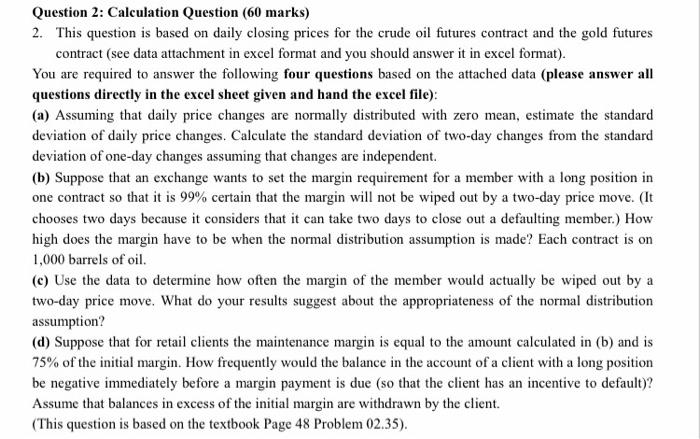

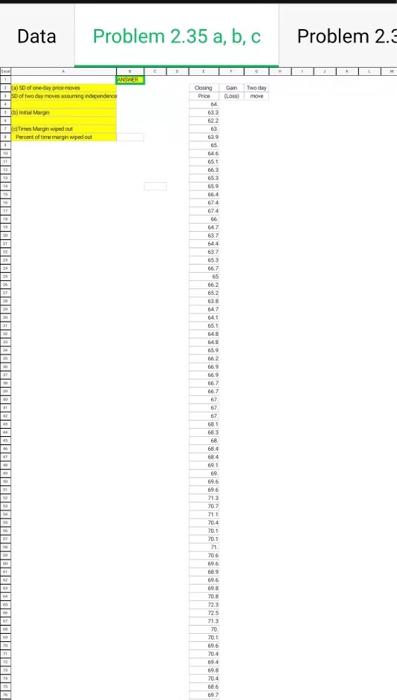

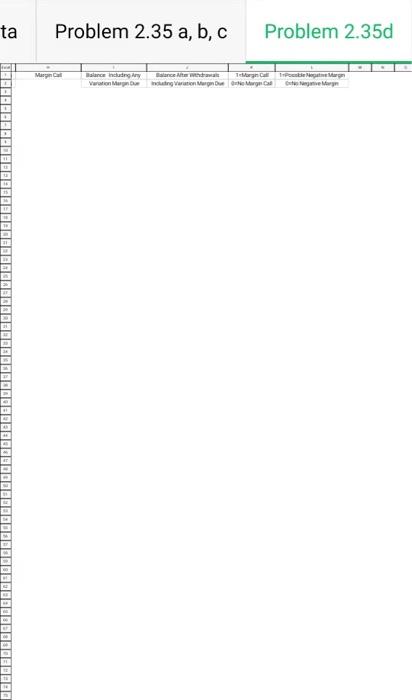

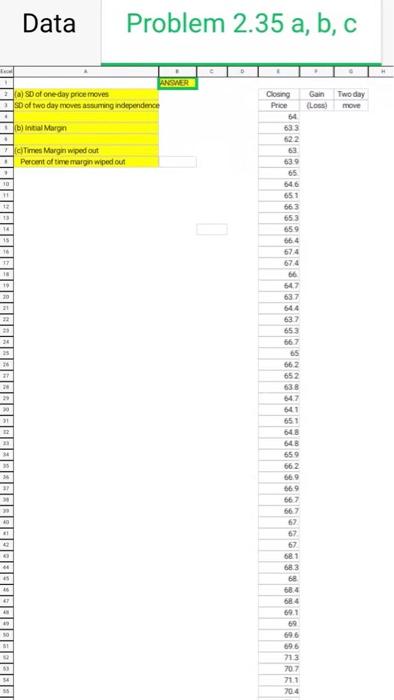

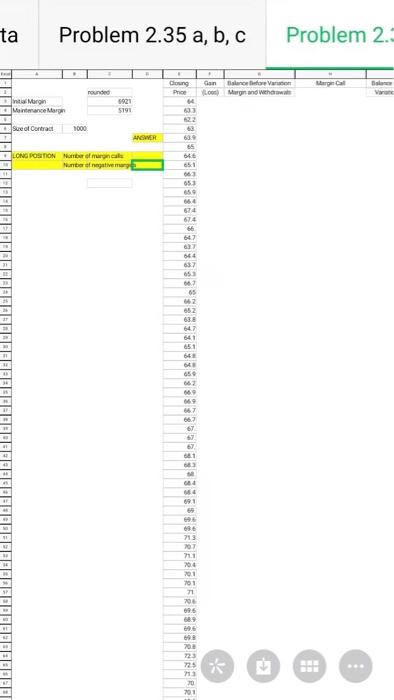

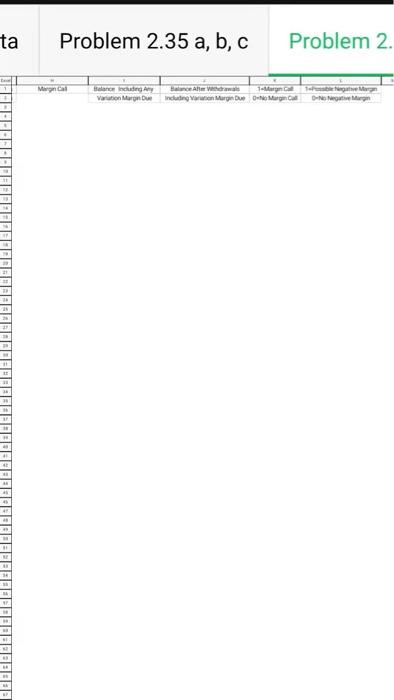

Question 2: Calculation Question (60 marks) 2. This question is based on daily closing prices for the crude oil futures contract and the gold futures contract (see data attachment in excel format and you should answer it in excel format). You are required to answer the following four questions based on the attached data (please answer all questions directly in the excel sheet given and hand the excel file): (a) Assuming that daily price changes are normally distributed with zero mean, estimate the standard deviation of daily price changes. Calculate the standard deviation of two-day changes from the standard deviation of one-day changes assuming that changes are independent. (b) Suppose that an exchange wants to set the margin requirement for a member with a long position in one contract so that it is 99% certain that the margin will not be wiped out by a two-day price move. (It chooses two days because it considers that it can take two days to close out a defaulting member.) How high does the margin have to be when the normal distribution assumption is made? Each contract is on 1,000 barrels of oil. (c) Use the data to determine how often the margin of the member would actually be wiped out by a two-day price move. What do your results suggest about the appropriateness of the normal distribution assumption? (d) Suppose that for retail clients the maintenance margin is equal to the amount calculated in (b) and is 75% of the initial margin. How frequently would the balance