Answered step by step

Verified Expert Solution

Question

1 Approved Answer

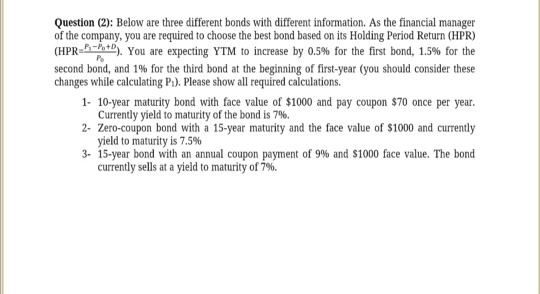

Question (2): Below are three different bonds with different information. As the financial manager of the company, you are required to choose the best bond

Question (2): Below are three different bonds with different information. As the financial manager of the company, you are required to choose the best bond based on its Holding Period Return (HPR) (HPR-SA). You are expecting YTM to increase by 0.5% for the first bond, 1.5% for the second bond, and 1% for the third bond at the beginning of first-year (you should consider these changes while calculating P:). Please show all required calculations. 1- 10-year maturity bond with face value of $1000 and pay coupon $70 once per year. Currently yield to maturity of the bond is 7%. 2- Zero-coupon bond with a 15-year maturity and the face value of $1000 and currently yield to maturity is 7.5% 3. 15-year bond with an annual coupon payment of 9% and $1000 face value. The bond currently sells at a yield to maturity of 7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started