Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 After running a multiple regression on sample of 204 companies in Kuala Lumpur Stock Exchange, following results are generated. Where; Y = Companies

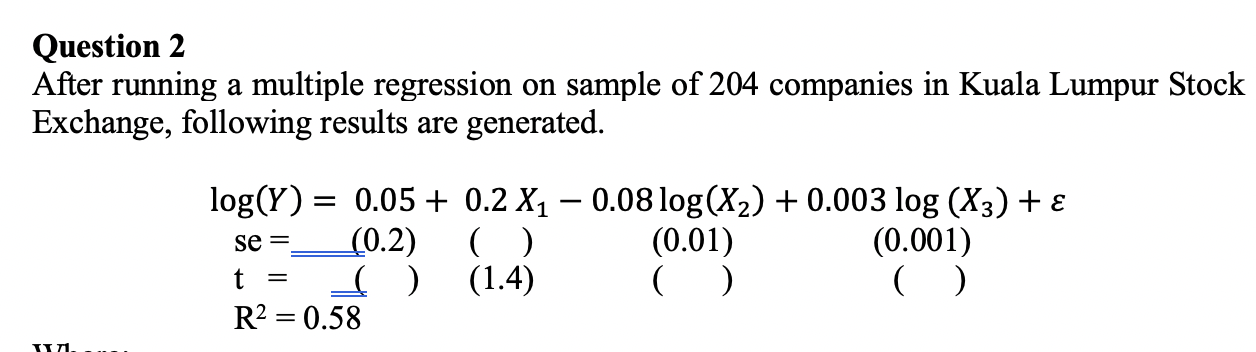

Question 2

After running a multiple regression on sample of 204 companies in Kuala Lumpur Stock Exchange, following results are generated.

Where;

Y = Companies sales in 1,000 units

X1 = Fixed asset in 1,000,000

X2 = Number of sales agents

X3 = GDP per capita

Required:

- Calculate the missing standard errors (se) and t-statistics (t). (4 marks)

- Interpret the sign and coefficient of the models. (6 marks)

- Which of independent variables are statistically significant at 0.05? (3 marks)

- Would you reject the null hypothesis that GDP per capita has no effect or whatsoever on sales? (2 marks)

- What is the overall significance of the regression at the 5 percent level? State the hypotheses and show the necessary calculations. What can you conclude? (8 marks)

- Can you interpret the coefficients of fixed asset (X1) and number of sales agents (X2) as elasticity coefficients? Why or why not? (2 marks)

[Total : 25 Marks]

I am not sure this question got use e-view or not.

Question 2 After running a multiple regression on sample of 204 companies in Kuala Lumpur Stock Exchange, following results are generated. = log(Y) 0.05 + 0.2 X1 0.08 log(x2) + 0.003 log (X3) + _(0.2) ( ) (0.01) (0.001) ( ) (1.4) ( ) C) R2 = 0.58 se = t = TIT Question 2 After running a multiple regression on sample of 204 companies in Kuala Lumpur Stock Exchange, following results are generated. = log(Y) 0.05 + 0.2 X1 0.08 log(x2) + 0.003 log (X3) + _(0.2) ( ) (0.01) (0.001) ( ) (1.4) ( ) C) R2 = 0.58 se = t = TITStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started