Answered step by step

Verified Expert Solution

Question

1 Approved Answer

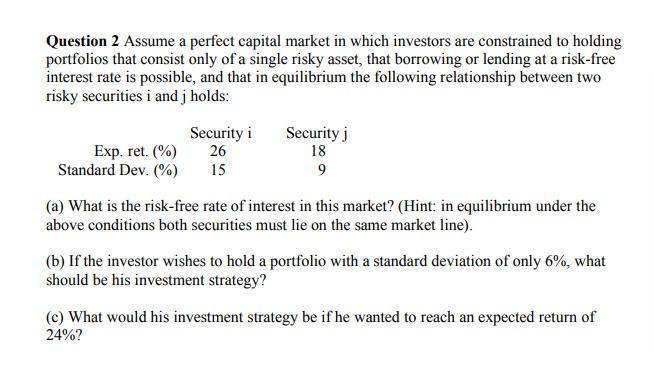

Question 2 Assume a perfect capital market in which investors are constrained to holding portfolios that consist only of a single risky asset, that

Question 2 Assume a perfect capital market in which investors are constrained to holding portfolios that consist only of a single risky asset, that borrowing or lending at a risk-free interest rate is possible, and that in equilibrium the following relationship between two risky securities i and j holds: Exp. ret. (%) Standard Dev. (%) Security i 26 15 Security j 18 9 (a) What is the risk-free rate of interest in this market? (Hint: in equilibrium under the above conditions both securities must lie on the same market line). (b) If the investor wishes to hold a portfolio with a standard deviation of only 6%, what should be his investment strategy? (c) What would his investment strategy be if he wanted to reach an expected return of 24%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a In a perfect capital market the riskfree rate of interest can be determined by finding the slope of the market line that connects the riskfree rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started