Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 After trading for 3 years, Steran Co. Ltd found that they encountered frequent cash flow problems. In order to keep track of cash

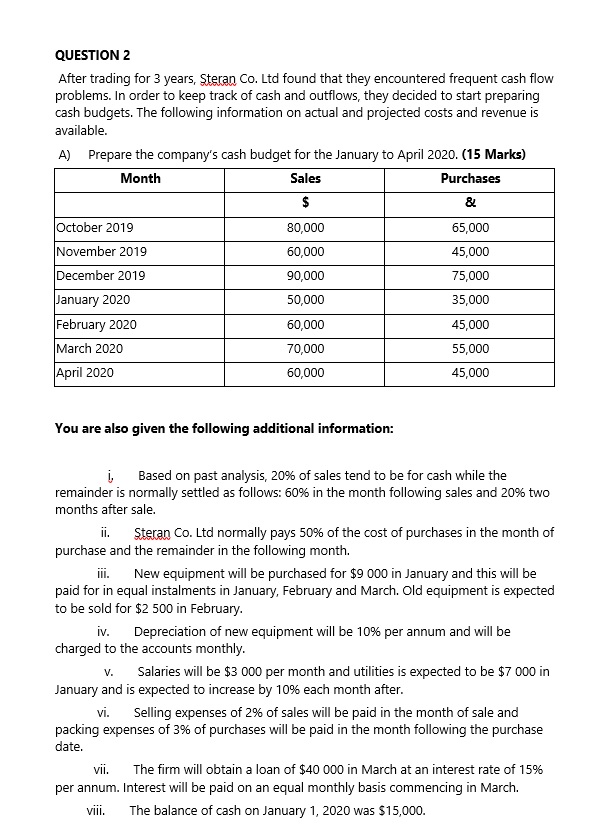

QUESTION 2 After trading for 3 years, Steran Co. Ltd found that they encountered frequent cash flow problems. In order to keep track of cash and outflows, they decided to start preparing cash budgets. The following information on actual and projected costs and revenue is available. A) Prepare the company's cash budget for the January to April 2020. (15 Marks) You are also given the following additional information: i. Based on past analysis, 20% of sales tend to be for cash while the remainder is normally settled as follows: 60% in the month following sales and 20% two months after sale. ii. Steran Co. Ltd normally pays 50% of the cost of purchases in the month of purchase and the remainder in the following month. iii. New equipment will be purchased for $9000 in January and this will be paid for in equal instalments in January, February and March. Old equipment is expected to be sold for $2500 in February. iv. Depreciation of new equipment will be 10% per annum and will be charged to the accounts monthly. v. Salaries will be $3000 per month and utilities is expected to be $7000 in January and is expected to increase by 10% each month after. vi. Selling expenses of 2% of sales will be paid in the month of sale and packing expenses of 3% of purchases will be paid in the month following the purchase date. vii. The firm will obtain a loan of $40000 in March at an interest rate of 15% per annum. Interest will be paid on an equal monthly basis commencing in March. viii. The balance of cash on January 1,2020 was $15,000. QUESTION 2 After trading for 3 years, Steran Co. Ltd found that they encountered frequent cash flow problems. In order to keep track of cash and outflows, they decided to start preparing cash budgets. The following information on actual and projected costs and revenue is available. A) Prepare the company's cash budget for the January to April 2020. (15 Marks) You are also given the following additional information: i. Based on past analysis, 20% of sales tend to be for cash while the remainder is normally settled as follows: 60% in the month following sales and 20% two months after sale. ii. Steran Co. Ltd normally pays 50% of the cost of purchases in the month of purchase and the remainder in the following month. iii. New equipment will be purchased for $9000 in January and this will be paid for in equal instalments in January, February and March. Old equipment is expected to be sold for $2500 in February. iv. Depreciation of new equipment will be 10% per annum and will be charged to the accounts monthly. v. Salaries will be $3000 per month and utilities is expected to be $7000 in January and is expected to increase by 10% each month after. vi. Selling expenses of 2% of sales will be paid in the month of sale and packing expenses of 3% of purchases will be paid in the month following the purchase date. vii. The firm will obtain a loan of $40000 in March at an interest rate of 15% per annum. Interest will be paid on an equal monthly basis commencing in March. viii. The balance of cash on January 1,2020 was $15,000

QUESTION 2 After trading for 3 years, Steran Co. Ltd found that they encountered frequent cash flow problems. In order to keep track of cash and outflows, they decided to start preparing cash budgets. The following information on actual and projected costs and revenue is available. A) Prepare the company's cash budget for the January to April 2020. (15 Marks) You are also given the following additional information: i. Based on past analysis, 20% of sales tend to be for cash while the remainder is normally settled as follows: 60% in the month following sales and 20% two months after sale. ii. Steran Co. Ltd normally pays 50% of the cost of purchases in the month of purchase and the remainder in the following month. iii. New equipment will be purchased for $9000 in January and this will be paid for in equal instalments in January, February and March. Old equipment is expected to be sold for $2500 in February. iv. Depreciation of new equipment will be 10% per annum and will be charged to the accounts monthly. v. Salaries will be $3000 per month and utilities is expected to be $7000 in January and is expected to increase by 10% each month after. vi. Selling expenses of 2% of sales will be paid in the month of sale and packing expenses of 3% of purchases will be paid in the month following the purchase date. vii. The firm will obtain a loan of $40000 in March at an interest rate of 15% per annum. Interest will be paid on an equal monthly basis commencing in March. viii. The balance of cash on January 1,2020 was $15,000. QUESTION 2 After trading for 3 years, Steran Co. Ltd found that they encountered frequent cash flow problems. In order to keep track of cash and outflows, they decided to start preparing cash budgets. The following information on actual and projected costs and revenue is available. A) Prepare the company's cash budget for the January to April 2020. (15 Marks) You are also given the following additional information: i. Based on past analysis, 20% of sales tend to be for cash while the remainder is normally settled as follows: 60% in the month following sales and 20% two months after sale. ii. Steran Co. Ltd normally pays 50% of the cost of purchases in the month of purchase and the remainder in the following month. iii. New equipment will be purchased for $9000 in January and this will be paid for in equal instalments in January, February and March. Old equipment is expected to be sold for $2500 in February. iv. Depreciation of new equipment will be 10% per annum and will be charged to the accounts monthly. v. Salaries will be $3000 per month and utilities is expected to be $7000 in January and is expected to increase by 10% each month after. vi. Selling expenses of 2% of sales will be paid in the month of sale and packing expenses of 3% of purchases will be paid in the month following the purchase date. vii. The firm will obtain a loan of $40000 in March at an interest rate of 15% per annum. Interest will be paid on an equal monthly basis commencing in March. viii. The balance of cash on January 1,2020 was $15,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started