as a cash outflow from operating activities. (v) Vittoria Ltd has provided you with 15 types of cash inflows and cash outflows in the answer booklet and requires you to determine where they should be included in the Statement of Cash Flows in accordance with NZ IAS 7 Statement of Cash Flows. Assume Vittoria Ltd uses the direct method for CFOA. Hint: Remember certain cash flows have a choice of classification; for these particular cash flows highlight the two choices available. CFOA-cash flows from operating activities, CFIA-cash flows from investing activities and CFFA- cash flows from financing activities. QUESTION 2 Required: (i) Prepare the following general ledger accounts for Vittoria Ltd: Plant and Equipment Accumulated depreciation Interest payable Income tax payable Long-term loan Retained earnings Question 2 continued: ii) Vittoria Ltd Statement of Cash Flows for the year ended 31 March 2018 Cash flows from operating activities Cash generated from operations Net cash (used in)from operating activities Cash flows from investing activities Net cash (used infrom investing activities Cash flows from financing activities Net cash (used in)from financing activities Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Question 2 continued: (iii) Vittoria Ltd Statement of Cash Flows for the year ended 31 March 2018 Cash flows from operating activities: Cash generated from operations Net cash (used in)from operating activities Cash flows from investing activities Net cash (used in)from investing activities Cash flows from financing activities Net cash (used in)from financing activities Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Question 2 (iii) continued: Reconciliation of net cash from operating activities to profit: Transactions of a non-cash basis Deferrals or accruals of past or fiuture operating cash receipts or payments: Items of incomelespense incuded in profit and classfed as CACFFA Giv) Explain, by completing the table below, how your answers to (ii) and (ii) above would change if Vittoria Ltd had classified interest expense paid as a cash outflow from operating activities. Only changes in relation to the changed classification of interest expense Indirect method used for CFOA: Direct method used for CFOA: Changes to CFOA would include: Changes' to CFOA would include Changes to CFFA would include: Changes to CFFA would include: Changes to CFIA would include: Changes to CFIA would include: Changes to the Reconciliation would include: Changes to the Reconciliation would include