Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Alan Li, a Singaporean, is employed by Good Luck Ltd (GLL), a company carrying on business in Hong Kong, as a brand

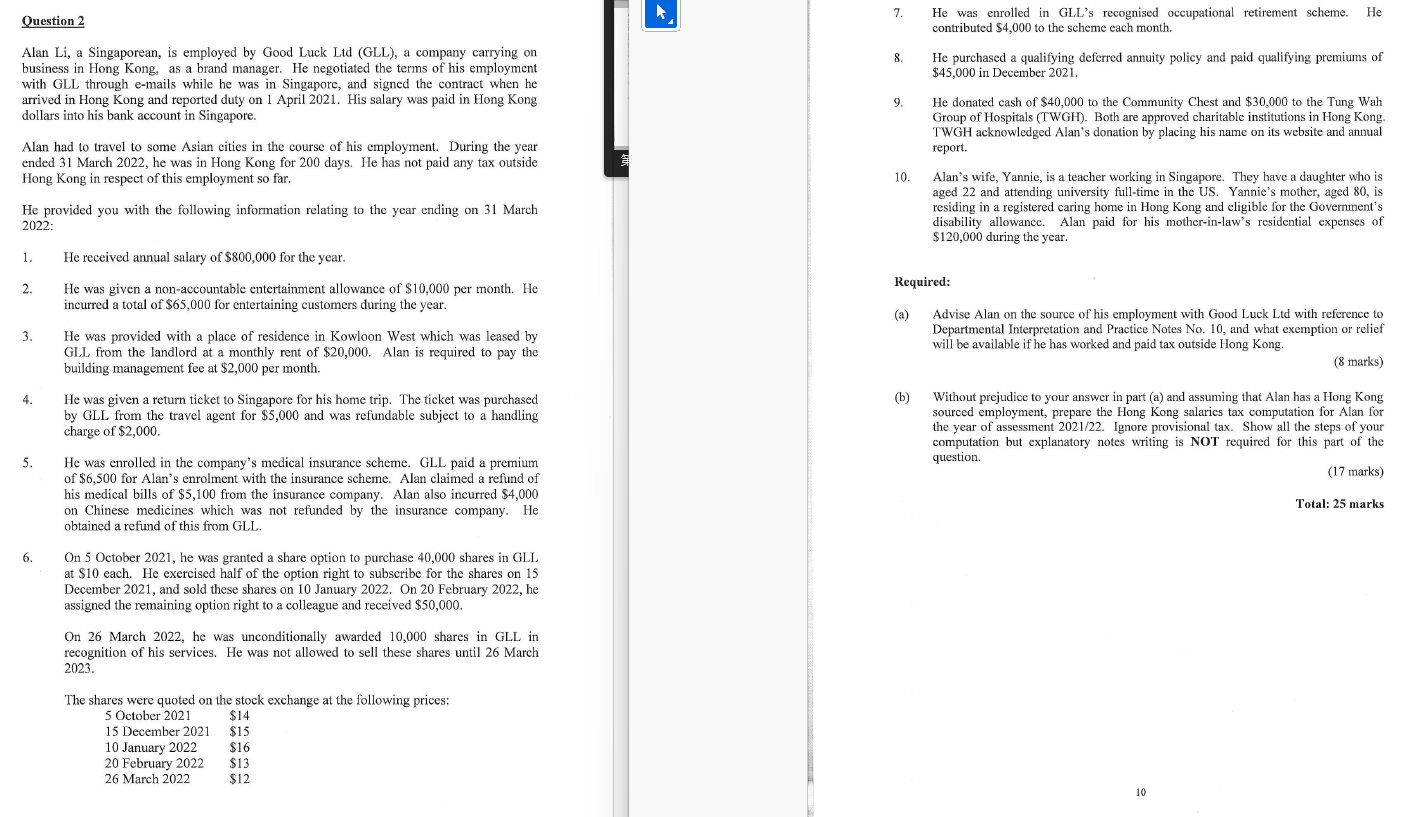

Question 2 Alan Li, a Singaporean, is employed by Good Luck Ltd (GLL), a company carrying on business in Hong Kong, as a brand manager. He negotiated the terms of his employment with GLL through e-mails while he was in Singapore, and signed the contract when he arrived in Hong Kong and reported duty on 1 April 2021. His salary was paid in Hong Kong dollars into his bank account in Singapore. Alan had to travel to some Asian cities in the course of his employment. During the year ended 31 March 2022, he was in Hong Kong for 200 days. He has not paid any tax outside Hong Kong in respect of this employment so far. He provided you with the following information relating to the year ending on 31 March 2022: 1. He received annual salary of $800,000 for the year. 2. 3. 4. 5. 6. He was given a non-accountable entertainment allowance of $10,000 per month. He incurred a total of $65,000 for entertaining customers during the year. He was provided with a place of residence in Kowloon West which was leased by GLL from the landlord at a monthly rent of $20,000. Alan is required to pay the building management fee at $2,000 per month. He was given a return ticket to Singapore for his home trip. The ticket was purchased by GLL from the travel agent for $5,000 and was refundable subject to a handling charge of $2,000. He was enrolled in the company's medical insurance scheme. GLL paid a premium of $6,500 for Alan's enrolment with the insurance scheme. Alan claimed a refund of his medical bills of $5,100 from the insurance company. Alan also incurred $4,000 on Chinese medicines which was not refunded by the insurance company. He obtained a refund of this from GLL. On 5 October 2021, he was granted a share option to purchase 40,000 shares in GLL at $10 each. He exercised half of the option right to subscribe for the shares on 15 December 2021, and sold these shares on 10 January 2022. On 20 February 2022, he assigned the remaining option right to a colleague and received $50,000. On 26 March 2022, he was unconditionally awarded 10,000 shares in GLL in recognition of his services. He was not allowed to sell these shares until 26 March 2023. The shares were quoted on the stock exchange at the following prices: 5 October 2021 $14 15 December 2021 $15 10 January 2022 $16 20 February 2022 $13 26 March 2022 $12 7. 8. 9. 10. He was enrolled in GLL's recognised occupational retirement scheme. He contributed $4,000 to the scheme each month. He purchased a qualifying deferred annuity policy and paid qualifying premiums of $45,000 in December 2021. He donated cash of $40,000 to the Community Chest and $30,000 to the Tung Wah Group of Hospitals (TWGH). Both are approved charitable institutions in Hong Kong. TWGH acknowledged Alan's donation by placing his name on its website and annual report. Alan's wife, Yannie, is a teacher working in Singapore. They have a daughter who is aged 22 and attending university full-time in the US. Yannie's mother, aged 80, is residing in a registered caring home in Hong Kong and eligible for the Government's disability allowance. Alan paid for his mother-in-law's residential expenses of $120,000 during the year. Required: (a) Advise Alan on the source of his employment with Good Luck Ltd with reference to Departmental Interpretation and Practice Notes No. 10, and what exemption or relief will be available if he has worked and paid tax outside Hong Kong. (b) (8 marks) Without prejudice to your answer in part (a) and assuming that Alan has a Hong Kong sourced employment, prepare the Hong Kong salaries tax computation for Alan for the year of assessment 2021/22. Ignore provisional tax. Show all the steps of your computation but explanatory notes writing is NOT required for this part of the question. (17 marks) Total: 25 marks 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a According to Departmental Interpretation and Practice Notes No 10 DIPN 10 the source of employment income is determined by the location where the services are rendered In Alans case he negoti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started