Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 An investment is expected to generate the following cash flows: Year 0 -$1,000,000 Year 1 $300,000 Year 2 $0 Year 3 $300,000

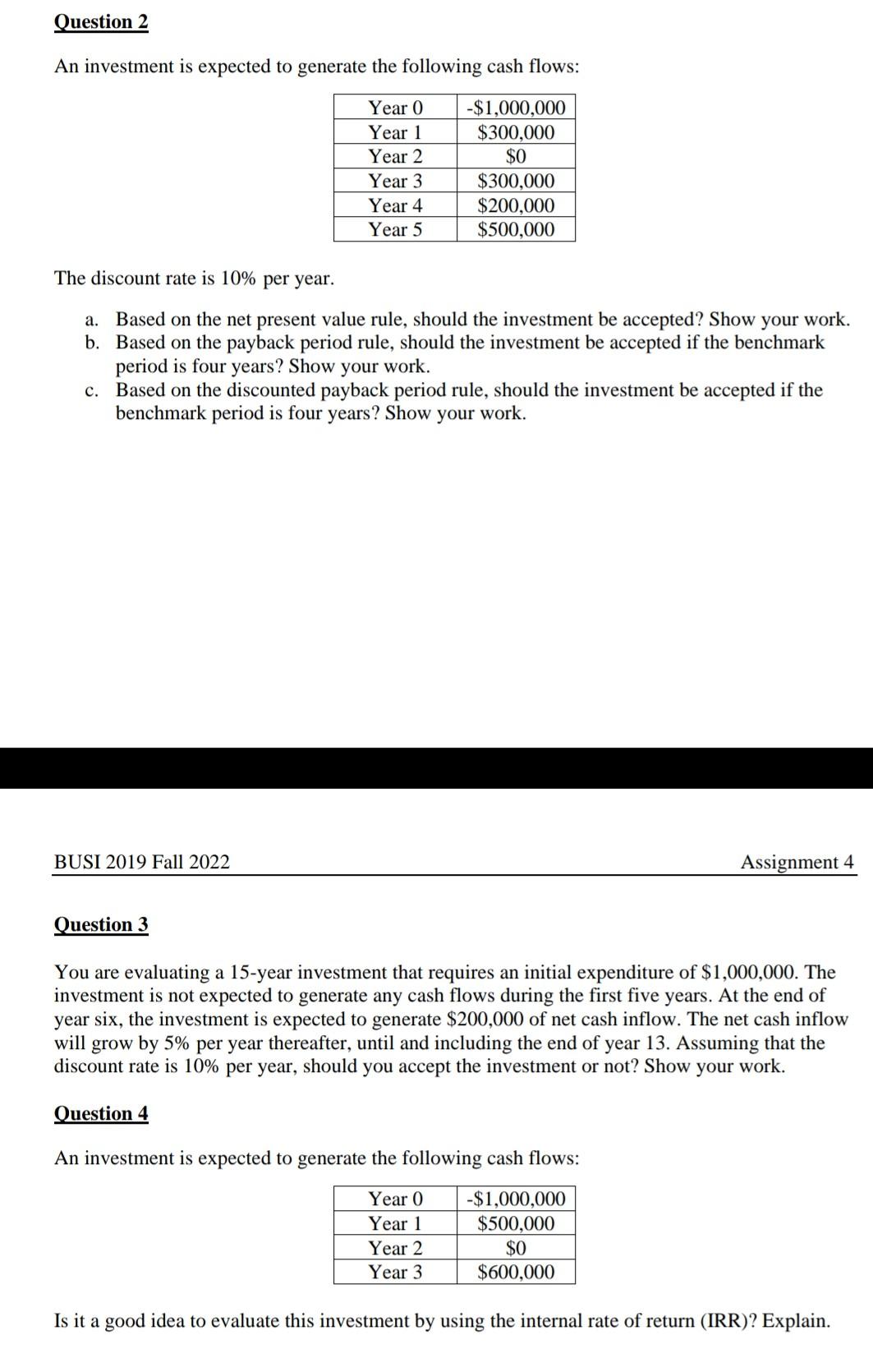

Question 2 An investment is expected to generate the following cash flows: Year 0 -$1,000,000 Year 1 $300,000 Year 2 $0 Year 3 $300,000 Year 4 $200,000 Year 5 $500,000 The discount rate is 10% per year. a. Based on the net present value rule, should the investment be accepted? Show your work. b. Based on the payback period rule, should the investment be accepted if the benchmark period is four years? Show your work. c. Based on the discounted payback period rule, should the investment be accepted if the benchmark period is four years? Show your work. BUSI 2019 Fall 2022 Question 3 Assignment 4 You are evaluating a 15-year investment that requires an initial expenditure of $1,000,000. The investment is not expected to generate any cash flows during the first five years. At the end of year six, the investment is expected to generate $200,000 of net cash inflow. The net cash inflow will grow by 5% per year thereafter, until and including the end of year 13. Assuming that the discount rate is 10% per year, should you accept the investment or not? Show your work. Question 4 An investment is expected to generate the following cash flows: Year 0 -$1,000,000 Year 1 $500,000 Year 2 $0 Year 3 $600,000 Is it a good idea to evaluate this investment by using the internal rate of return (IRR)? Explain.

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of NPV of the project Initial capital 1000000 rate 1000 Year Cashflow PV Factor Equals P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started