Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Simon is 55 and has decided to set up an SMSF. The members will be himself, his wife jo (aged 52), and their

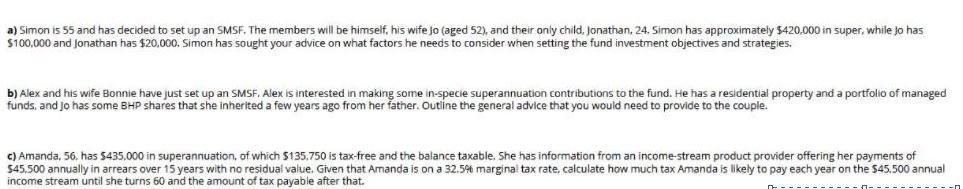

a) Simon is 55 and has decided to set up an SMSF. The members will be himself, his wife jo (aged 52), and their only child. Jonathan, 24. Simon has approximately $420.000 in super, while Jo has $100.000 and Jonathan has $20.000. Simon has sought your advice on what factors he needs to consider when setting the fund investment objectives and strategies. b) Alex and his wife Bonnie have just set up an SMSF. Alex is interested in making some in-specie superannuation contributions to the fund. He has a residential property and a portfolio of managed funds, and Jo has some BHP shares that she inherited a few years ago from her father. Outine the general advice that you would need to provide to the couple. C) Amanda, 56. has 5435.000 in superannuation, of which $135.750 is tax-free and the balance taxable. She has information from an income-stream product provider offering her payments of $45.500 annually in arrears over 15 years with no residual value. Given that Amanda is on a 32.596 marginal tax rate, calculate how much tax Amanda is likely to pay each year on the $45.500 annual income stream until she turns 60 and the amount of tax payable after that.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Implementation of the techniques in tune with funding targets The goal of portfolio management is to spend money on securities is securities in any ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started