Answered step by step

Verified Expert Solution

Question

1 Approved Answer

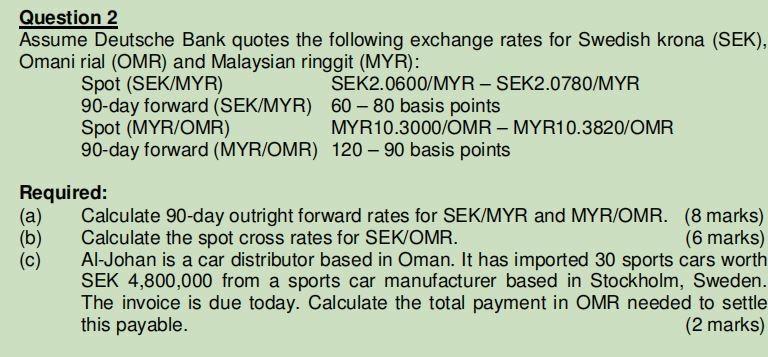

Question 2 Assume Deutsche Bank quotes the following exchange rates for Swedish krona (SEK), Omani rial (OMR) and Malaysian ringgit (MYR): Spot (SEK/MYR) SEK2.0600/MYR -

Question 2 Assume Deutsche Bank quotes the following exchange rates for Swedish krona (SEK), Omani rial (OMR) and Malaysian ringgit (MYR): Spot (SEK/MYR) SEK2.0600/MYR - SEK2.0780/MYR 90-day forward (SEK/MYR) 60 - 80 basis points Spot (MYR/OMR) MYR10.3000/OMR - MYR10.3820/OMR 90-day forward (MYR/OMR) 120 - 90 basis points Required: (a) Calculate 90-day outright forward rates for SEK/MYR and MYR/OMR. (8 marks) (b) Calculate the spot cross rates for SEKIOMR. (6 marks) (c) Al-Johan is a car distributor based in Oman. It has imported 30 sports cars worth SEK 4,800,000 from a sports car manufacturer based in Stockholm, Sweden. The invoice is due today. Calculate the total payment in OMR needed to settle this payable. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started