Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 and 4 - Financial Accounting Question 2 U. Wait owns an estate agency. The trial balance of her undertaking at 31 August 2006

Question 2 and 4 - Financial Accounting

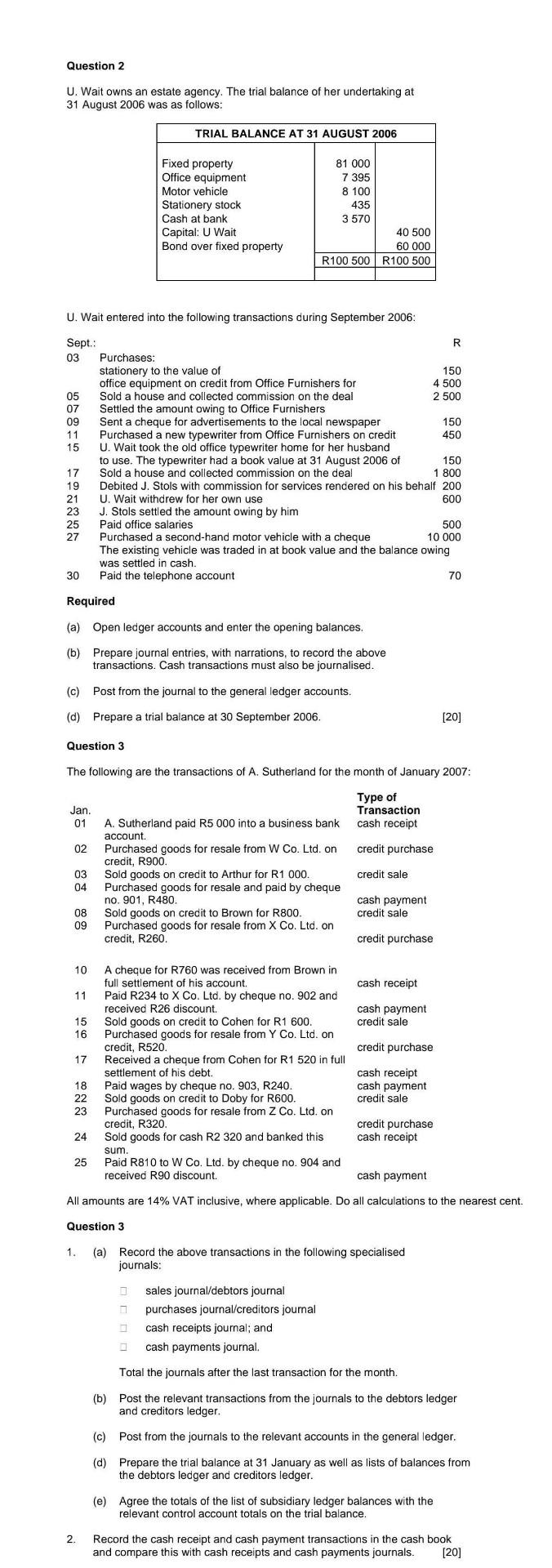

Question 2 U. Wait owns an estate agency. The trial balance of her undertaking at 31 August 2006 was as follows: U. Wait entered into the following transactions during September 2006: Sept:: 03 Purchases: stationery to the value of office equipment on credit from Office Furnishers for 05 Sold a house and collected commission on the deal Settled the amount owing to Office Furnishers Sent a cheque for advertisements to the local newspaper Purchased a new typewriter from Office Furnishers on credit U. Wait took the old office typewriter home for her husband to use. The typewriter had a book value at 31 August 2006 of Sold a house and collected commission on the deal Debited J. Stols with commission for U. Wait withdrew for her own use U. Wait withdrew for her own use J. Stols settled the amount owing by him Paid office salaries \begin{tabular}{lr} Purchased a second-hand motor vehicle with a cheque & 500 \\ \hline \end{tabular} The existing vehicle was traded in at book value and the balance owing was settled in cash. 30 Paid the telephone account 70 Required (a) Open ledger accounts and enter the opening balances. (b) Prepare journal entries, with narrations, to record the above transactions. Cash transactions must also be journalised. (c) Post from the journal to the general ledger accounts. (d) Prepare a trial balance at 30 September 2006. [20] Question 3 The following are the transactions of A. Sutherland for the month of January 2007: Jan. 01 A. Sutherland paid R5 000 into a business bank 02 03 04 09 account. Purchased goods for resale from W Co. Ltd. on credit, R900. Sold goods on credit to Arthur for R1 000 . Purchased goods for resale and paid by cheque no. 901, R480. Sold goods on credit to Brown for R800. Purchased goods for resale from X Co. Ltd. on credit, R260. 10 A cheque for R760 was received from Brown in full settlement of his account. 11 Paid R234 to X Co. Ltd. by cheque no. 902 and received R26 discount. 15 Sold goods on credit to Cohen for R1 600. credit, R520. goods for resale from Y Co. Ltd. on 17 Received a cheque from Cohen for R1 520 in full settlement of his debt. 18 Paid wages by cheque no. 903, R240. 22 Sold goods on credit to Doby for R600. credit, R320. 24 Sold goods for cash R2 320 and banked this sum. 25 Paid R810 to W Co. Ltd. by cheque no. 904 and received R90 discount. Type of Transaction cash receipt credit purchase credit sale cash payment credit sale credit purchase cash receipt cash payment credit sale credit purchase cash receipt cash payment credit sale credit purchase cash receipt cash payment All amounts are 14% VAT inclusive, where applicable. Do all calculations to the nearest cent. Question 3 1. (a) Record the above transactions in the following specialised journals: sales journal/debtors journal purchases journal/creditors journal cash receipts journal; and cash payments journal. Total the journals after the last transaction for the month. (b) Post the relevant transactions from the journals to the debtors ledger and creditors ledger. (c) Post from the journals to the relevant accounts in the general ledger. (d) Prepare the trial balance at 31 January as well as lists of balances from the debtors ledger and creditors ledger. (e) Agree the totals of the list of subsidiary ledger balances with the relevant control account totals on the trial balance. 2. Record the cash receipt and cash payment transactions in the cash bookStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started