in the account of a client with a long position be negative immediately before a margin payment is due (so that the client has an incentive to default)? Assume that balances in excess of the initial margin are withdrawn by the client. (This question is based on the textbook Page 48 Problem 02.35). Data Problem 2.35 a, b, c Problem 2.5 Gorg Two des Jatus wyn wedi wed 09 663 653 674 637 63 66 US 06 62 64 . . 162 6. 669 ST 6 664 4 70 70.1 70 2 10 704 054 70.4 606 ta Problem 2.35 a, b, c Problem 2.35d Gang alance indir ded 0921 Margin w 22 of NOOR GE LO POSTON Meberapa NE EV 9 29 ME SV 2 499 66 13 CO IM 04 200 700 08 13 LOC 696 2014 04 ta Problem 2.35 a, b, c Problem 2.350 Margar alance including any once it wa Teorgina Poster Vrati Martin Meru Camer BOBOEDDOBBEDROOBODDBODOUDOBB DDDDDDDDDDDDDDDDDDDD Data Problem 2.35 a, b, c ANSWER (a) SD of one day price moves so of two day moves assuming independence Gain Los Two day move b) Intial Maron Time Margin wiped out Percent of tre marginwiped out 10 11 12 13 TE 15 27 Closing Price 64 633 622 63 63 65 646 651 663 653 659 66.4 674 674 66 547 637 644 637 653 667 65 662 652 638 647 641 651 648 643 659 662 66.9 669 667 66.7 62 67 67 681 683 68 68.4 684 601 62 696 696 713 70.7 71.1 70.4 40 46 4 ta Problem 2.35 a, b, c Problem 2: rounded Cloung Price Ganslatore 1.00 Morgan Wenda Margin Maintenance More 1921 5191 693 Sual Contract 1000 ANSWER 63 639 65 LONG POSITION Mutter of manale Number of negative 651 663 053 65 574 674 66 647 63 644 637 653 667 65 2 52 547 641 651 66 659 662 669 09 667 662 67 691 65 713 207 204 701 71 706 696 68 96 700 223 725 7 20 200 * ta Problem 2.35 a, b, c Problem 2. are inchang Arya Aher vermeld in hegten Variation Moron De Including in Margin De Oro Mugil Dewan